Buying your first home is an exciting time, especially when you are prepared for the process.

Based on our REALTORS® experience helping many buyers successfully purchase their first home, we’ve created a guide to help get you started.

1. Know what you can afford

For many first-time homebuyers, the decision to buy comes after considering the advantages of owning versus renting. Once you've decided that owning is right for you - the first step is to find out how much you can afford to spend on a home.

Buyers today are not required to put 20% down. There are financing programs available that allow 0%, 3.5%, or even 5% down. We can direct you to a local mortgage lender to determine how much you can comfortably afford, and what program is right for you.

Knowing what budget you are comfortable working with is critical before you start your search and fall in love with a property that you may or may not be able to afford.

2. Understand the Local Market

Pricing and demand vary from town to town and even within neighborhoods.

- Educate yourself by looking at recent sales data in the towns that interest you. Use our Sold Property Search to see sales in a specific time period, price range, and town.

- Know whether it is a buyer’s or a seller’s market. Review our quarterly Vermont Market Report.

- Contact an Agent to help and provide even more insight into recent supply-and-demand trends within the area you're considering.

3. Establishing Your Search Criteria

You may start your search believing a wood-burning fireplace is essential to your dream home. But after seeing a few properties, you may come to find it is not so important.

Create a list of your needs and wants. Differentiate what is truly a want vs. a need - your willingness to compromise may expand the number of homes to choose from.

Consider these additional suggestions:

- Are you willing to buy a fixer-upper? If so, do you have the know-how and time to do the work yourself? If not, consider getting estimates on how much that fixer-upper will cost in the long-term.

- Do you want to handle landscaping and snow removal yourself? If not - consider expanding your search to include a Condo or Townhouse.

- Interested in new construction? Consider opening your criteria to include a broader range of towns. A 20-minute addition to your commute may get you the home of your dreams in a price range you can afford.

4. Finding Your Home

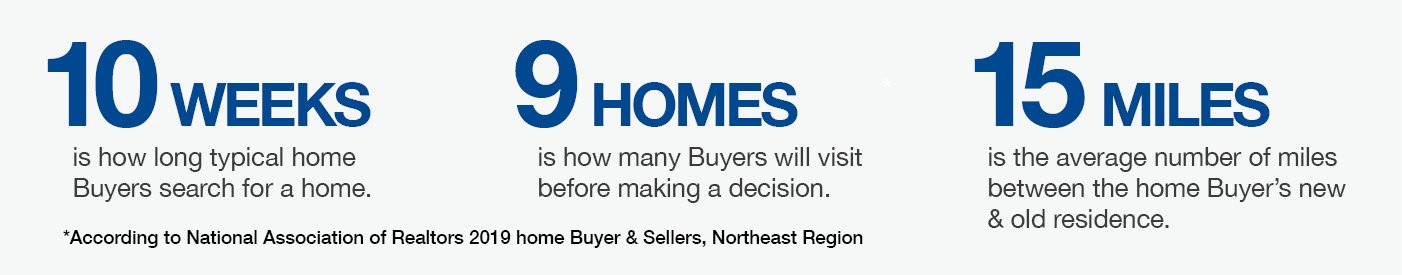

Over 90% of today’s homebuyers begin their search online. With many resources right at your fingertips, search the newest listings, browse open houses, view the latest market stats, and get familiar with Vermont towns.

5. Making an Offer

Making an offer is both exciting and nerve-wracking. Your Realtor will help you formulate a winning offer, based on the dynamics of the home’s neighborhood and the condition of the property.

6. Getting to Closing

Once you and the seller have agreed upon a price and have a signed contract, it’s time to swing into action to ensure a smooth closing.

In addition to your Agent and your mortgage lender, you’ll want to hire the following professionals to get you to the closing table:

- A real estate attorney

- A qualified home inspector

After your mortgage lender approves the loan, a closing date will be coordinated between all parties. But before the closing date, there are several more steps and deadlines your Realtor will guide you through:

- After your bank performs an appraisal, you’ll want to schedule an inspection of the home. This is a chance for you to learn about any issues the house might have, and may become a basis for additional negotiations, depending on what is found.

- Secure homeowner’s insurance. Your real-estate attorney will provide a title search to make sure the home has no liens or other claims on the property.

- Plan for moving day: book a moving company and call utility companies to get the home's electricity and other services changed into your name.

7. Closing on Your New Home

- Schedule a final walk-through of the house. This will allow you to make sure the condition of the house hasn’t changed, or to check on whether items negotiated after the home inspection have been performed.

- A closing can require two hours or more of your time, so plan appropriately.