Ranjit “Buddy” Singh, NMLS 92046

[email protected]

Julie Thorpe NMLS# 92216

[email protected]

There was positive news for mortgage rates which ended 2023 at the low 6% range as the market cheered lower inflation. Rates have moved slightly higher since then, as there are questions with the size, timing, and quantity of Fed rate cuts in the coming year. Freddie Mac expects rates to remain in 6-7% range for 2024, higher than other industry and market participants are estimating. Historically, there have been momentary dips in mortgage rates based on reactions to economic data so it is important to have a very responsive and attentive mortgage representative who has access to live markets this year.

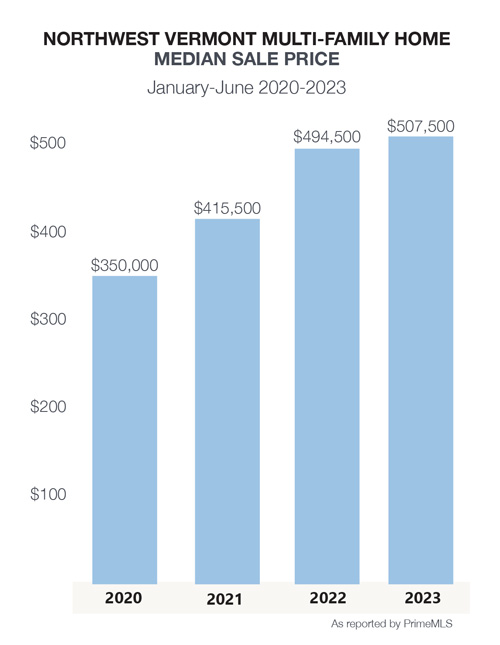

We saw notable changes in the lending environment in 2023. As a recap, FHA ended life of loan mortgage insurance for buyers with 10% down. Fannie Mae added a 5% down payment option for qualified borrowers on 2-4 unit primary residence. This indicates Fannie Mae’s understanding that many homebuyers are priced out of this market, and the income from a multi-unit property provides a path to homeownership. We also saw changes in loan level price adjustments for first time home buyers to offset the rise in rates.

We saw other trends in 2023 that have helped homebuyers access the American dream. There was an increase in borrowers using cosigners, having larger down payments and receiving gifts from family members to make homes more affordable. Multiple homebuyers combining resources to qualify for a multi-unit instead of renting has also become more popular. This strategy increases buying power and helps bolster each partner’s long term financial planning goals.

The mortgage “lock in effect,” where homeowners are locked into a rate lower than 4%, will continue to strain inventory. This creates a reduction of both buyers and sellers, as current homeowners are reluctant to sell and find a different home at a higher rate. Any reduction in mortgage rates should help alleviate some of this log jam.

Forecasting into 2024, we will most likely be seeing more programs become available as lenders adjust their guidelines and overlays to accommodate buyers and adjust for a continued seller’s market. There continues to be a need to bring new buyers into the housing market by some non-traditional paths. Educating another generation of homeowners on these new programs and developments will be of paramount importance. Continued outreach and education will strengthen the industry’s ability to keep opening doors for Vermont homeowners.

Spruce Disclaimer: The information in this report is for informational purposes only and does not represent an offer or commitment to provide any product or service. Any rate quotes, prices or the physical information included have been obtained from sources believed to be reliable, but we do not guarantee their accuracy or completeness. Any mentions of third-party names, products, and services are for referential purposes only and are not meant to imply any sponsorship, endorsement, or affiliation unless otherwise noted. This information is based on current market conditions and is subject to change without notice

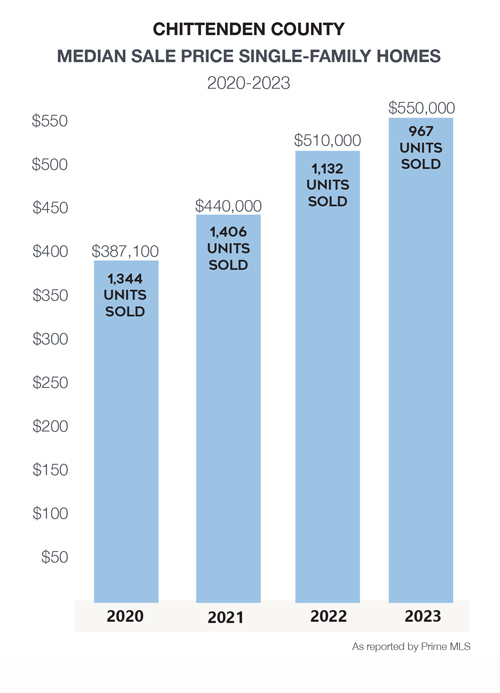

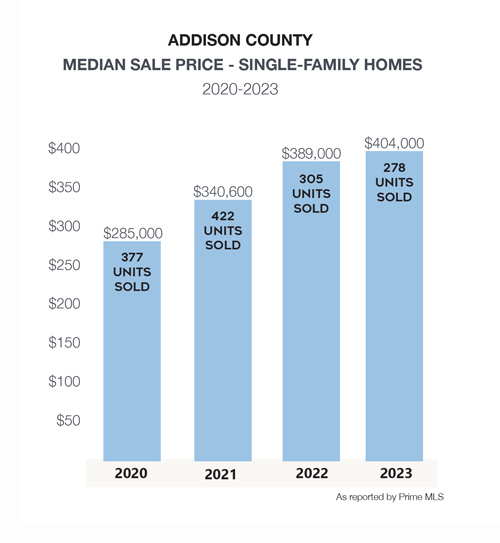

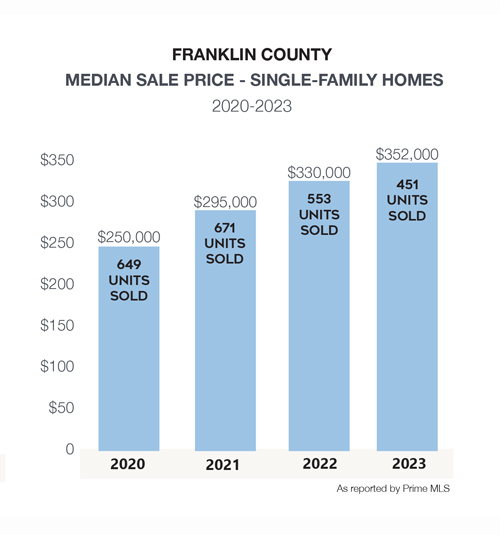

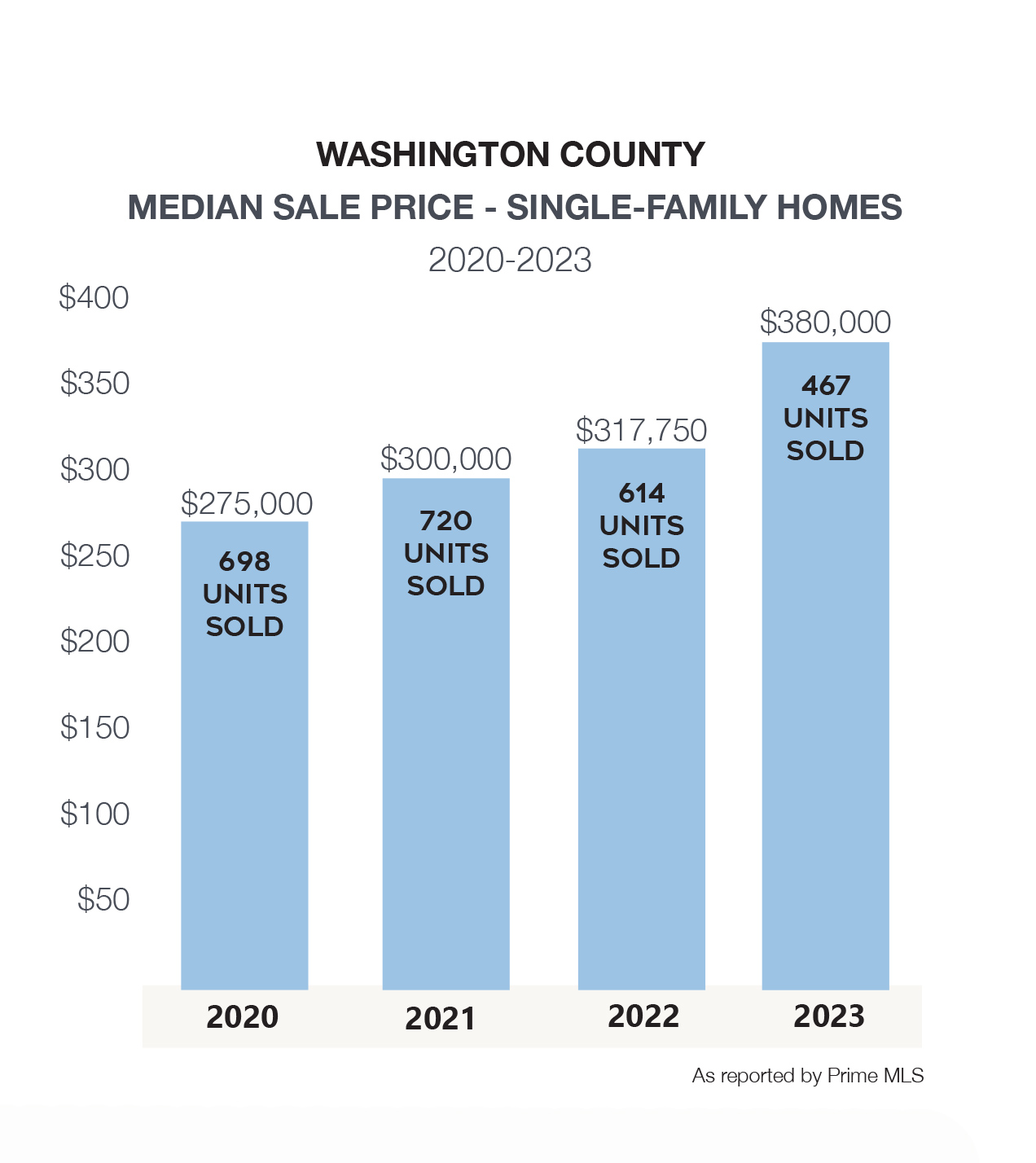

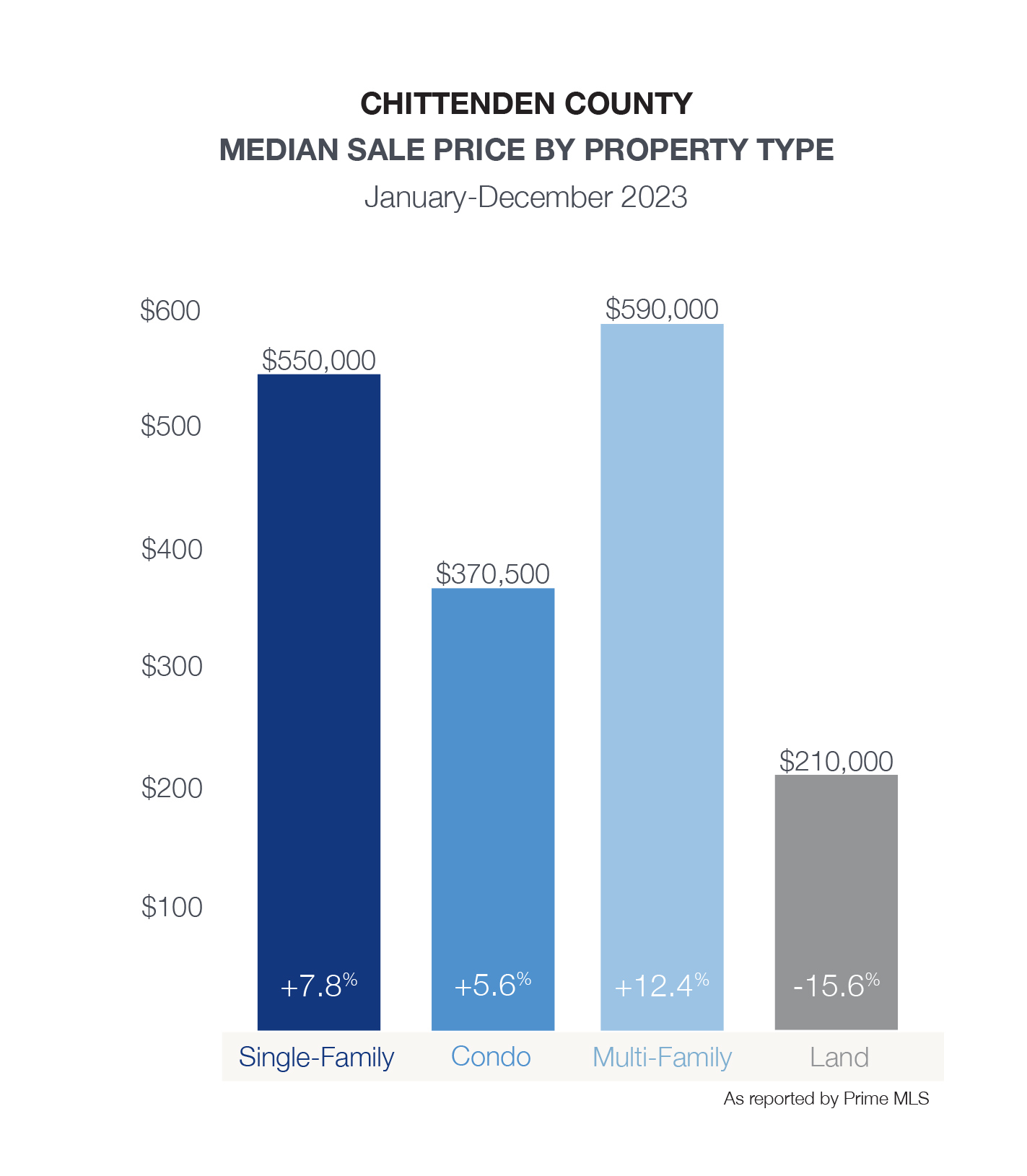

While prices for single-family homes have increased across the county by 42% since 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen

While prices for single-family homes have increased across the county by 42% since 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen