| Single-Family January-June 2023 | |||

|---|---|---|---|

| Median Sale Price: | Units Sold: | Newly Listed: | Days on Market: |

| $507,500 2.6% | 50 -52.8% | 76 -48.5% | 48 -2.0% |

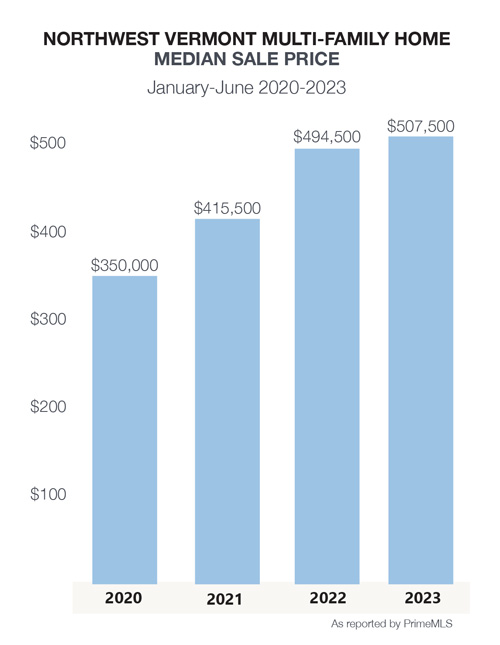

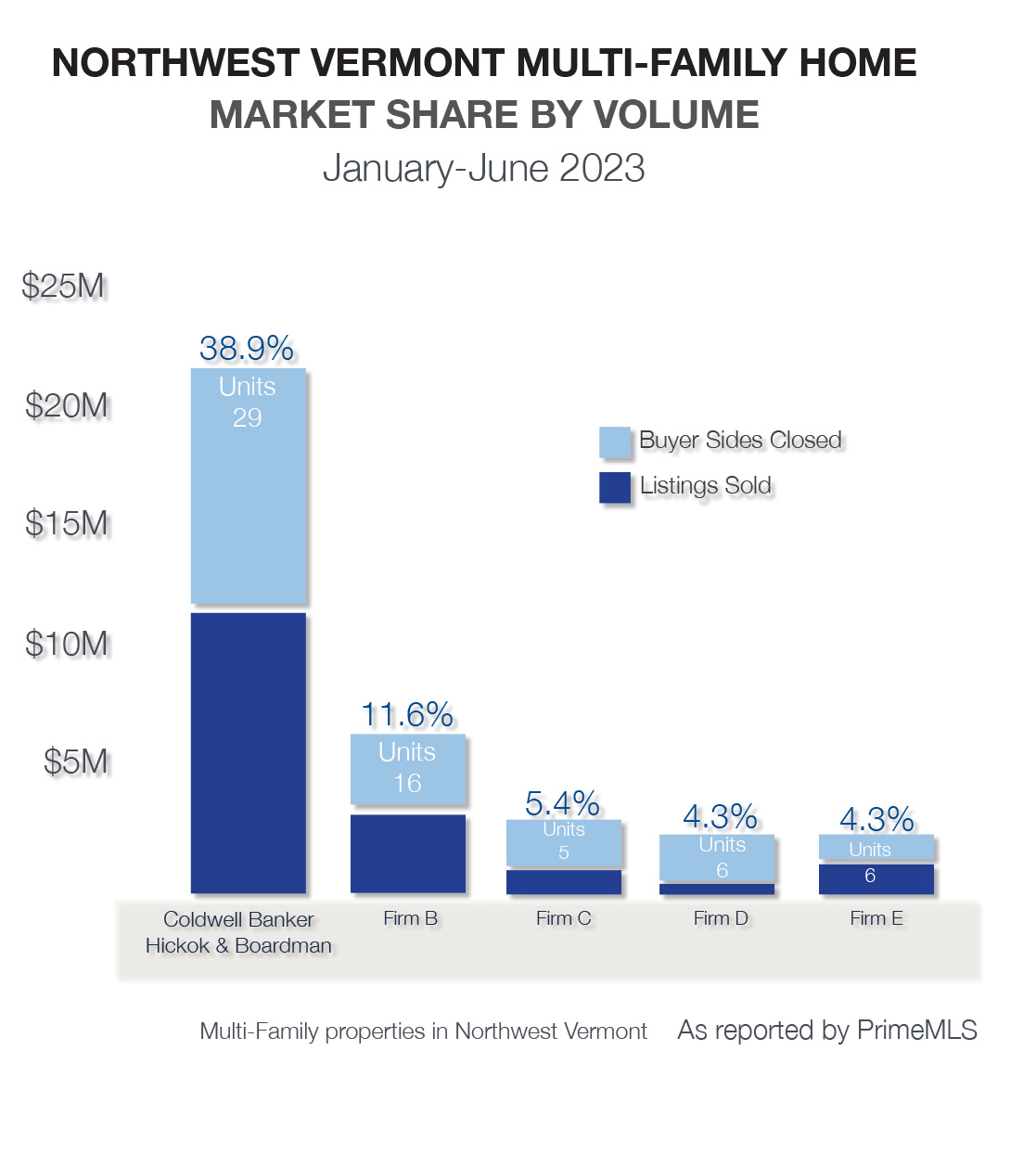

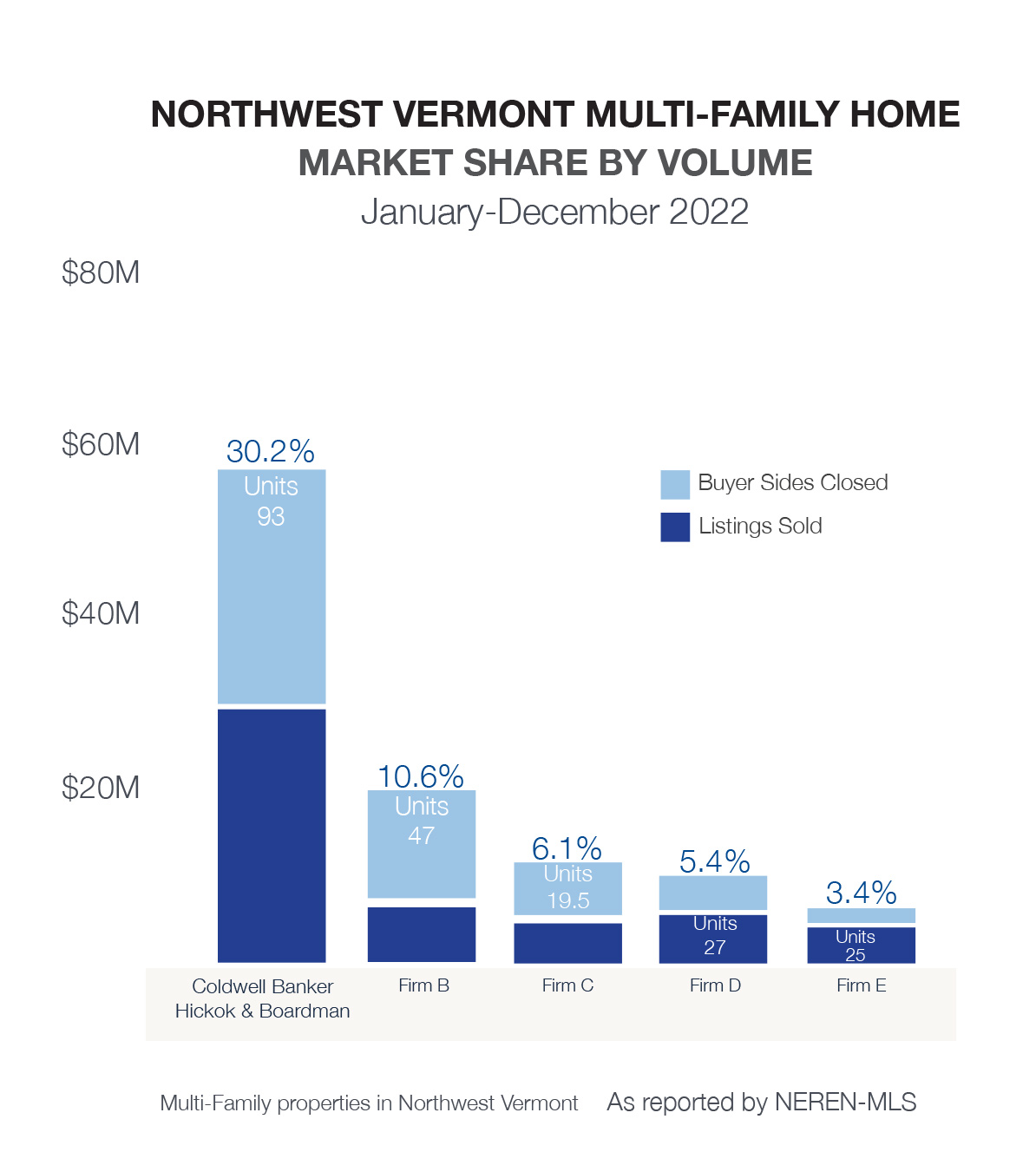

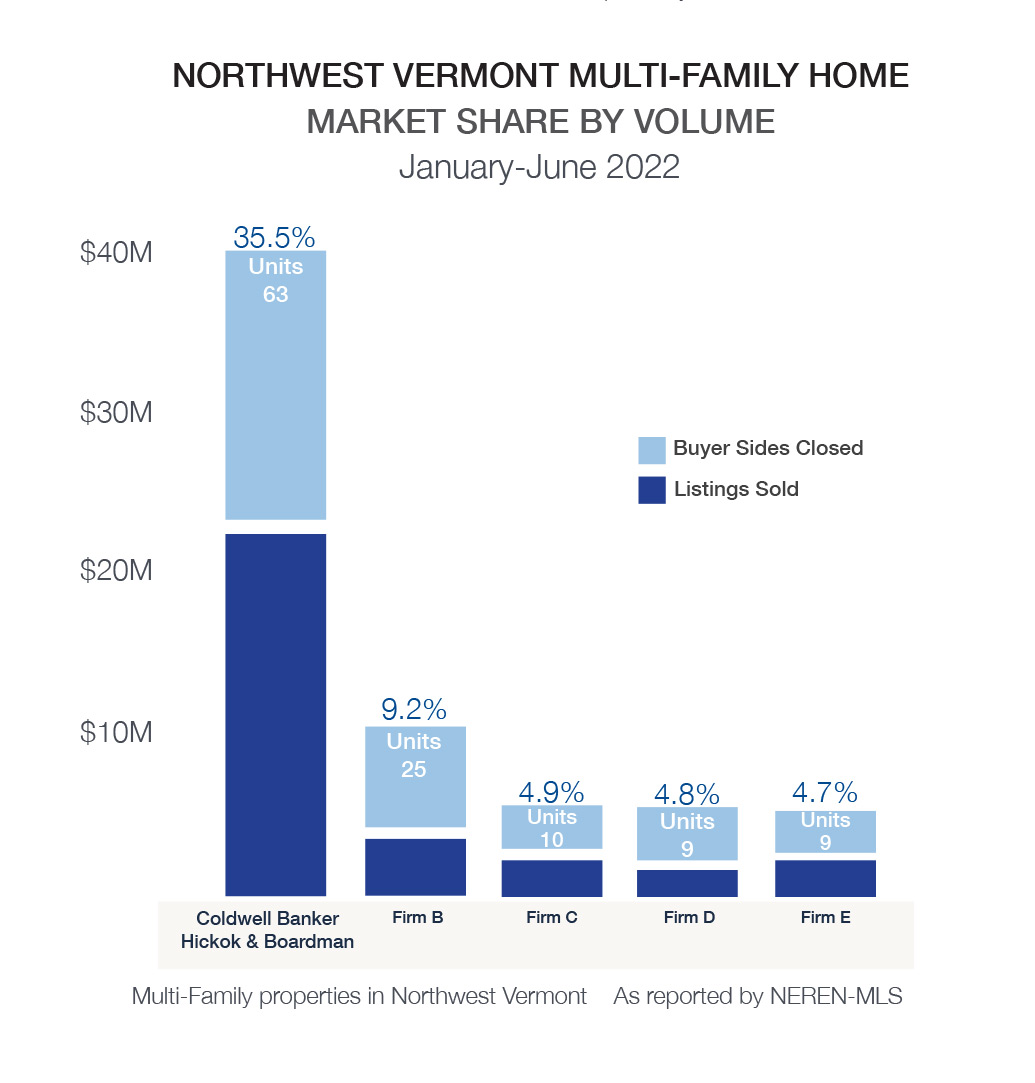

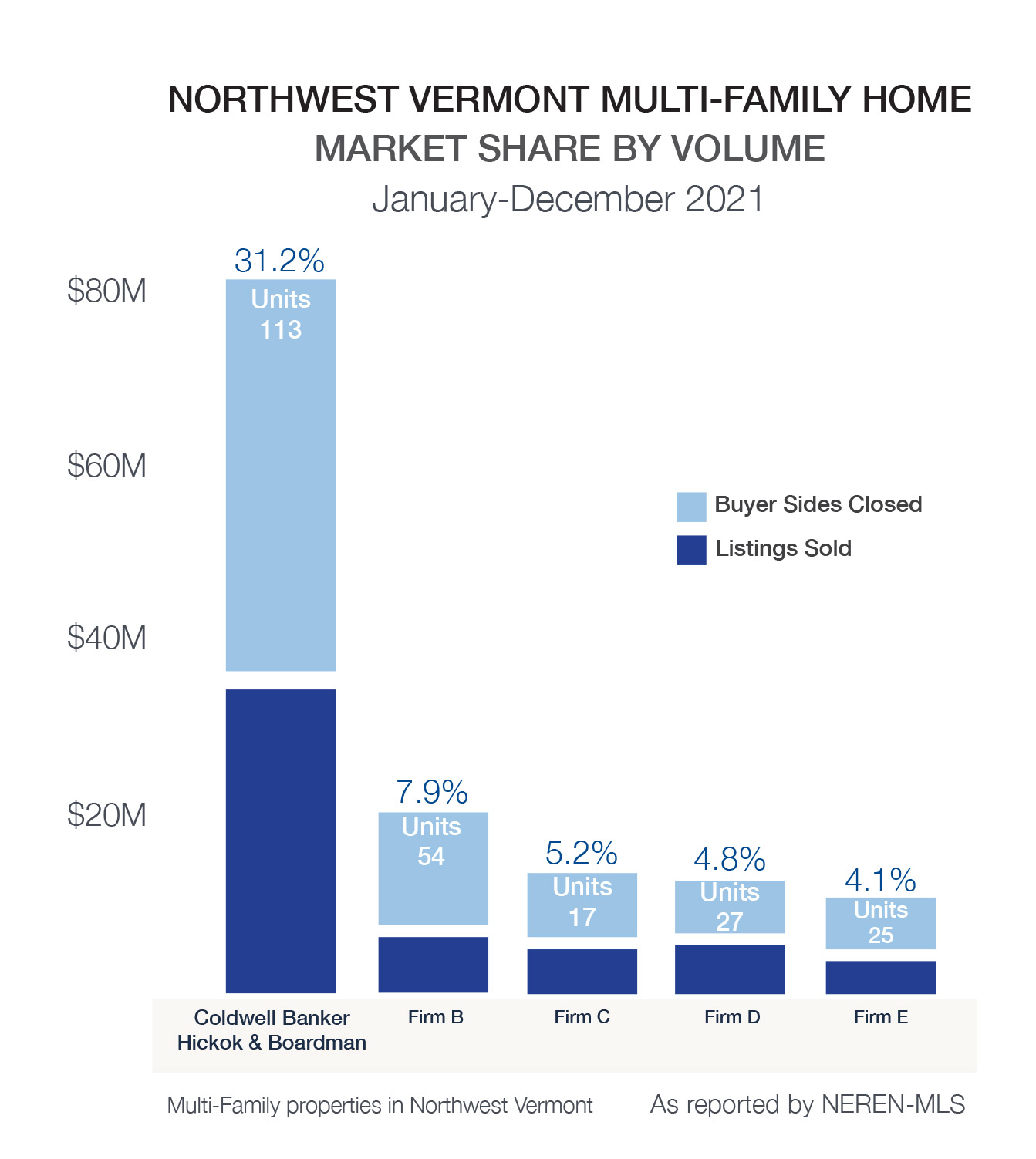

The multi-family market continues to provide owners with solid and predictable investment opportunities. In Northwest Vermont, the median price grew a modest 2.6% while posting a 45% gain since 2020. Despite the increase in mortgage interest rates over the past year, demand remains strong for Burlington and Chittenden County properties. In Chittenden County, where 70% of the multi- family sales closed, the median price jumped 10% over the same time last year.

These properties are a desirable property class in large part due to low vacancy rates, rising rents, steady appreciation, tax benefits, and a hedge against stock market fluctuations. Owners may be holding onto properties as they perceive a lack of alternative investment options and don’t want to give up their pre-2022, low mortgage rates. The 53% decline in sales is a direct correlation to lack of inventory versus demand. Well-located and well-maintained properties, as usual, continue to draw the most interest, selling quickly, in many cases at or above list price.

| MEDIAN SALE PRICE | VS 2022 | UNITS SOLD | VS 2022 | NEWLY LISTED | VS 2022 | DAYS ON MARKET | VS 2022 | |

|---|---|---|---|---|---|---|---|---|

| Chittenden County | $575,000 | 10.1% | 35 | -57.3% | 52 | -51.9% | 35 | -12.5% |

| Addison County | $286,000 | -32.7% | 7 | 40.0% | 8 | -46.7% | 113 | 79.4% |

| Franklin County | $287,500 | -3.2% | 8 | -55.6% | 15 | -16.7% | 47 | -44.1% |

Rental Market Update

Rental Market Update

The rental vacancy rate has been reported at 0.8%, and while rental rates increased only modestly during the pandemic, rates are projected to go up locally and nationally in 2022 and beyond. Many would-be home buyers are opting to stay put in their rentals after unsuccessfully writing multiple offers for purchases.

The rental vacancy rate has been reported at 0.8%, and while rental rates increased only modestly during the pandemic, rates are projected to go up locally and nationally in 2022 and beyond. Many would-be home buyers are opting to stay put in their rentals after unsuccessfully writing multiple offers for purchases.

Many would-be buyers are staying put or returning to the

Many would-be buyers are staying put or returning to the