| Single Family | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $293,000 (+5.8%) | $325,542 (+3.3%) | 2,275 (-0.8%) | 3,098 (-2%) | 87 (-12.1%) |

| Condo | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $230,000 (+1%) | $260,105 (+1.4%) | 752 (+6.5%) | 892 (+11.6%) | 70 (-15.7%) |

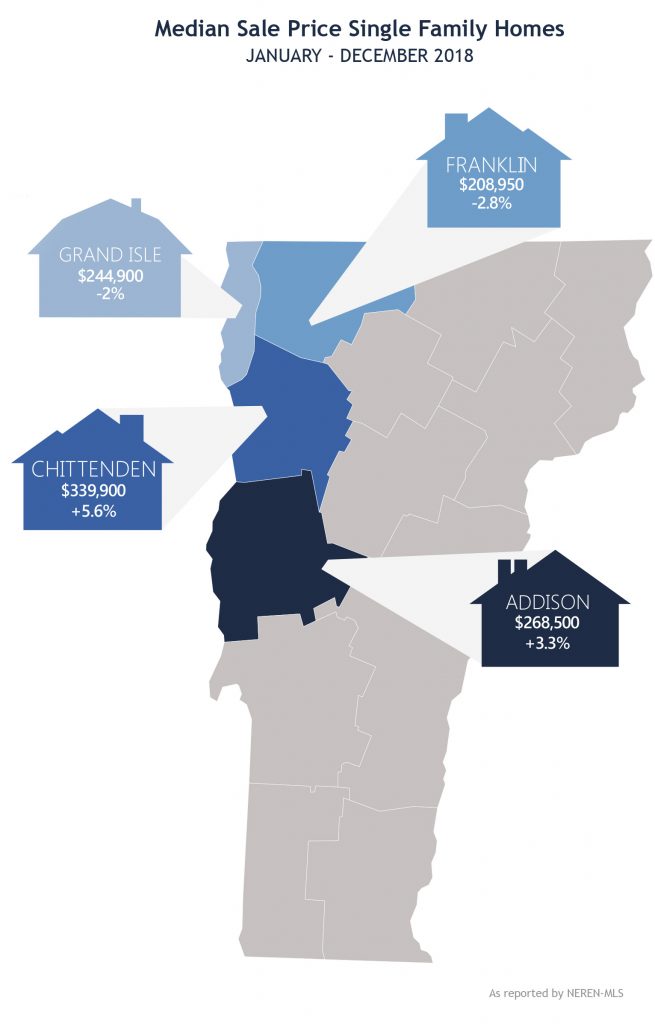

Our early 2019 Market Report provides a recap of real estate sales throughout the four counties in northwest Vermont: Addison, Chittenden, Franklin and Grand Isle. In addition to residential real estate sales, we look at results and trends in luxury & multi family home sales – as well as land sales throughout the region.

Low inventory continues to be the story in the local and national housing market. Properties coming on the market for sale have been in short supply for a few years resulting in fewer closed sales while demand remains strong. Steadfast price growth for single and multi-family homes in northwest Vermont is good news for sellers – and has challenged some first-time home buyers who were caught in multiple offer scenarios in certain hot price points and locations.

Low inventory continues to be the story in the local and national housing market. Properties coming on the market for sale have been in short supply for a few years resulting in fewer closed sales while demand remains strong. Steadfast price growth for single and multi-family homes in northwest Vermont is good news for sellers – and has challenged some first-time home buyers who were caught in multiple offer scenarios in certain hot price points and locations.

2018 was a volatile year for the stock markets – with the DOW, S&P 500 and Nasdaq all ending the year lower than they started – the first time that has happened since 2008. Having said that, the markets spent most of 2018 climbing rather than falling- with never before seen heights. While the markets ended down -the overall economy soared. The economic expansion has been driven for years by historically low interest rates. After a several adjustments in 2018, the federal reserve is less eager to raise rates at the same pace and has already trimmed its forecast for expected rate hikes in 2019. Most experts project an average of 5.25% by the end of this year. While interest rates have risen slightly– they are still relatively low. And consumer spending is thriving. These are indications of a healthy economy for 2019 – even if not at the same pace as before. The federal government shut down has impacted the economy as well as the housing market – with furloughed government employees unable to provide a recent pay stub in order to prove current employment to mortgage lenders resulting in delays or cancellation of some home purchases. The full effect remains to be seen.

The overall trend in home sales has been positive since 2011 on a national and local level. In some larger markets across the country markets have begun to slow however Vermont benefits from relative stability with moderate growth year over year. The National Association of REALTORS’ Chief Economist, Lawrence Yun, cites home price increases moderating in 2019. Tight inventory conditions remain an ongoing concern that will keep prices relatively elevated, but stable.

New construction projects may ease the shortage somewhat, but the need for affordable homes is not being met. Builders face challenges in land, permit and materials cost as well as shortages in labor which has been putting the price of new homes in the area well above $400,000. Some communities are challenging new developments, with neighbors raising concerns about the loss of green space and wildlife habitats. The quality of life that draws people to Vermont needs to be carefully balanced with the cost of living in our beautiful state.

Millennials make up to 45% of the home buyer market and affordability is a factor. Heavy student loan debt and changing interest rates affect purchase power. For a $300,000 loan – a 1% increase in interest rate equates to an additional $178 per month to the mortgage payment. Working with a local lender – with a common-sense approach to underwriting – will benefit purchasers navigating this market. With most home buyers purchasing property for lifestyle reasons, many are quick to recognize that buying a home is a way to build wealth in the long run.

2019 will remain a Seller’s market in most of the region, with a true “buyer’s market” not on the immediate horizon due to limited inventory, increasing prices and interest rates. Buyers should not stay away from the housing market especially if they are at point in their life where they are ready and able to buy. Buyers who have watched from the sideline and now fear missing out on their dream of home ownership – or risk facing higher finance costs to do so – should act now! They may face less competition early in the season and sellers may still realize a gain on their home sale. This should be a cue for potential sellers to enter the market early in 2019 – rather than waiting for the typical height of the market in the Spring.

Buyers and sellers alike should have these best practices in mind: identify your wants and needs, learn about the market, form reasonable expectations, perform your due diligence, and be prepared to act – with the assistance of a skilled and trusted Realtor.