| Single Family | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $224,000 (-3.0%) | $254,258 (-2.0%) | 353 (+12.4%) | 507 (+21.3%) | 72 (-21.3%) |

| Condo | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $227,500 (+3.4%) | $256,259 (+4.0%) | 705 (-3.0%) | 798 (-3.0%) | 82 (+7.9%) |

The Mid-Year point is an important milestone for real estate trends, especially in northwest Vermont. We are in the midst of the traditional “height of the market.” Closings on real estate sales surge in June, July, and August in between the school year, vacations, holidays – with new household formation and other life events that typically drive the market. Our Mid-Year report recaps the inventory and sales of property during the 1st six months – and provides a snapshot of trends we may see in the Fall of 2018.

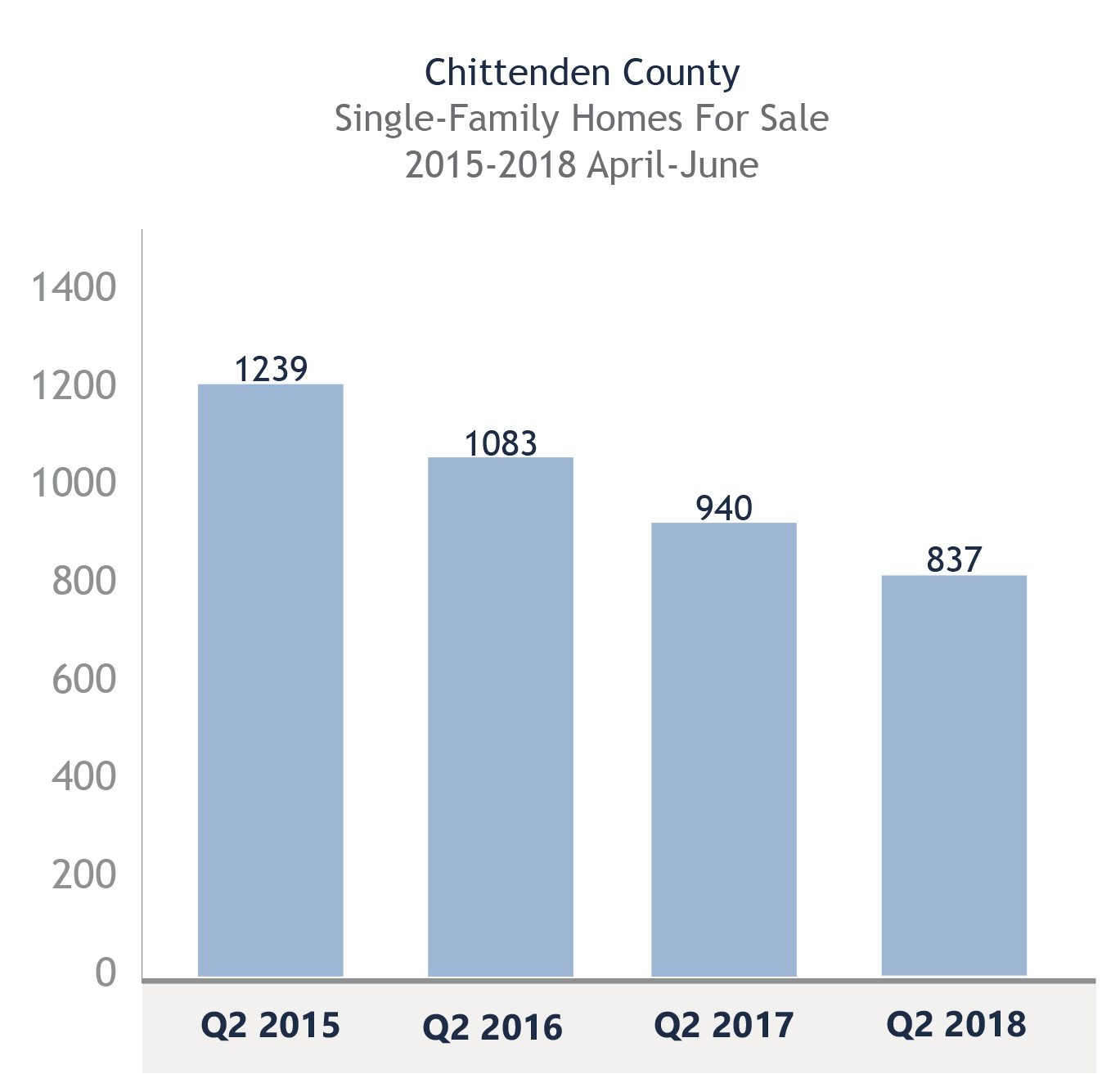

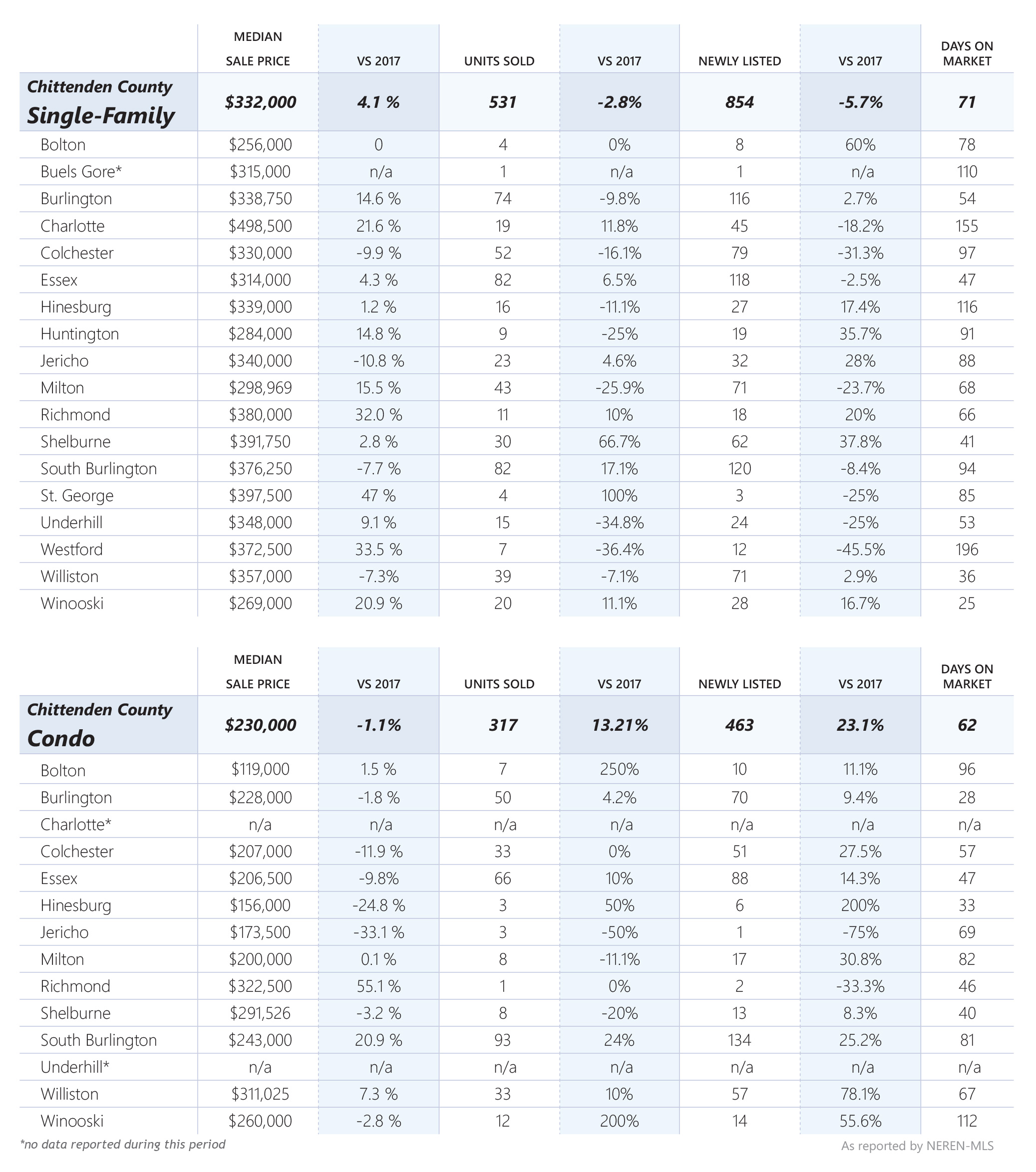

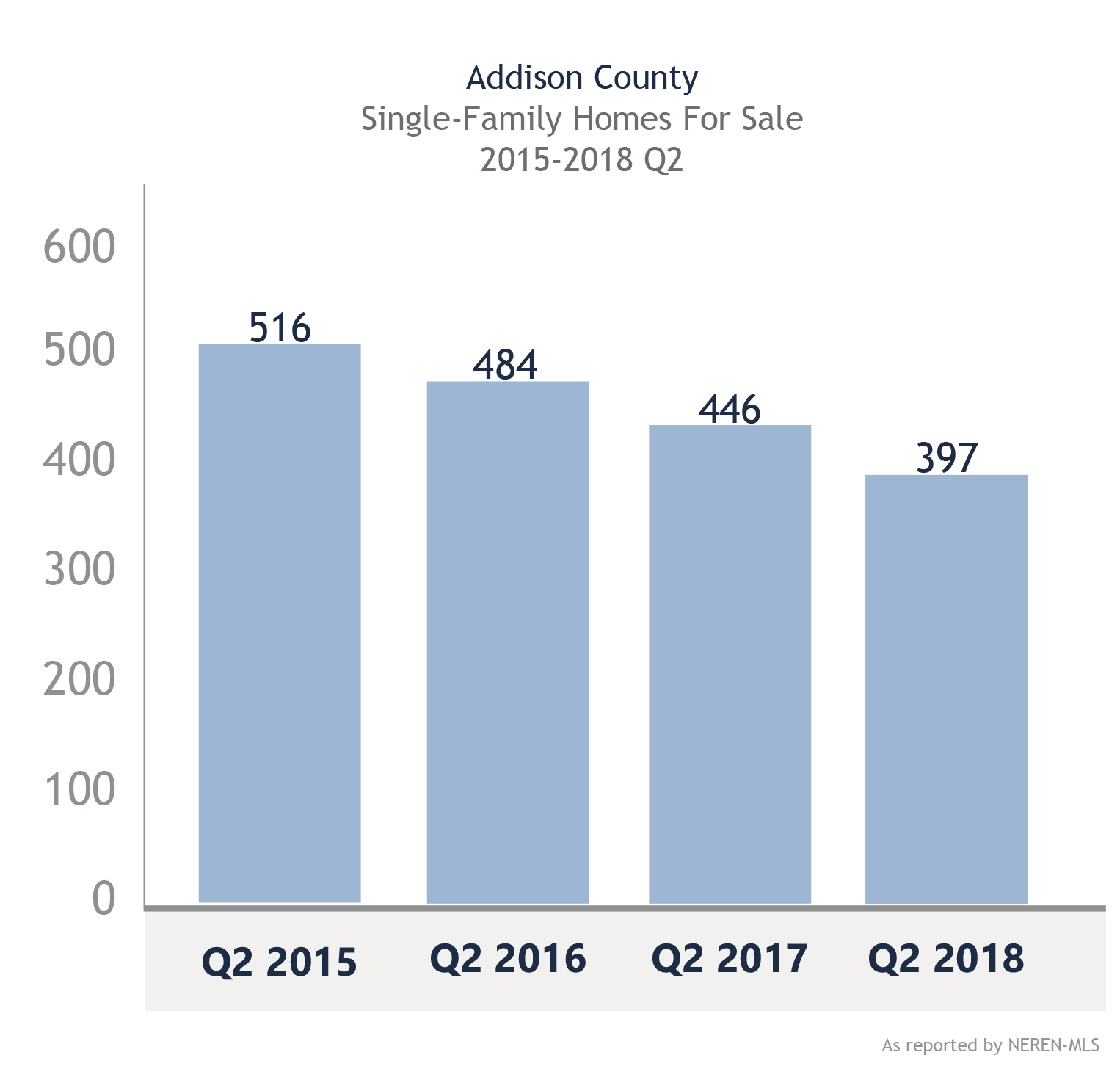

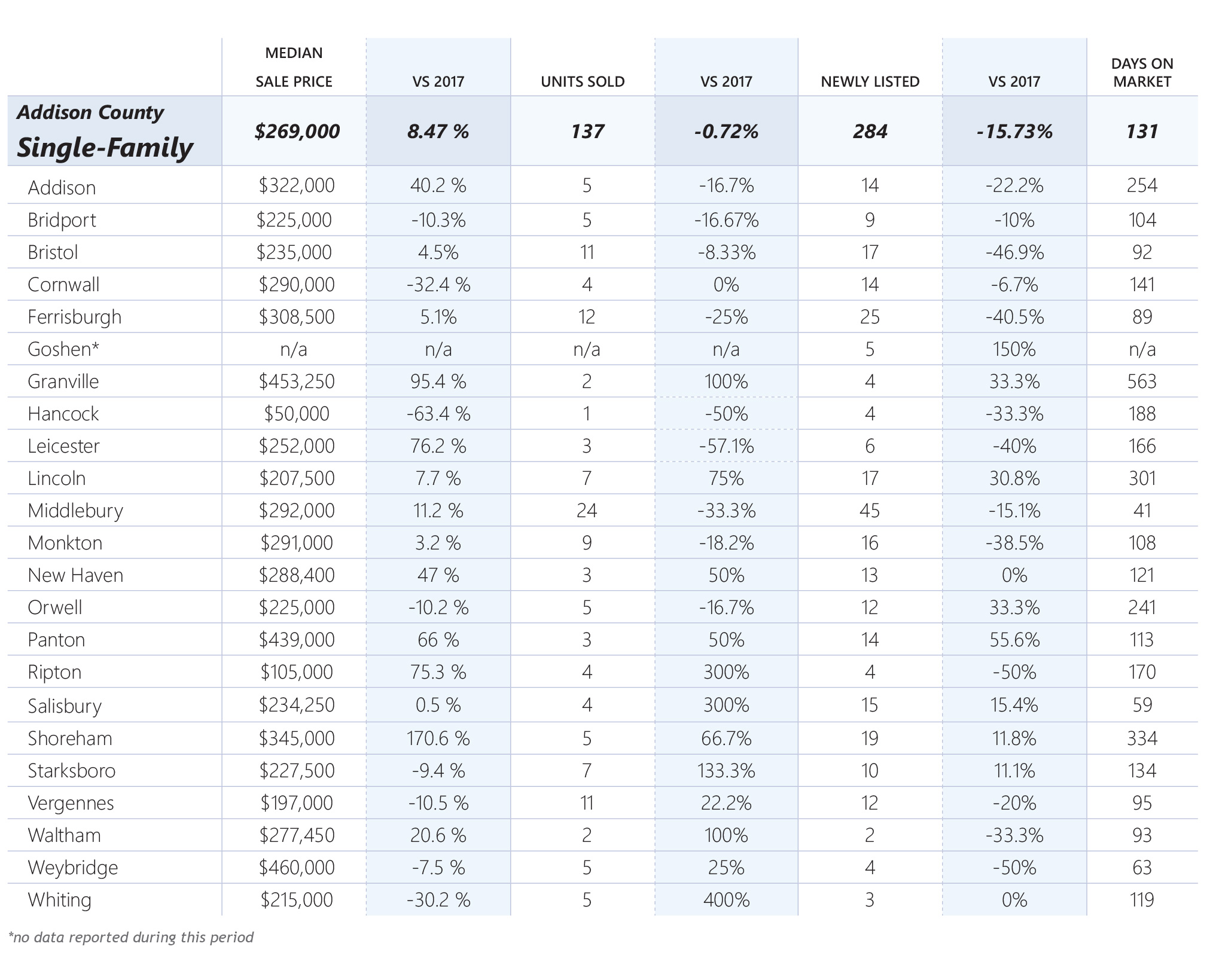

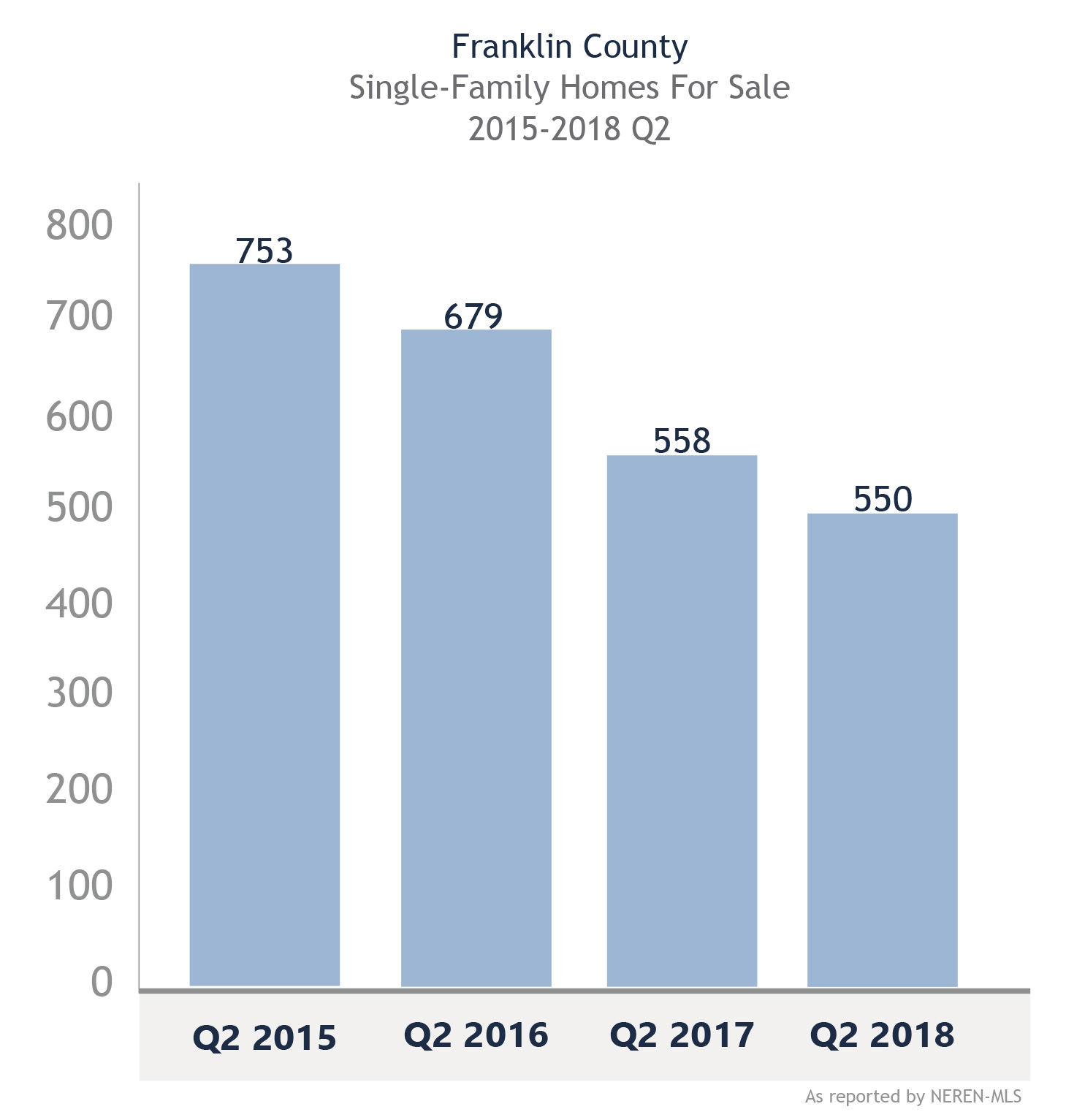

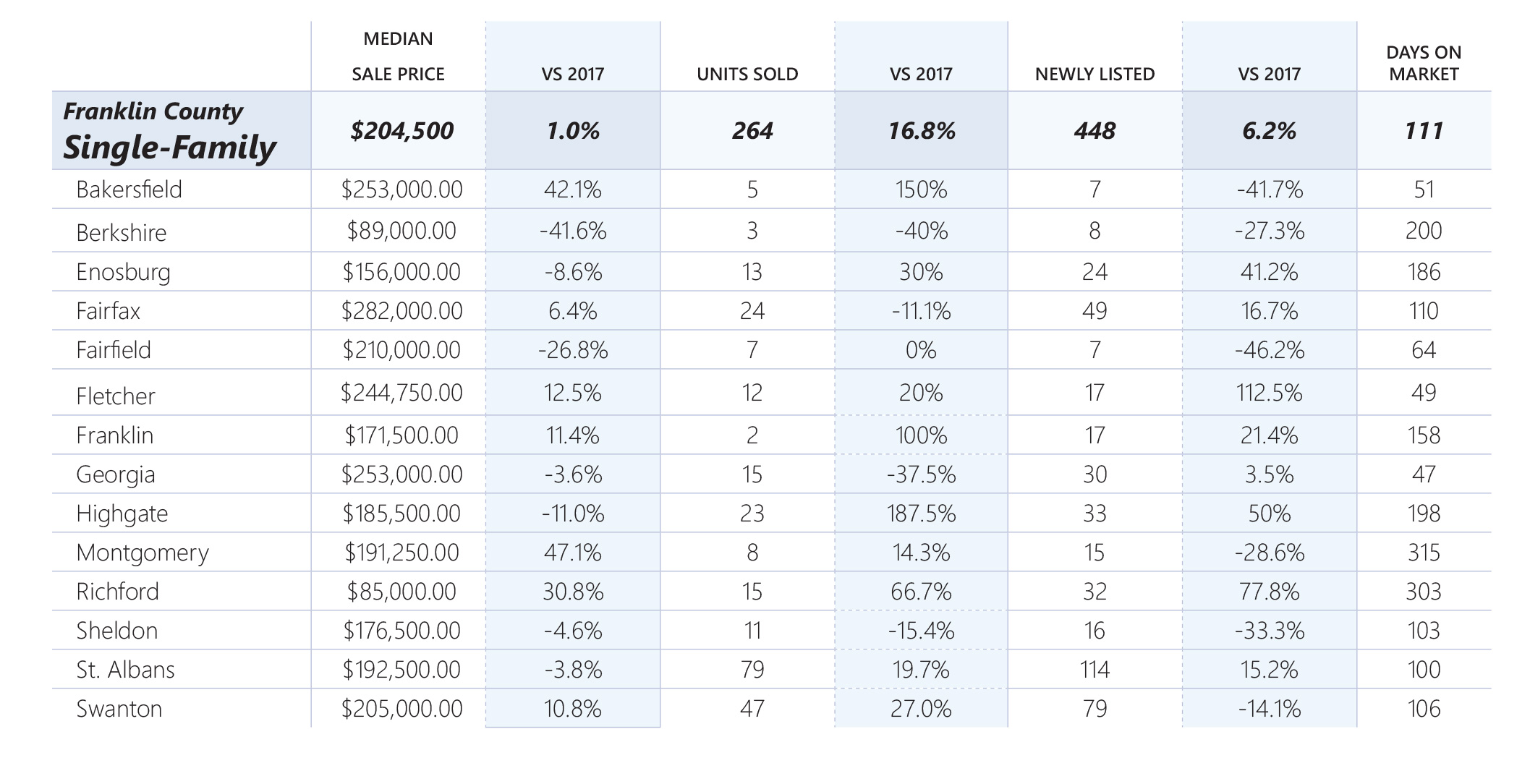

The number of properties sold, across all categories including single family, condos, multi-family, land and luxury properties, in northwest Vermont increased over the 1st half of 2017. This positive trend reflects strong buyer demand and is a welcomed sign after a moderate, but long-term decline in unit sales. The median and average sale prices continued to rise for single family, multi-family and land sales. Single-family unit sales were up 2.1% over 2017 in the first half. Newly listed properties declined by 6.7%. While inventory levels are still at near record lows, the 2nd quarter showed some moderate improvement.

Condominiums remain a popular choice, often for ease of maintenance and affordability. Newly listed condominiums were up 21.3% year to date with 507 listings. This helped spur a 12.4% increase in sales in the first half of 2018. The median and average sale prices had slight declines at 3.0 and 2.0% respectively.

Days on market dropped to 99 days in the single-family market, down 4.8% from last year and condominiums declined by 21.3% to 72 days on market. Chittenden County is reflecting a 3 months supply on hand in single family and condominiums. A balanced market is considered 5-6 months supply.

Our Vermont market reflects the current national trend of low inventory levels. Lawrence Yun, Chief economist for the National Association of Realtors, says a solid economy and job market should be generating a much stronger sales pace than what has been seen so far this year across the country.

Rising mortgage rates are also a factor. “This year we saw a move up in mortgage rates, from 4 to 4.5%, which increased the urgency of some buyers to purchase. Combined with limited inventory, a tight rental market, and an uptick in economic activity, we saw increased competition in the first time home buyer/affordable price range. Even with credit standards loosening to encourage more activity these other factors are stretching the budgets of some prospective buyers. Mortgage industry experts say that providing credit is not the problem but rather the current supply of housing not meeting the demand,” says Ranjit “Buddy “ Singh of Spruce Mortgage in Burlington.

Our sales associates have seen continued strong buyer demand, especially in price segments below $350,000. Often these buyers are facing competing offers made on new listings resulting in purchases above asking price, waived inspections, substantial deposits or even cash sales. Some sellers are identifying new properties prior to committing their property to sale and making the successful next purchase a contingency of the sale of their existing property. Timing and coordination are key, and your Realtor can be of great assistance in a tight market.

New housing development in our region, although limited, is a very welcome addition to our market and has given some relief in a few market segments. We expect the current market conditions to continue throughout the 2nd half of 2018.

After a slow start to 2018, home sales in

After a slow start to 2018, home sales in

Single Family homes sold in

Single Family homes sold in

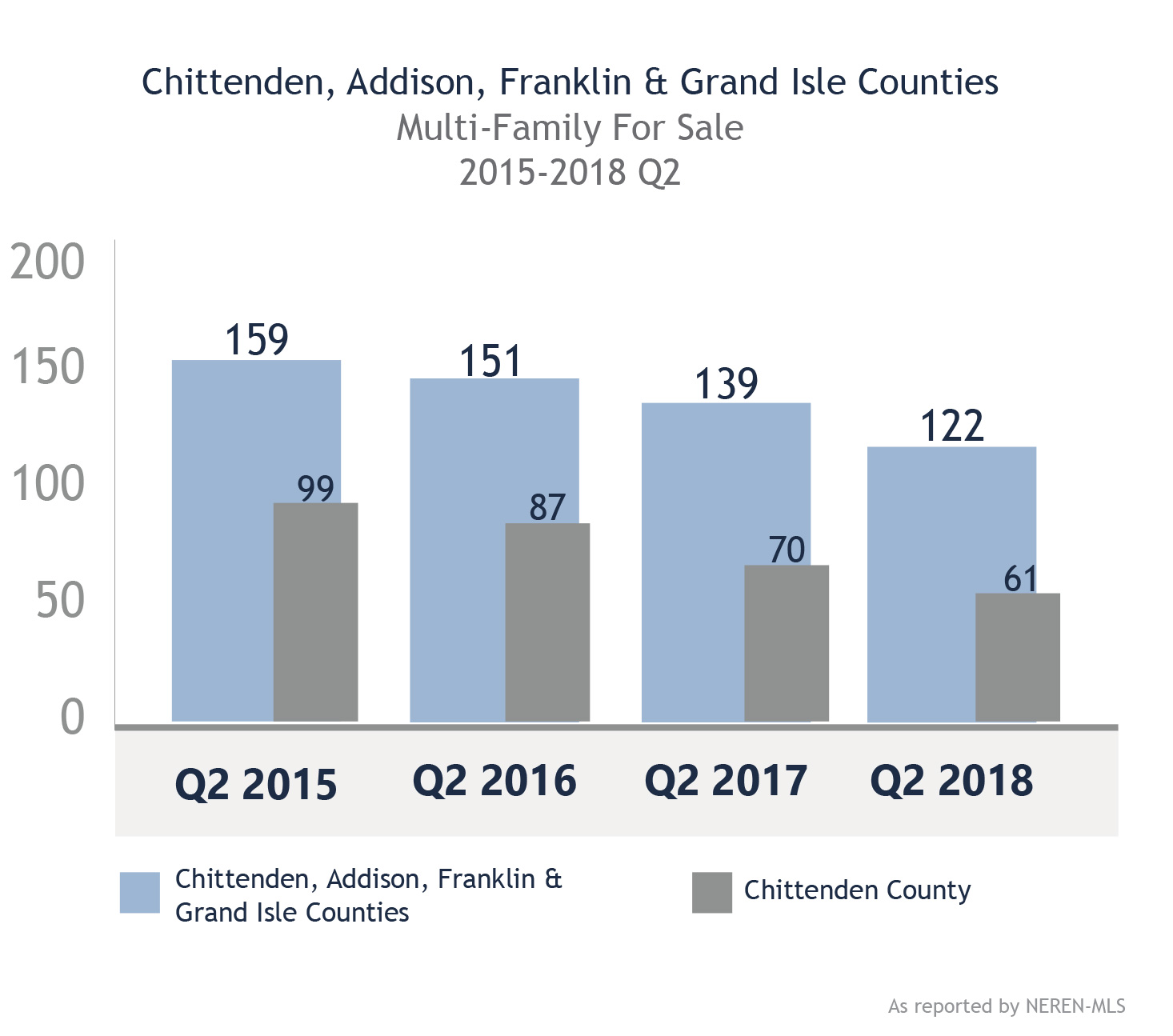

Investors continue to show strong demand for

Investors continue to show strong demand for