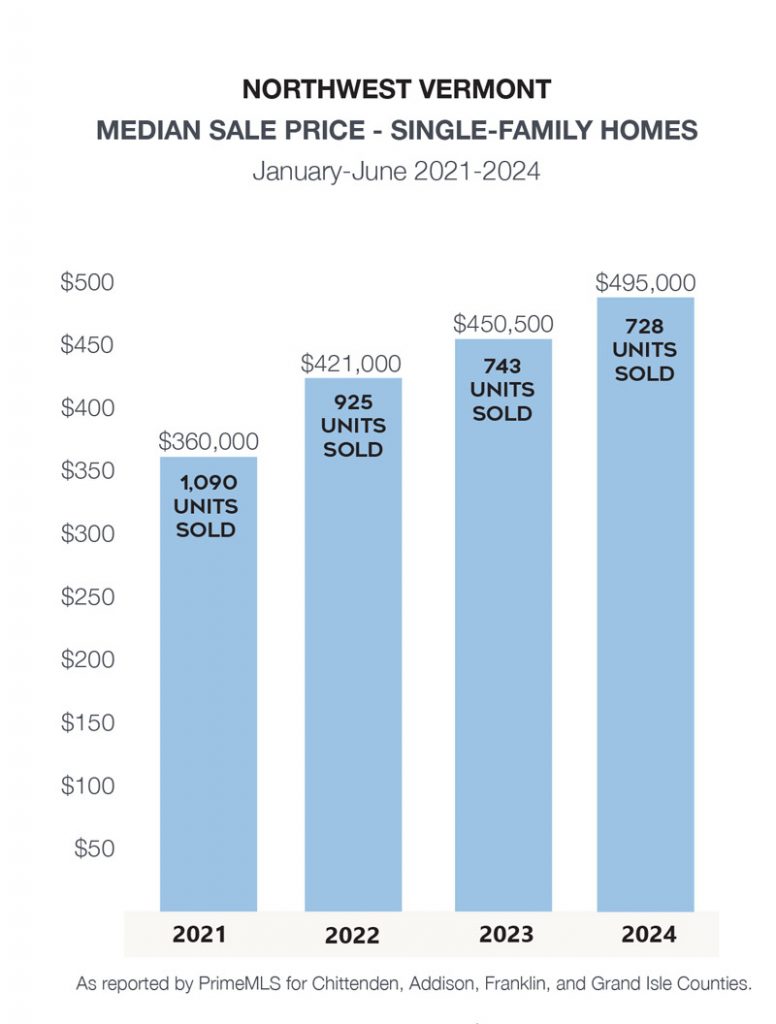

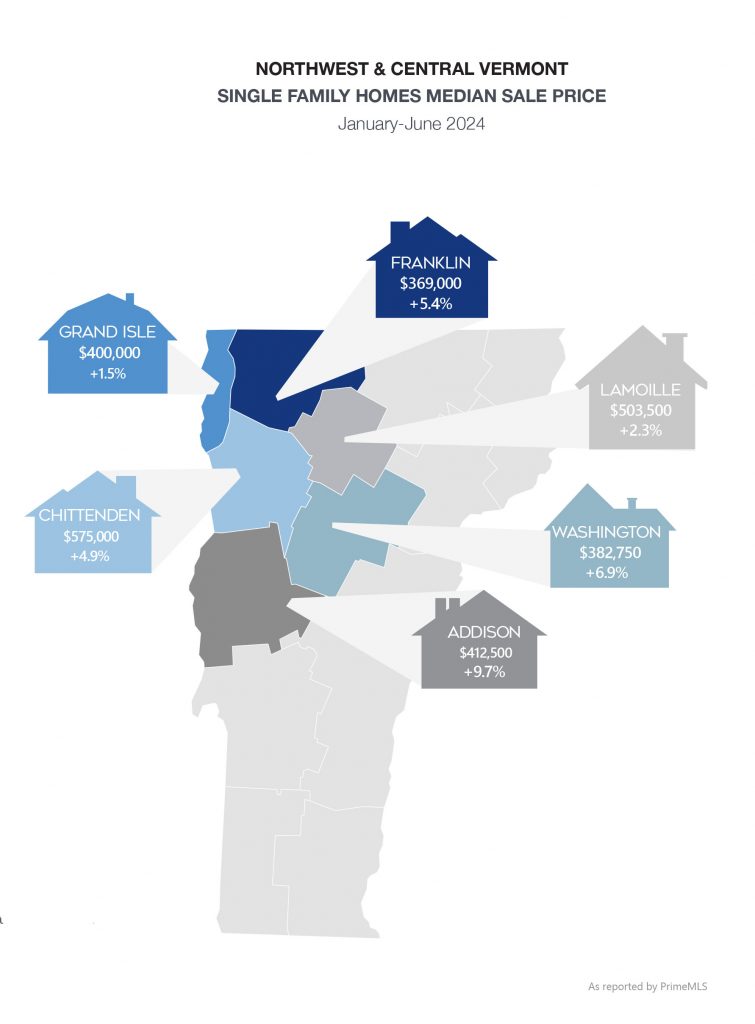

After nearly five years of declining inventory, the number of single-family homes, condos, and multi-family homes rose during the first half of 2024. The first six months of 2024 saw a healthy increase in newly listed properties. Most of the increase in new listings came from April – June. The additional inventory did not temper the increase in the median sale price of single-family homes, which rose nearly 10% during the period. The impact of higher inventory will result in increased sales as the year progresses. However, 2024 (like 2023) will likely be one of the lowest sales years in history as the market continues to rebalance post-pandemic.

| Single-Family January-June 2024 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $459,776 +6.9% | $569,738 +10.6% | 728 -2.4% | 1150 +7.7% | 39 +18.2% |

| Condos January-June 2024 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $350,000 -1.4% | $403,755 -1.8% | 286 +11.3% | 427 +26.0% | 23 +43.8% |

| MULTI-FAMILY January-JUNE 2024 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $525,000 +3.5% | $572,285 +1.4% | 48 -4.0% | 107 +40.8% | 58 +20.8% |

| Land January-June 2024 | ||||

|---|---|---|---|---|

| Median Sale Price: | Average Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $150,000 +3.8% | $204,693 +0.2% | 79 -14.1% | 153 -5.6% | 134 +3.1% |

Properties that were listed and went pending in May and June are scheduled to close in July and August. The additional inventory provides more options for buyers, slows the pace of the market, and eases the upward pressure on home prices. Home buyers who have stayed in the market have benefitted. The shift in inventory has enabled buyers to include inspection contingencies and request seller concessions, including help with closing costs and repairs.

It is unclear if there will be a Fed rate cut in 2024 – which many experts were hoping for. If mortgage rates finally decline, more buyers may move off the sideline – resulting in a surge in demand that will absorb the gain in inventory. We continue to see many homeowners “locked” into historically low mortgage rates, and they are challenged to move in exchange for a higher rate and possibly a higher-priced home. Mortgage rates fell just under 7% in June. Various experts predict the rates to end the year between 6.5% and 7.0%.

It is unclear if there will be a Fed rate cut in 2024 – which many experts were hoping for. If mortgage rates finally decline, more buyers may move off the sideline – resulting in a surge in demand that will absorb the gain in inventory. We continue to see many homeowners “locked” into historically low mortgage rates, and they are challenged to move in exchange for a higher rate and possibly a higher-priced home. Mortgage rates fell just under 7% in June. Various experts predict the rates to end the year between 6.5% and 7.0%.

Despite the continuing upward trend in home prices, there is unlikely to be a “housing crash” in 2024. Over the past few decades, new home construction in Vermont has not provided enough new housing to fill the need. “Entry-level” homes are particularly scarce; the low level of inventory, coupled with the financial stability (equity in their homes) of most homeowners, is much different than during the Great Recession.

Millennials will continue entering the home-buying market, maintaining demand this year. Current demographics support continued strong demand through the next several years. Nationally and locally, there needs to be more homes to meet demand. In Vermont, 5,000-6,000 new homes are needed to improve supply over the next five-plus years. Land use regulations and a limited labor force are two challenges in achieving that goal.

Nationally, the median price for existing homes in May rose 5.8% from a year ago to a new record high of $419,300. “Home prices reaching new highs are creating a wider divide between those owning properties and those who wish to be first-time buyers,” said Lawrence Yun, chief economist at NAR. We continue to advocate for more new construction at all price points in Vermont.

Remainder of 2024

For Buyers:

- Expect Higher Prices: Home prices are likely to remain high, with potential slight declines in mortgage interest rates.

- Financial Preparation: Save money for a down payment and work on your credit score. Consult with a local lender to learn about mortgage programs so you are ready when the right home is listed.

- Market Understanding: Work with a skilled professional who can provide you with information on the market you are searching. Understand the pricing and inventory in addition to how quickly homes sell (DOM). This enables you to feel comfortable making an offer and moving forward.

- Be Flexible: Be open-minded about your needs and wants. The best time to buy a home is based on your needs. When you find a home that meets your needs and that you can afford, it is the time to buy.

For Sellers:

- Price Predictions: Fannie Mae, Mortgage Banker Association, and the National Association of Realtors predict home prices to rise around 4% over 2023 by year-end.

- Work with Experts: Collaborate with an agent or team with proven results, market knowledge, and a strong marketing presence to best position your home to the broadest pool of buyers.

- Competitive Pricing: Pay close attention to the homes for sale and sold in your neighborhood.

- Recent comparable sales will help determine the sale price for your home. Some price points are not as competitive as others, so be prepared to accept some contingencies and make some concessions.

- Maintenance and Appeal: Ensure your home is well-maintained with lots of curb appeal. Buyers are looking for homes that need few, if any, improvements since they are already under pressure with rising prices, mortgage interest rates, and property taxes.