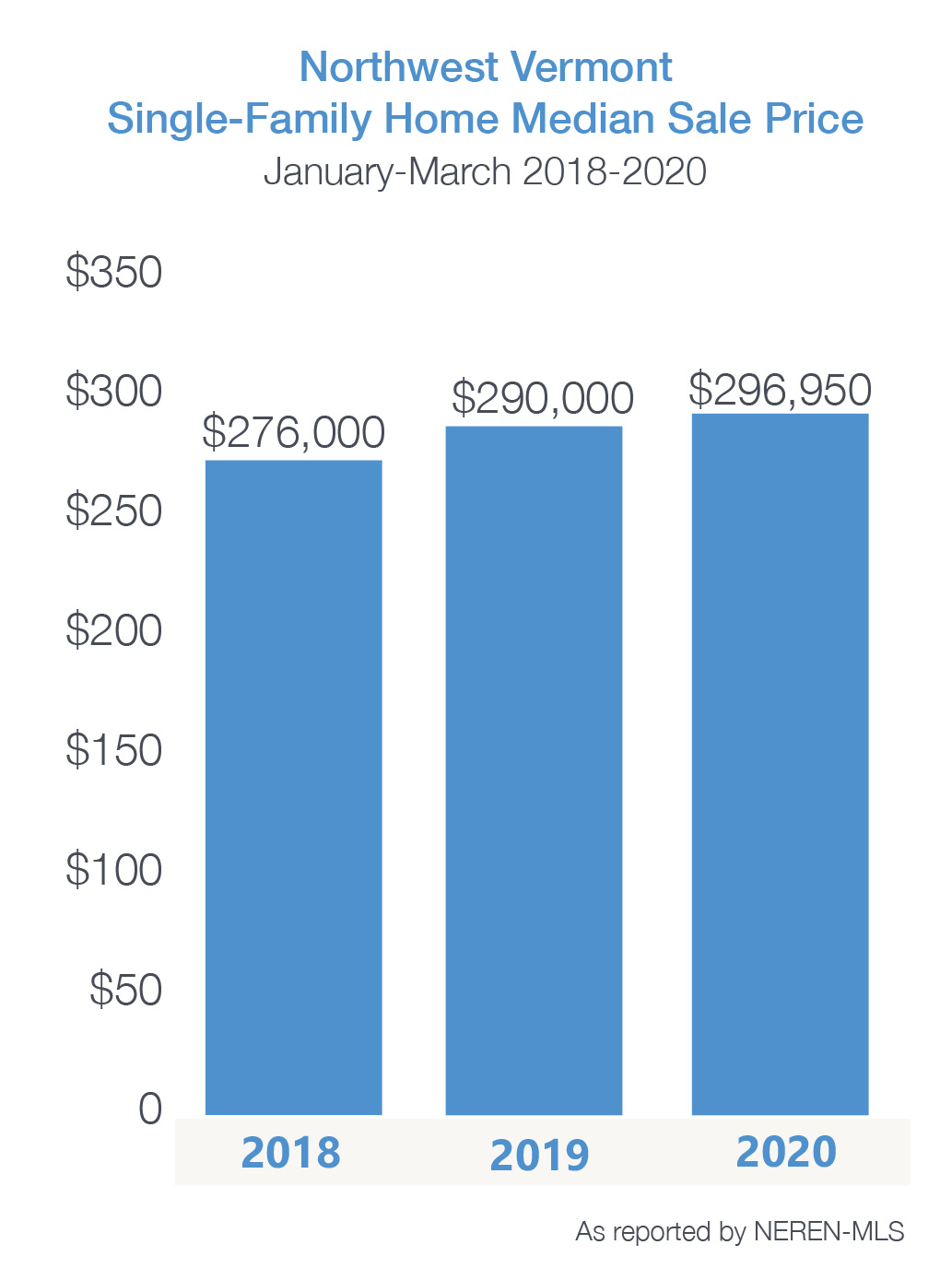

| Single Family | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $296,500 +2.4% | $338,089 +4.2% | 374 +6% | 529 -12.3% | 99 +8.8% |

| Condo | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $257,600 +8.5% | $283,475 +10.4% | 144 +26.3% | 184 +19.5% | 67 -14.1% |

We cannot comment on the 1st quarter results without reflecting on the Coronavirus pandemic that arrived in the midst of it and will continue to impact us for the remainder of 2020. During the recent weeks, we have been reminded about the role HOME plays in our lives. We thank our state officials, health care providers, and all essential workers for the sacrifices and difficult decisions they continue to make to keep our community safe.

Residential real estate transactions have a longer lead time than most consumer purchases. These transactions close, on average, 45-60 days from the time of contract. Therefore, results in this 1st quarter market report – with sales closed by March 31st – reflect business efforts from the 4th quarter of 2019 through January of this year.

Residential real estate transactions have a longer lead time than most consumer purchases. These transactions close, on average, 45-60 days from the time of contract. Therefore, results in this 1st quarter market report – with sales closed by March 31st – reflect business efforts from the 4th quarter of 2019 through January of this year.

The current public health crisis we find ourselves in is already resulting in an economic crisis. As the residual impact of COVID-19 begins to plateau, the question we are being asked is “what will the impact be on the real estate market?” We don’t have a crystal ball, however, John Burns Real Estate Consulting noted, “Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices) …. the current slowdown is playing out similarly thus far.” As of April 1, 2020, three of the major financial institutions, including Goldman Sachs are calling for a V type recovery. They do reserve the option to change that prediction as things proceed.

The Great Recession of 2008 was driven largely by the housing sector. This is not the case today. In fact, the leading indicators regarding housing were sound at the onset of this necessary pause. Nationally, inventory levels were at a 3-month supply (vs. 8-month supply in 2007); most economists believe a 6-month supply is a balanced market. We have been in a sellers’ market for some time. Price appreciation has been steady and moderate. In addition, the equity position for most home owners is strong.

We cannot predict how long we will be sheltering in place or how deep the impact will be prior to working our way out of this. We do believe that this time, housing is poised to be part of the solution.

We cannot predict how long we will be sheltering in place or how deep the impact will be prior to working our way out of this. We do believe that this time, housing is poised to be part of the solution.

“Housing is a foundational element of every person’s well-being. And with nearly a fifth of US gross domestic product rooted in housing-related expenditures, it is also critical to the well-being of our broader economy,” as recently noted by Chris Herbert of the Joint Center for Housing Studies at Harvard University. The fact that the Vermont housing sector enters this current recession underbuilt rather than overbuilt, coupled with continued historic low interest rates, positions housing to help lead our way out of this when the time comes.

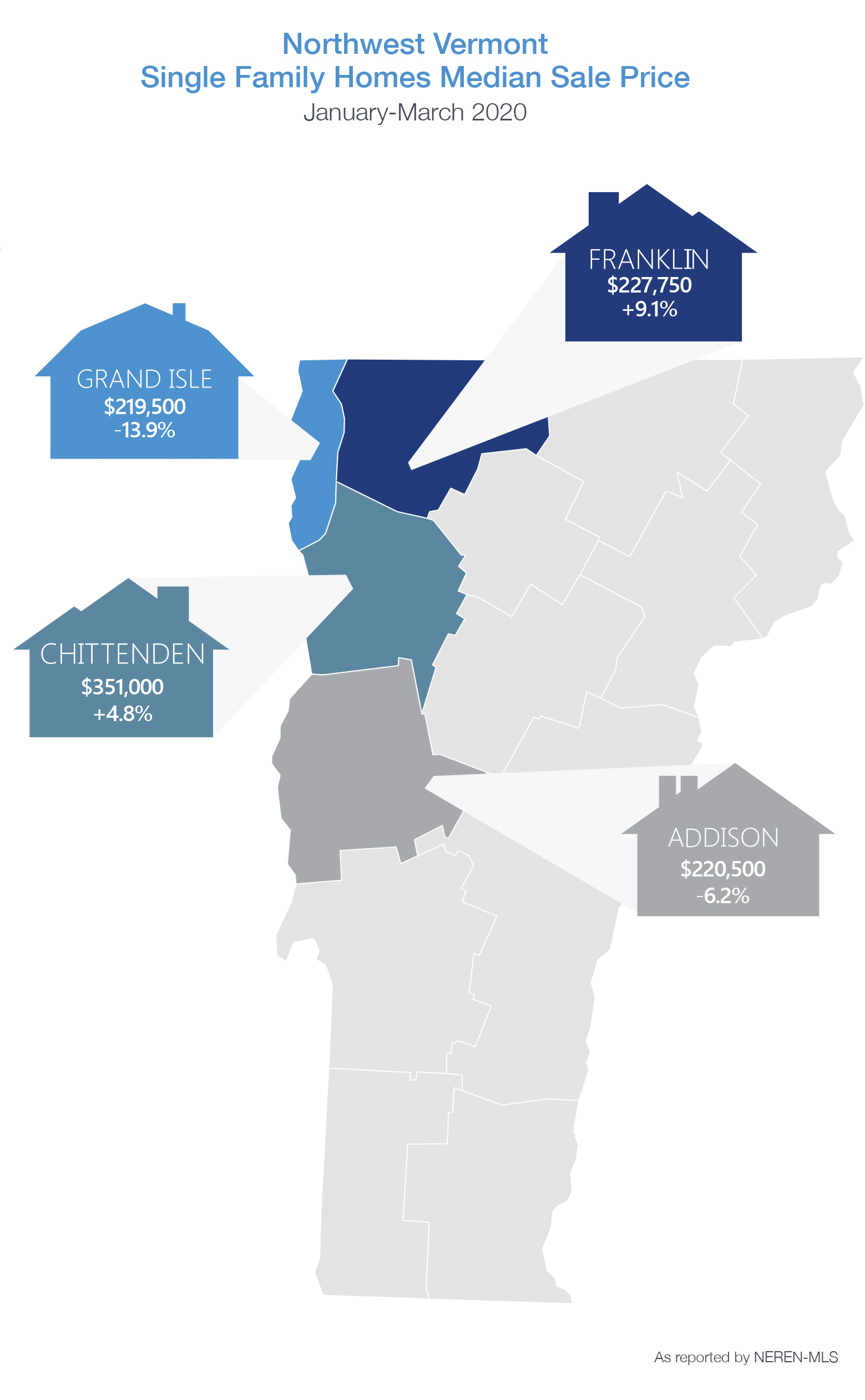

In Northwest Vermont, the real estate market during the 1st quarter of 2020 was strong. The number of properties listed for sale continued to increase after years of decline. Buyer demand was strong amidst low interest rates and median prices were steadily growing. Governor Phil Scott issued a Stay At Home order on March 25th which effectively put the brakes on real estate services. Purchase contracts already in process faced some hurdles getting to closing. With safety and public health as a priority, attorneys and lenders adjusted their customary practices and closed real estate sales without parties present – via Power of Attorney. Buyers and Sellers in newer contracts, that had not worked through contingencies such as property inspections, have extended those contract deadlines when possible.

As of April 20th, the Governor is allowing limited in-person activities of no more than two people. Many buyers we have surveyed are remaining in the market. Detailed property photographs and video enable savvy buyers to make offers subject to inspections at such a time that is deemed safe. Our agents are advising clients to work with a local lender for an up to date mortgage pre-approval.

Sellers are using the time at home to prepare for market. Our Marketing Team is working closely with sellers to produce videos and strategically position their homes for optimal viewing by buyers. Our website, HickokandBoardman.com, has been visited by potential buyers across the country- notably from states effected early on by COVID-19. Vermont has long been considered a healthy and safe place to live. Particularly in the aftermath of a crisis, such as the events of 9/11, many residents of larger cities looked to Vermont to begin the next chapter in their lives. Recently, Conde Nast Traveler announced the 2019 Readers’ Choice Awards for the Friendliest Cities in the U.S., ranking Burlington 8th in the country – the only northern city on the list.

While working from home and conducting meetings via apps like Zoom may be new for many, our Agents have been effectively working remotely for several years. From using technology to share and sign contracts, to conducting showings and consultations via Facetime with out-of-state clients – we are well positioned to best serve our clients.

Never more than now, do we appreciate what HOME means to all of us. Stay safe and hold your family and friends close. We appreciate the relationships we share with all of you and together we will work to keep #VermontStrong.