The top-of-mind question with homebuyers and sellers in Northwest Vermont is whether the market’s recent healthy trends will continue. The answer, based on pricing and demand in the first half of 2016, is a definite “yes,” although tight inventory levels remain an issue in Chittenden County.

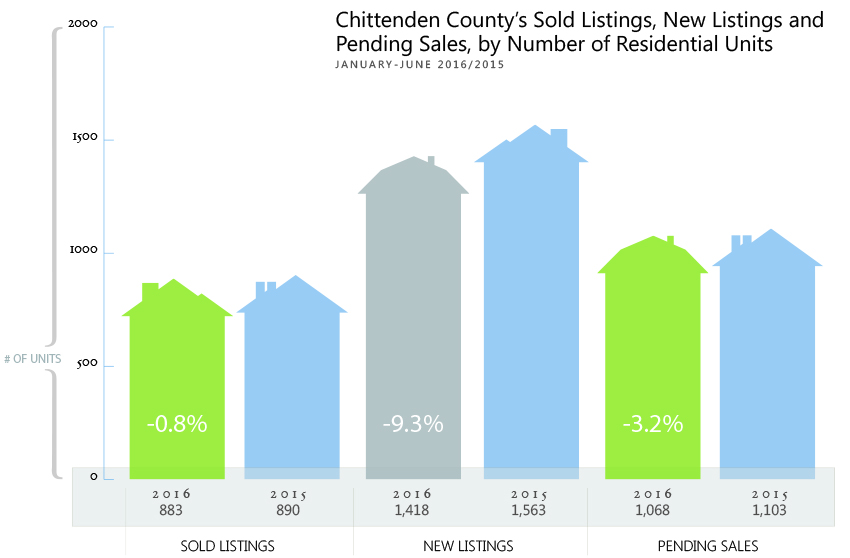

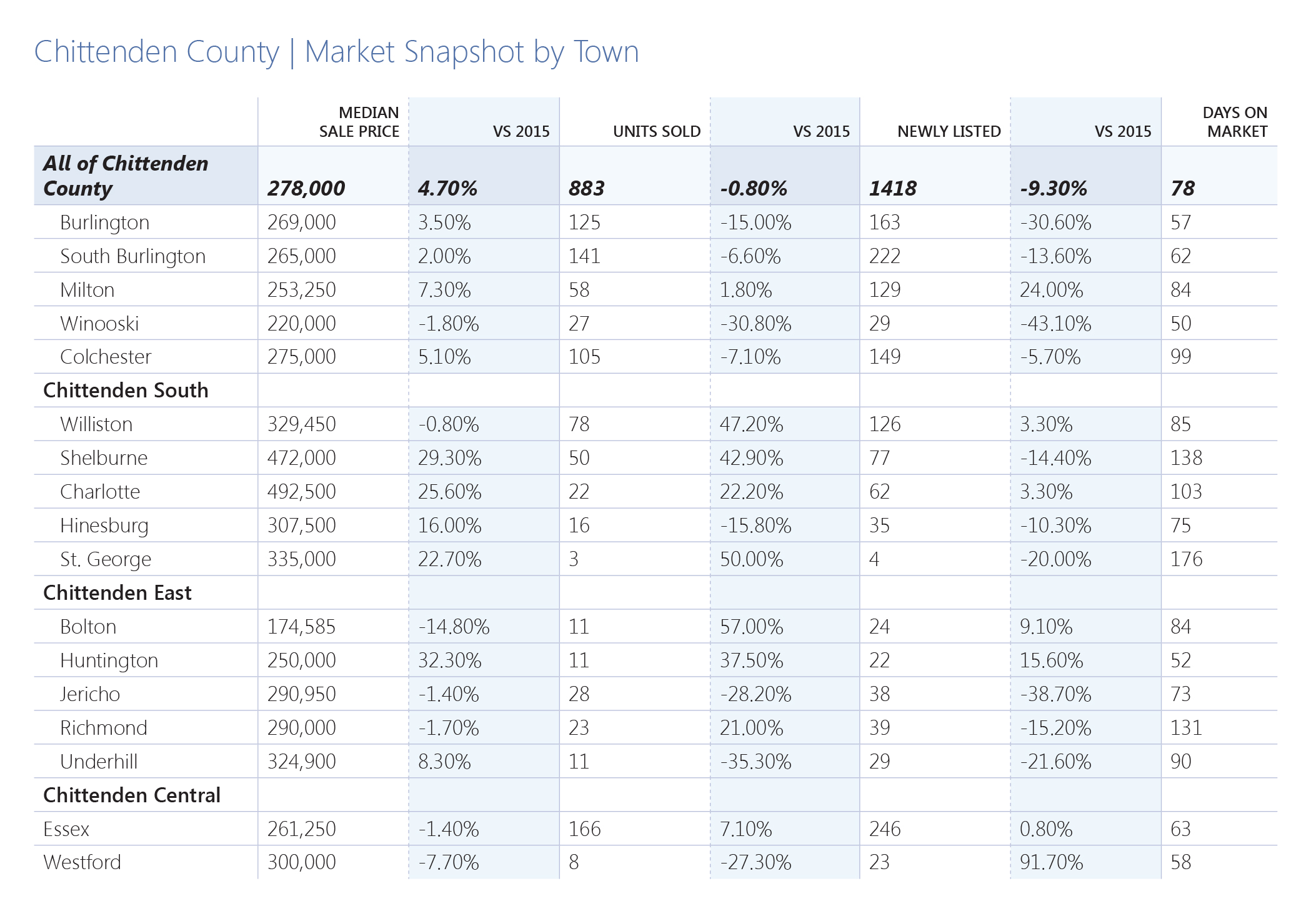

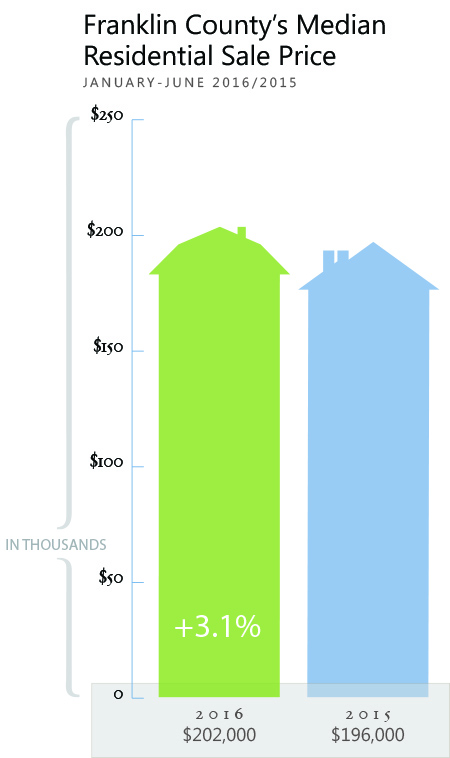

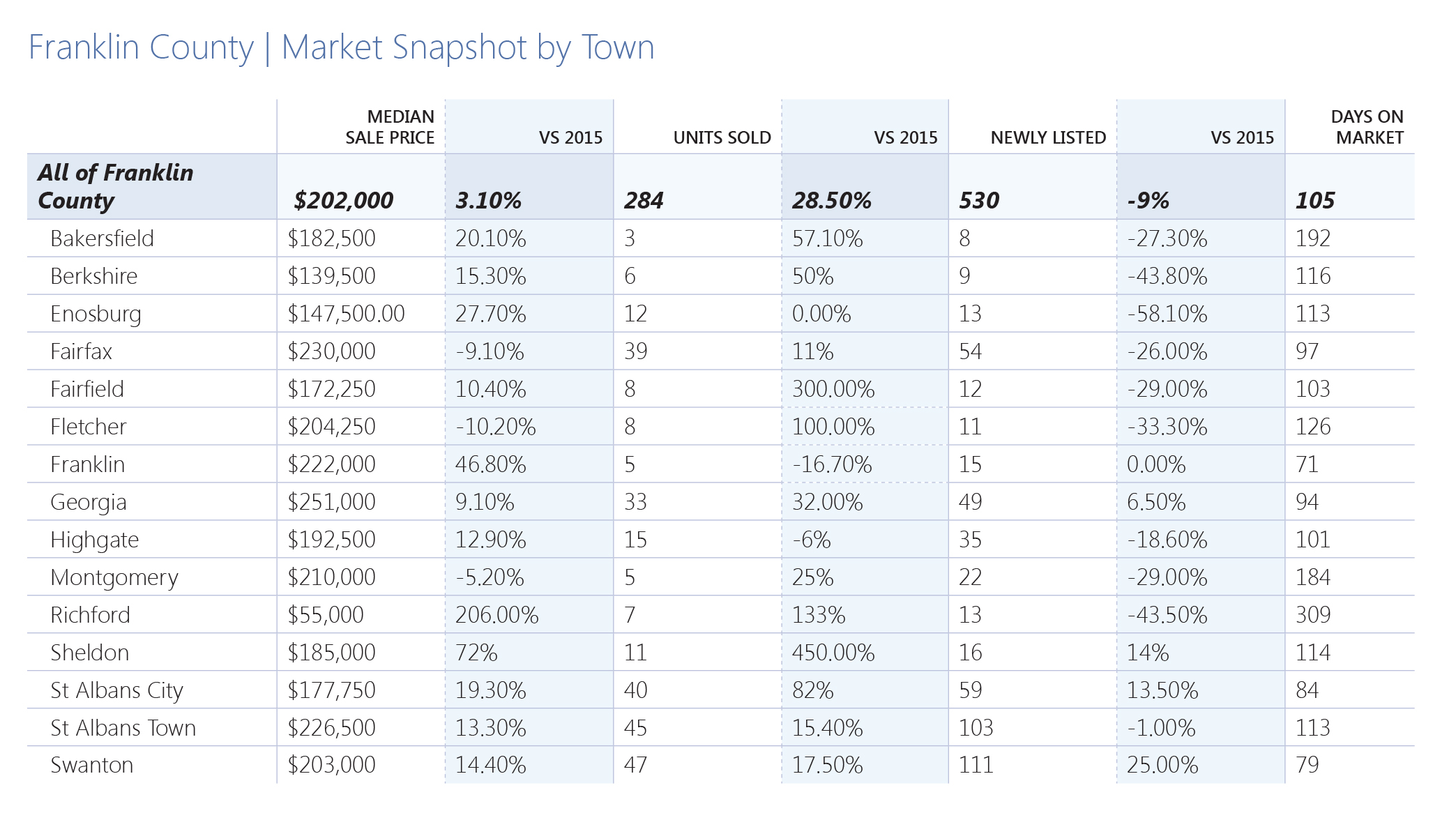

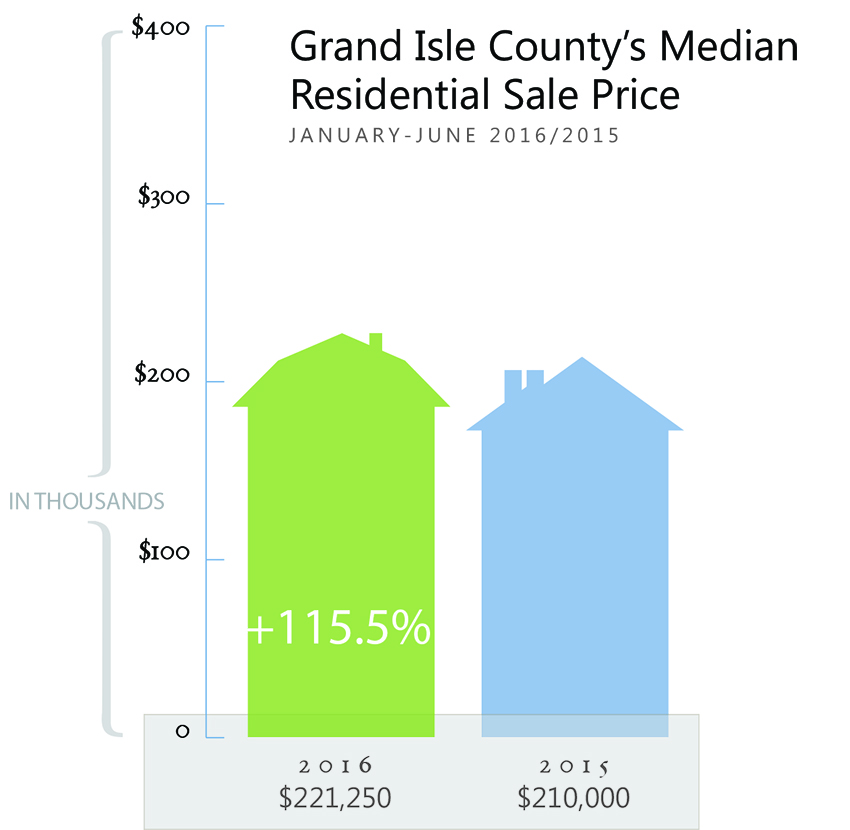

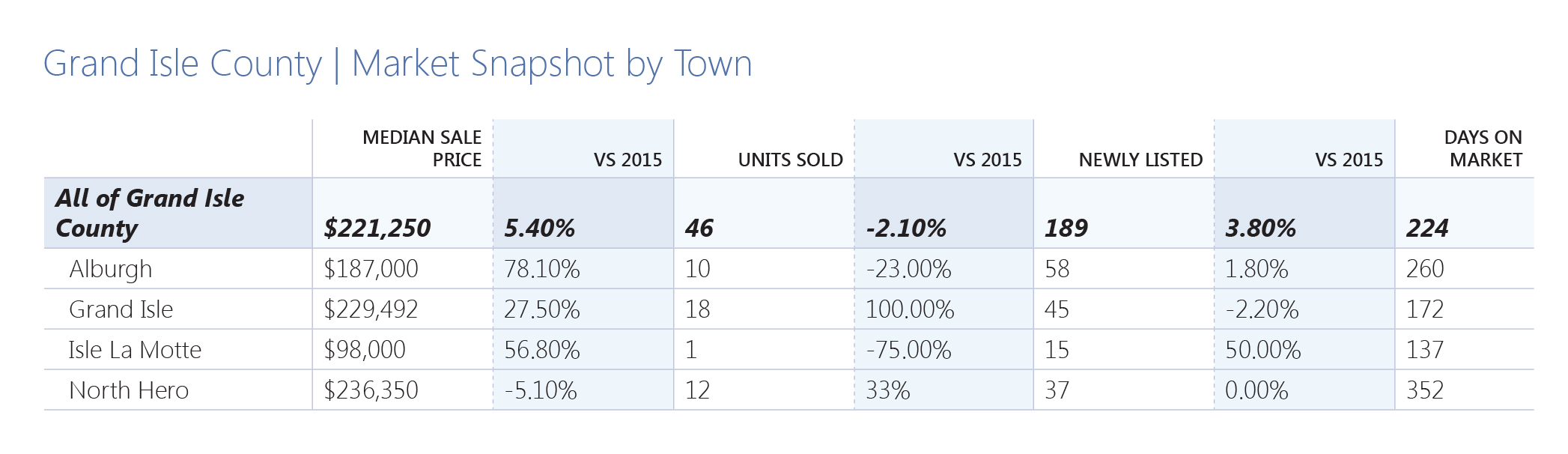

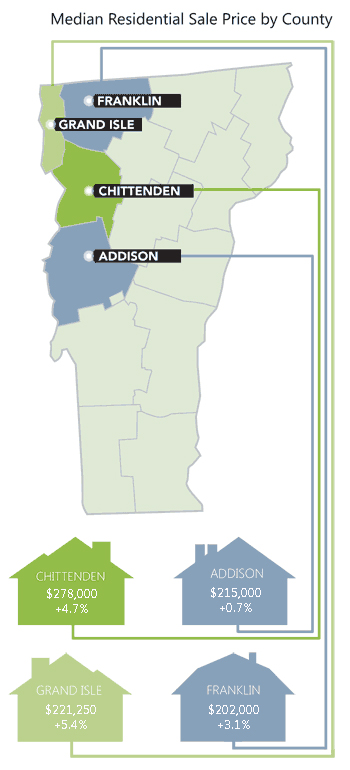

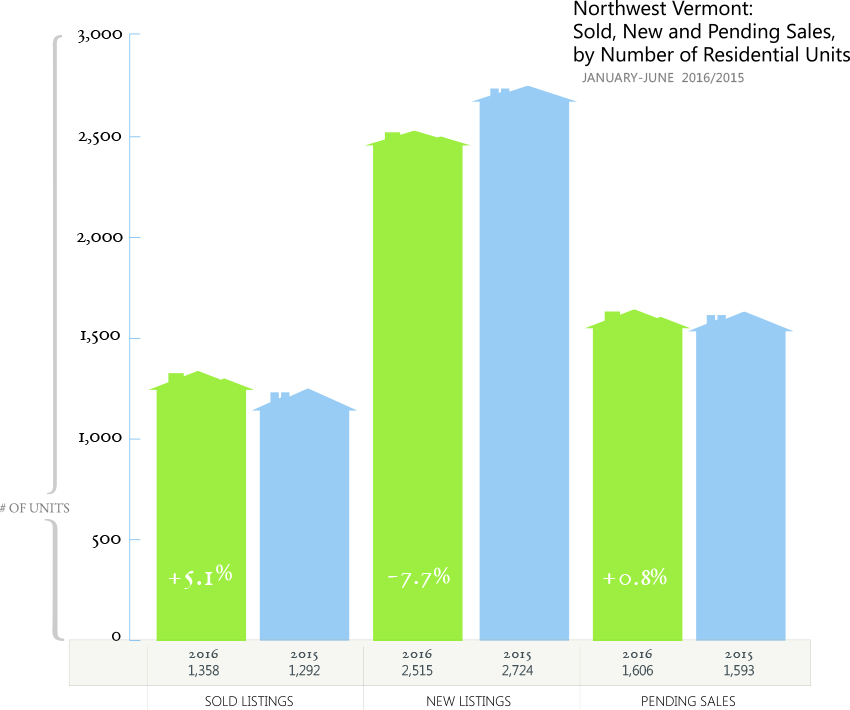

Demand was robust in the first six months of the year, with the number of residential sales rising 5.1% across our region’s four counties. Pricing rose slightly, with a 0.5% gain, although the area’s busiest region – Chittenden County – witnessed a 4.7% gain in median sale pricing.

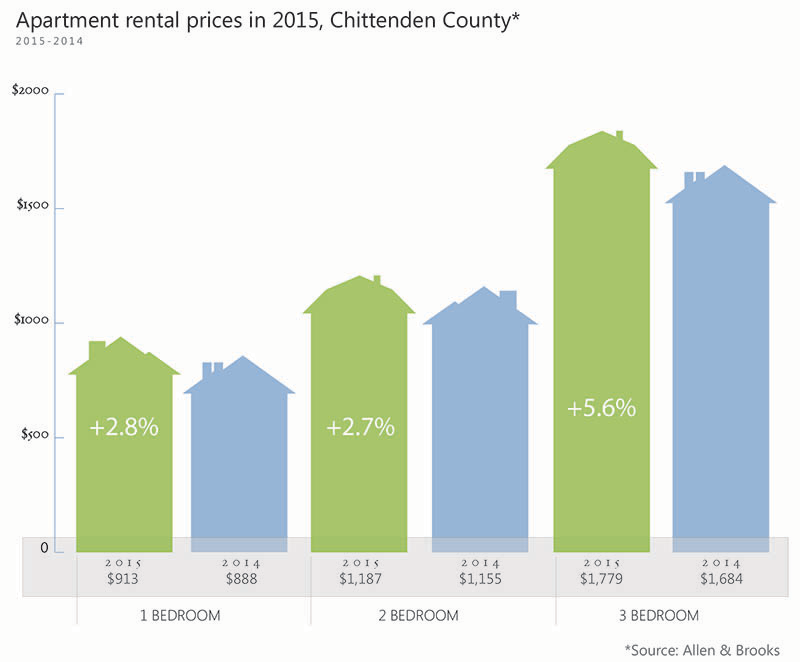

Economic trends continue to strengthen in Northwest Vermont, with local businesses and institutions such as MyWebGrocer and University of Vermont continuing to hire. With new professionals moving to the region, they are spurring demand for both residential properties and rental apartments. The unemployment rate in Vermont stood at 3.1% in May, among the lowest in the country.

Still, several economic concerns at the national and international level may be making consumers feel less confident, at least for the moment. Consumers remain “cautiously optimistic” about economic growth, according to the Conference Board’s June survey. The pending presidential election may cause some consumers to hesitate to commit to big purchases until after the vote. Additionally, the U.K. has voted to leave the European Union, which has added to concerns about the strength of the international economy.

The uncertainty has prompted the Federal Reserve to hold off on raising interest rates. The good news for the property market is that mortgage rates remain at near-record lows, which means lower borrowing costs for buyers or homeowners who want to refinance.

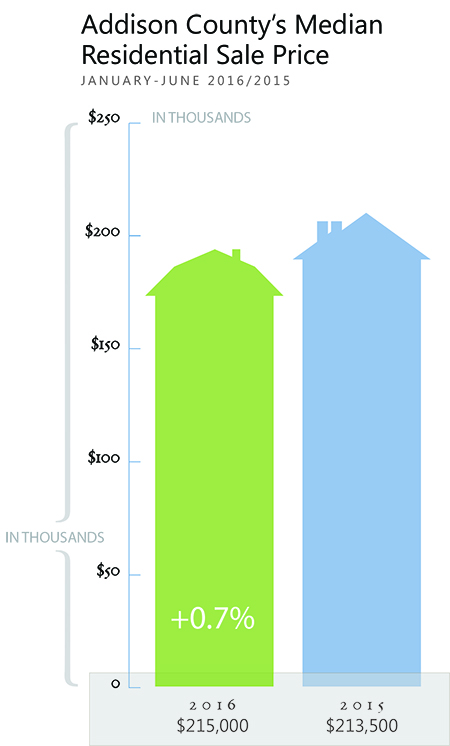

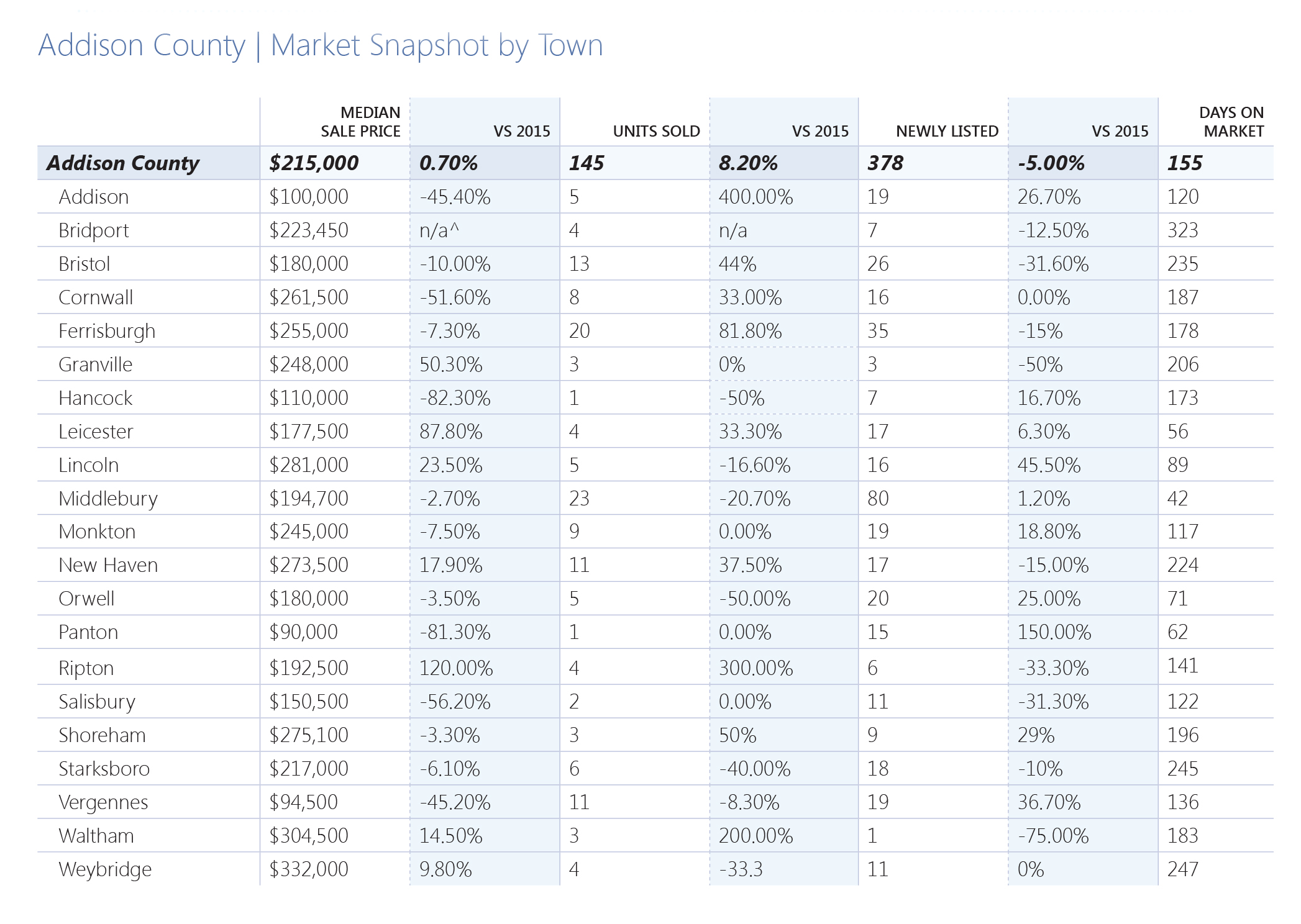

Yet even with those low rates, affordability remains problematic, most notably in Chittenden County. Some buyers are seeking housing in lower-cost counties such as Franklin and Addison Counties. Within Chittenden County, the most sought-after housing is in the $250,000 to $400,000 range, although the market is suffering from low inventory in that segment.

Because of those trends, first-time home buyers, especially those in the millennial generation, may either remain renters or make sacrifices to purchase their first homes, such as looking farther afield for property or buying a home that needs renovation. First-time homebuyers are returning to the market, however, with a Coldwell Banker Hickok & Boardman Realty survey last year finding that 37% of our clients had just purchased their first home, close to the typical 40% of the market.

Some builders are responding by adding affordable housing units, while earlier this year a new coalition called Building Homes Together was formed with the goal of adding 3,500 new homes over the next five years.

Act 46, the education governance reform law passed last year that calls for larger school districts, continues to evolve, with school districts and communities around the state evaluating school mergers. Because of these changes, we recommend homeowners and potential buyers discuss the possible impact with their Realtor, local lawmakers and school board members.

Regardless of inventory levels, our Realtors are finding that well-priced homes in good condition are enjoying strong demand from buyers. Before listing, sellers should consider upgrades and fixing deferred maintenance issues, since buyers may be less likely to bid on a home that needs work. “Smart-home” technology, for temperature control, lighting, and security, may also help your home stand out, especially with tech-savvy buyers.

Coldwell Banker Hickok & Boardman is forecasting continued steady growth in pricing and sales for 2016. Based on current trends, we believe sales volume may rise about 5 percent, while pricing could gain about 1% to 2%, or similar to the national forecast from the National Association of Realtors.

As always, it remains that both sellers and buyers need to reflect on their personal situation. Utilizing the local knowledge within this report and the advice of your agent – you can make an informed decision about your next move.

The Vacancy Rate Is Easing

The Vacancy Rate Is Easing