Looking back at 2023, it is evident that the year was characterized by dwindling inventory and escalating mortgage interest rates, leading to decreased affordability amid a continuing uptrend in median sale prices both regionally and nationally. Notably, the inventory of available homes in 2023 was half compared to 2019 levels, with cash transactions accounting for 30% of total transactions, up from 20% pre-pandemic. Economists, contemplating the outlook for 2024, foresee a probable adjustment in interest rates by year’s end. The question is: Will these adjustments suffice in prompting more activity among sellers and buyers, motivating them to transition from inertia to action in pursuit of significant lifestyle changes or long-postponed decisions? Residential real estate sales are largely influenced by life events such as marriages, divorces, births, deaths, or relocations.

| Single-Family January-December 2023 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $459,776 +6.9% | $530,366 +5.8% | 1,802 -15.3% | 2116 -10.8% | 29 +16.0% |

| Condos January-December 2023 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $359,900 +5.9% | $404,973 +5.2% | 557 -21.2% | 647 -7.7% | 22 +4.8% |

| Multi-Family January-December 2023 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

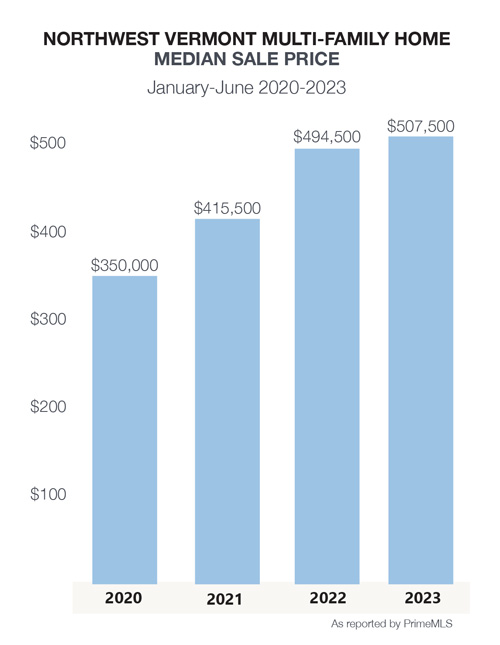

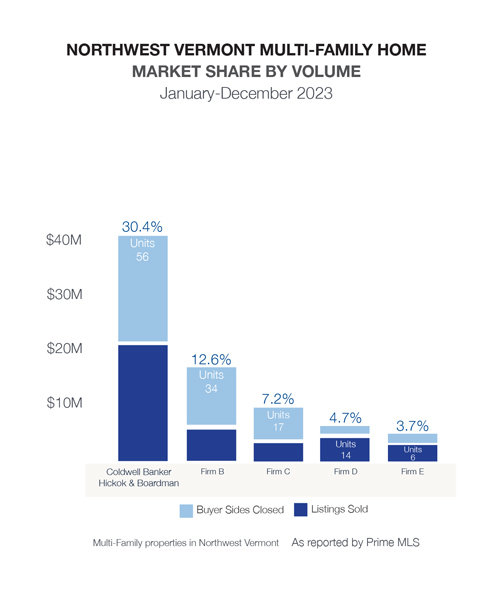

| $572,934 + 12.2% | $484,852 -1.1% | 118 -35.5% | 184 -10.2% | 49 -9.3% |

| Land January-December 2023 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $139,000 +0.4% | $210,078 -0.2% | 185 -20.9% | 301 -6.8% | 118 -23.4% |

Nationally, existing home sales dropped by 18%, hitting the lowest point since 1995. On the other hand, new home sales saw a slight increase of 4.5% across the country. In Vermont, the demand for new homes far exceeds the supply, with estimates suggesting a need for approximately 6000 new homes annually, compared to the current production which falls significantly short of this figure. Challenges such as higher interest rates, labor shortages, and the complexities of the permit process hinder builders’ efforts. Notably, the top priorities for this year’s legislature revolve around safety, security, and housing. Vermont’s slow labor market growth is largely attributed to the housing shortage and affordability issues, as potential workers face difficulties relocating due to inadequate housing options.

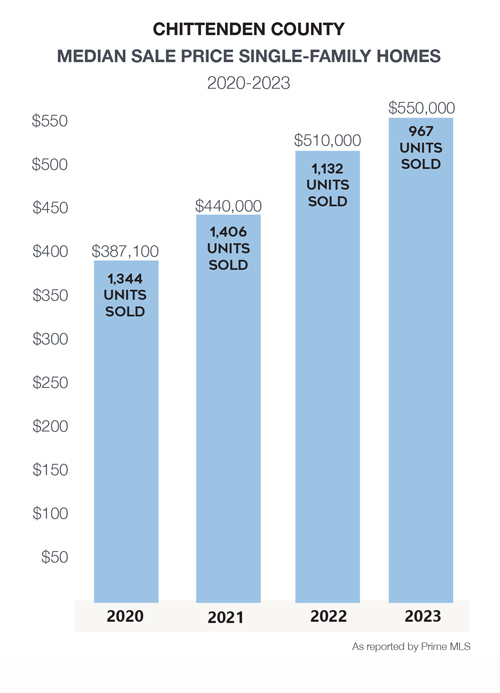

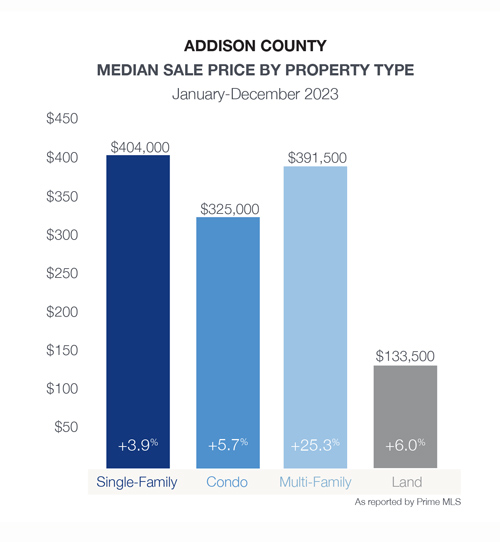

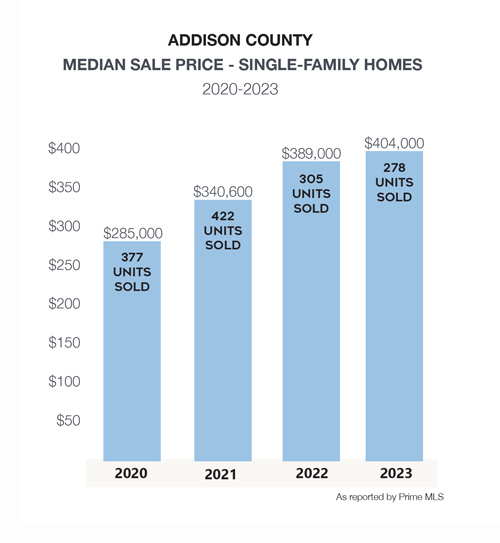

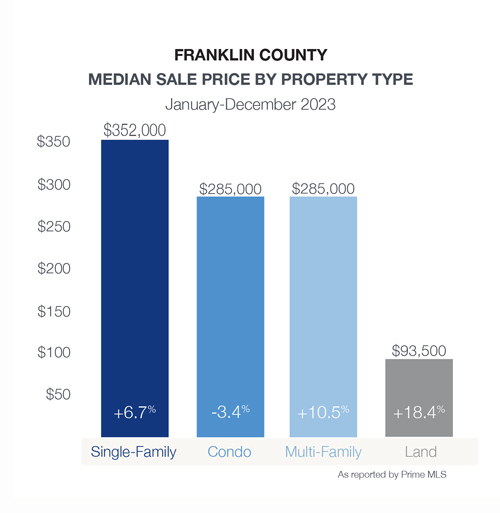

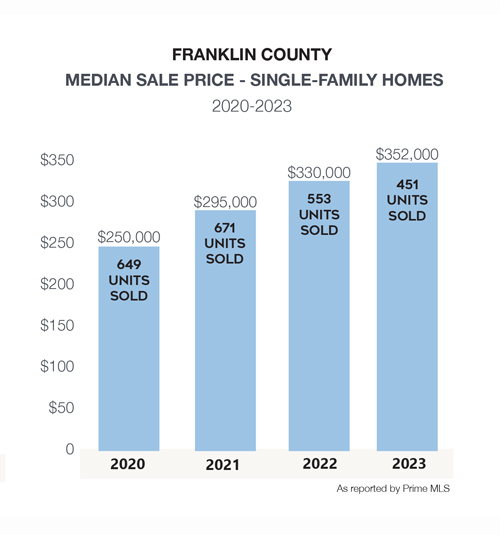

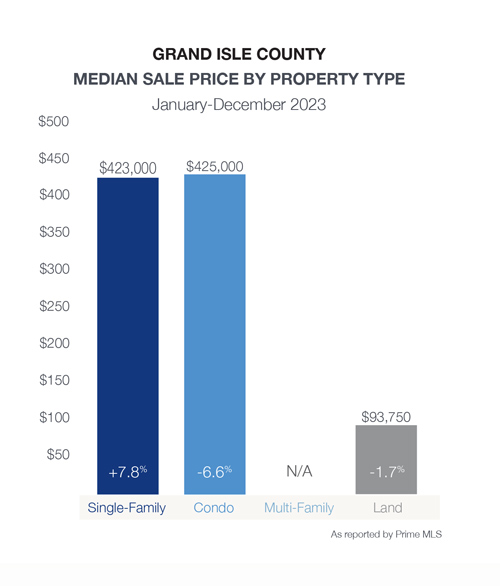

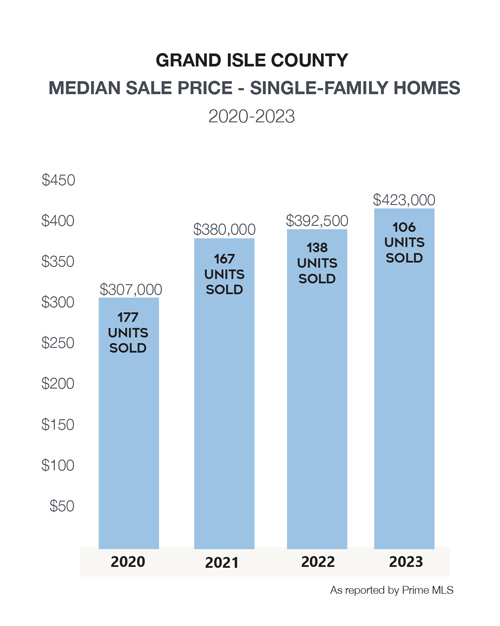

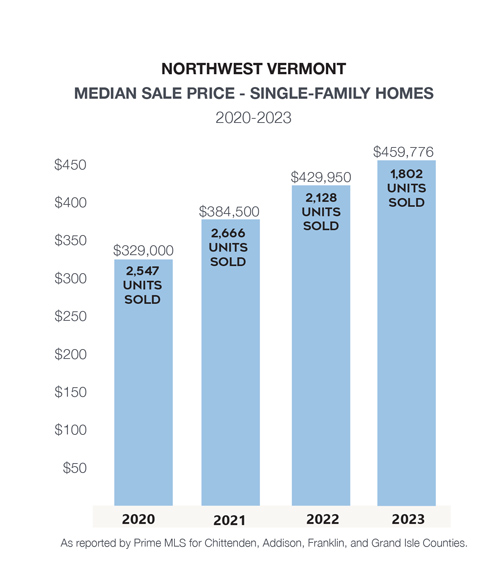

In northwest Vermont, including counties like Chittenden, Addison, Franklin, and Grand Isle, the median sale price of single-family homes rose by nearly 7%, while the number of units sold dropped by 15%. The imbalance between supply and demand was further exacerbated by an 11% decrease in homes entering the market, pushing the median sale price to $459,776 in the area with significant variations at the city, town, and county levels. Over the past four years, median home prices have seen a 40% increase, and moderate increases are expected to continue over the next three to five years. This underscores the importance for prospective buyers to act rather than wait for price corrections or mortgage rate declines. Given the significant appreciation in home values, homeowners are advised to consider capital gains implications when deciding whether to stay put or capitalize on their equity. However, the current capital gains exemption, unchanged for 25 years, is increasingly viewed as outdated, prompting calls for adjustments to reflect inflationary trends.

Forecasts from Lawrence Yun, the Chief Economist for National Association of Realtors, suggest a potential 14% increase in home sales this year, accompanied by modest price appreciation estimates ranging between 2.5% to 5%. Despite some buyers anticipating price declines, local market conditions driven by supply-demand imbalances do not support such expectations. Various economists and institutions, including the Mortgage Bankers Association and Fannie Mae, predict mortgage rates hovering around 6% to 6.5%, a level deemed acceptable by both buyers and sellers, capable of stimulating market activity. Additionally, external factors such as the presidential election year, Federal Reserve rate adjustments, and global geopolitical developments could exert further influence on the real estate landscape in 2024.

Forecasts from Lawrence Yun, the Chief Economist for National Association of Realtors, suggest a potential 14% increase in home sales this year, accompanied by modest price appreciation estimates ranging between 2.5% to 5%. Despite some buyers anticipating price declines, local market conditions driven by supply-demand imbalances do not support such expectations. Various economists and institutions, including the Mortgage Bankers Association and Fannie Mae, predict mortgage rates hovering around 6% to 6.5%, a level deemed acceptable by both buyers and sellers, capable of stimulating market activity. Additionally, external factors such as the presidential election year, Federal Reserve rate adjustments, and global geopolitical developments could exert further influence on the real estate landscape in 2024.

A downward trajectory in the marketplace could incentivize homeowners with exceptionally low rates to consider selling, thereby alleviating the inventory crunch experienced in 2023. Dubbed the “lockdown effect,” many sellers have hesitated to trade their current interest rates for higher terms, but as rates gradually recede and life circumstances evolve, this grip will loosen and market activity is expected to rebound. We will continue to monitor mortgage rates throughout 2024.

In summary, amidst the complex interplay of economic indicators and socio-political factors, consumer sentiment is on the upswing, with prospective buyers encouraged to seize opportunities that align with their present and foreseeable needs while remaining within their financial means.

Long term, the solution must include more and larger development to meet demand. Reputable and well-established builders are working hard to roll out new projects and additional phases of established communities. Extensive permitting and labor shortages are impacting cost, ultimately absorbed by purchasers. More action by state and local officials is needed to satisfy demand, address affordability, and positively impact our aging housing stock.

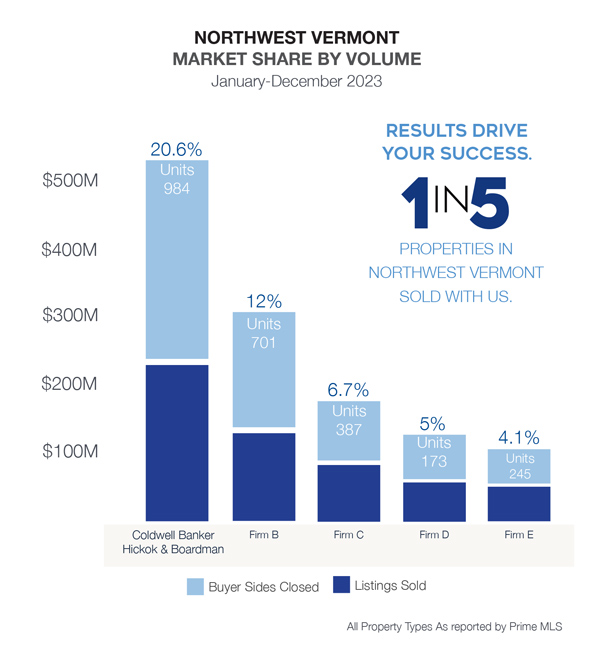

To best navigate this market successfully, it is crucial for both buyers and sellers to be well-informed about the current conditions and trends and adapt their strategies accordingly. Our well-skilled and experienced Agents can provide you with the guidance you need to make your next move.

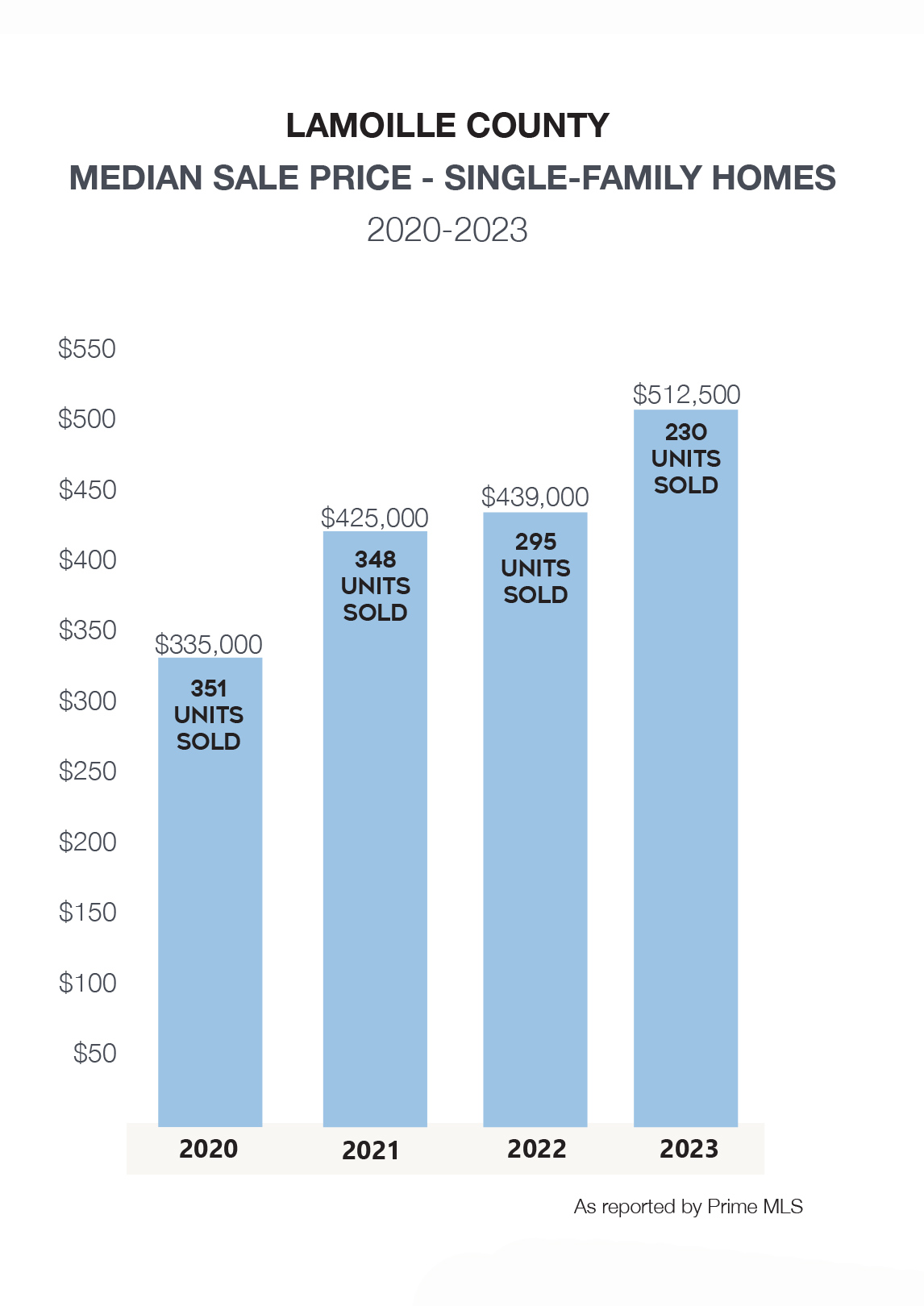

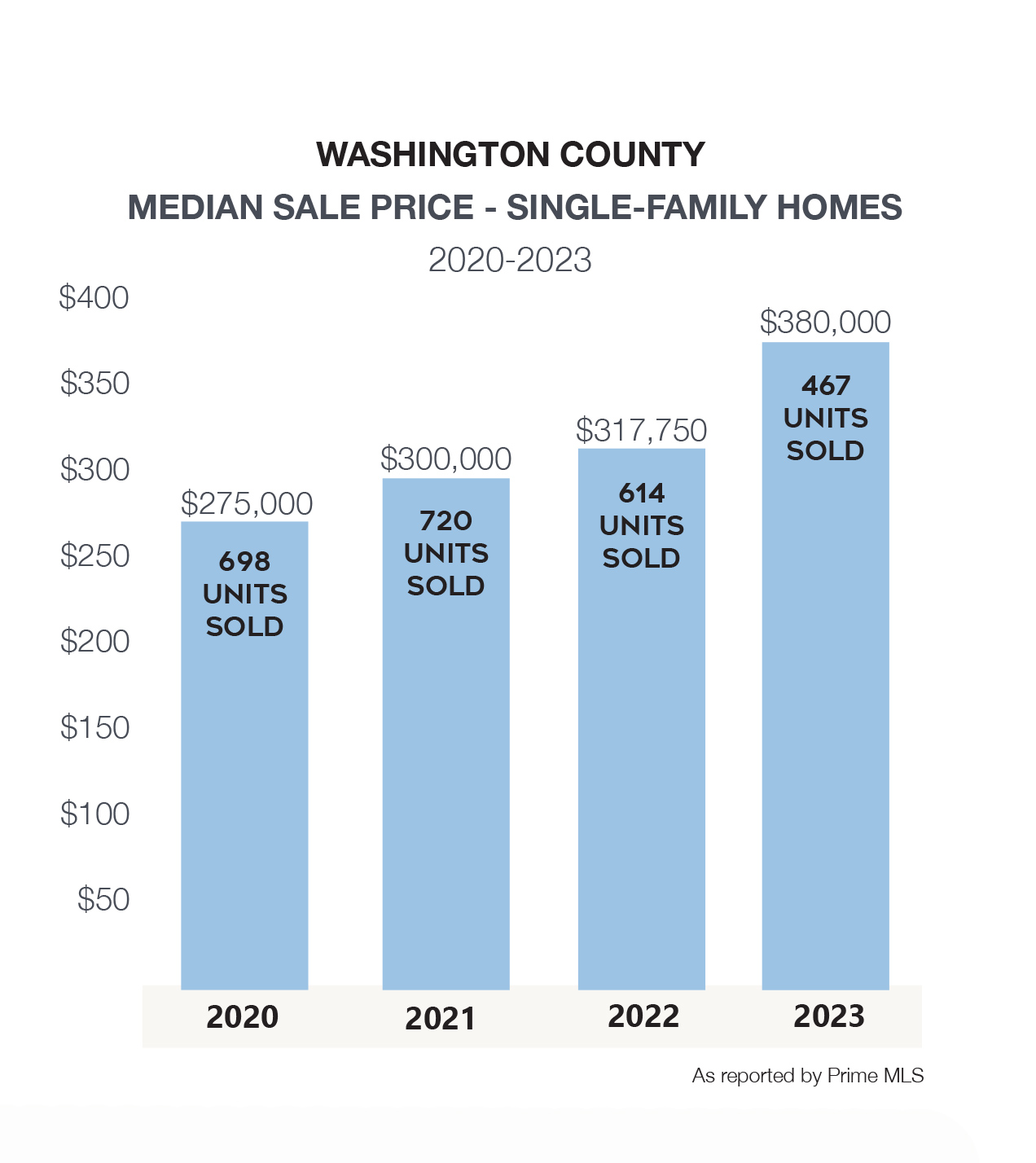

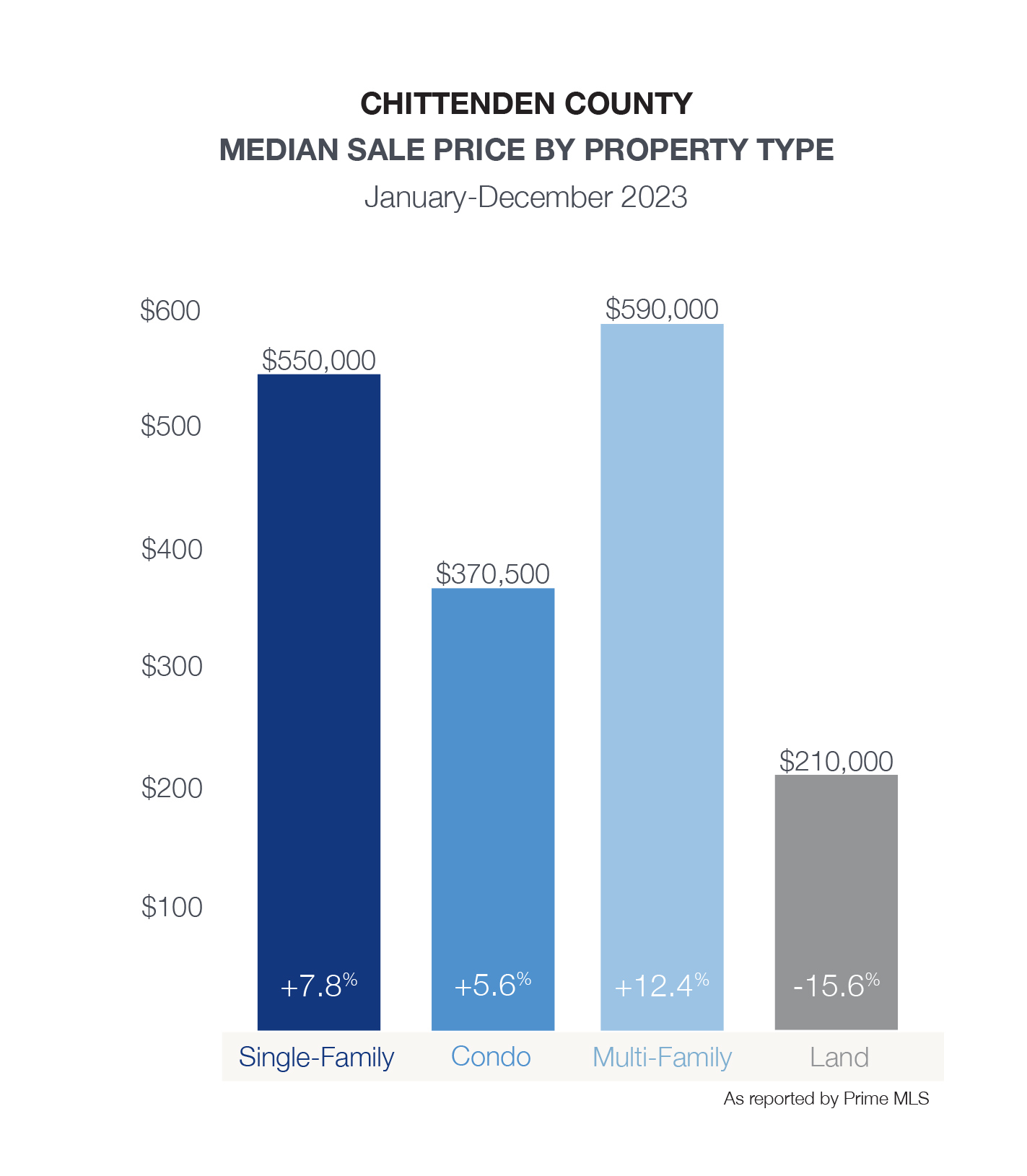

While prices for single-family homes have increased across the county by 42% since 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen

While prices for single-family homes have increased across the county by 42% since 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen