| Multi-Family Averages | ||

|---|---|---|

| Median Sale Price: | Units Sold: | Days on Market: |

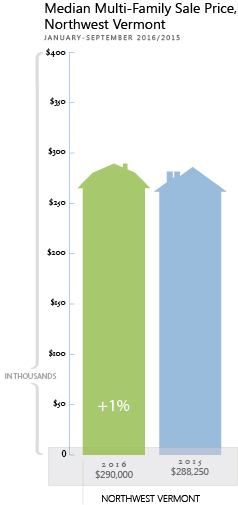

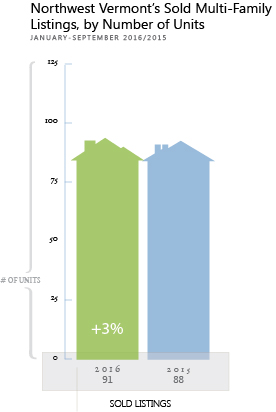

| $290,000 (+1%) | 91 (+3%) | 162 (+5%) |

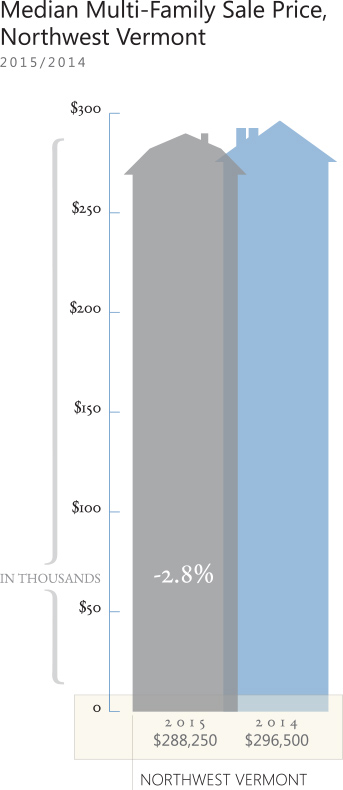

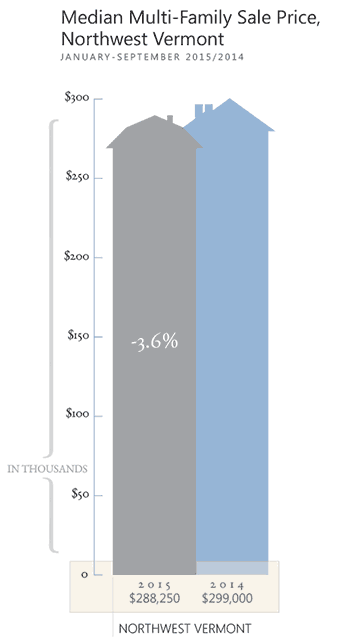

As with the residential market, the multi-family market is witnessing strong demand tempered by lower inventory levels. That’s pushing up pricing in some markets, especially sought-after towns such as Burlington.

As with the residential market, the multi-family market is witnessing strong demand tempered by lower inventory levels. That’s pushing up pricing in some markets, especially sought-after towns such as Burlington.

The vacancy rate in Chittenden County has eased somewhat from record low levels in previous years, although it still remains below the national level. At the same time, local businesses such as Dealer.com and GE Healthcare continue to hire, bringing professionals into the region. Those dynamics are supporting a vibrant market for rental properties, which in turn draws investors to the multi-family investment market.

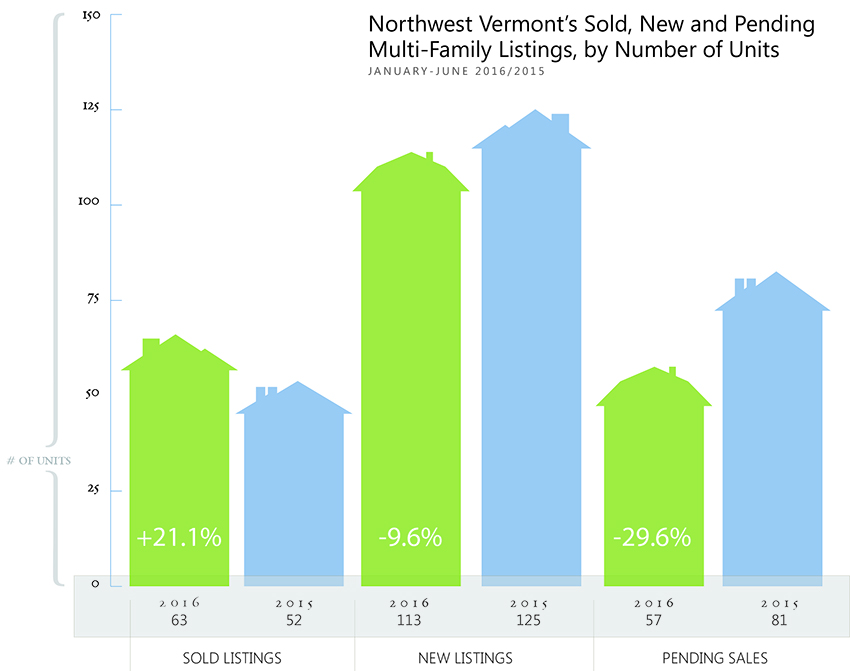

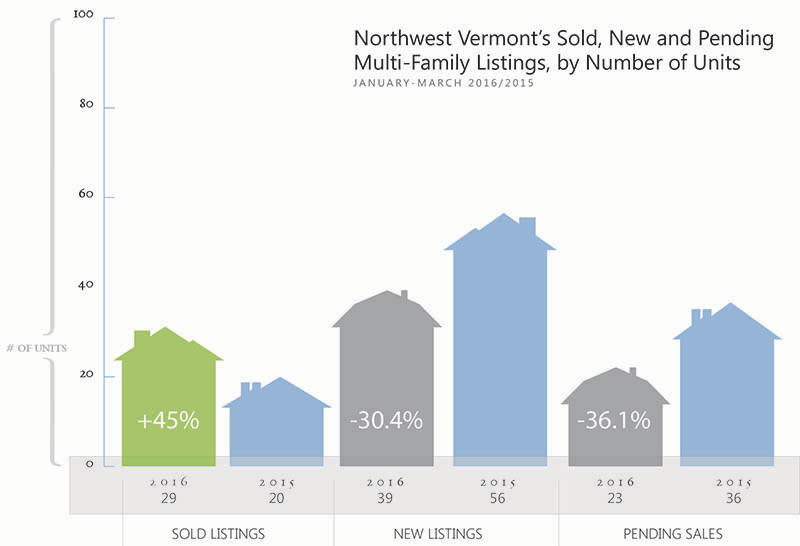

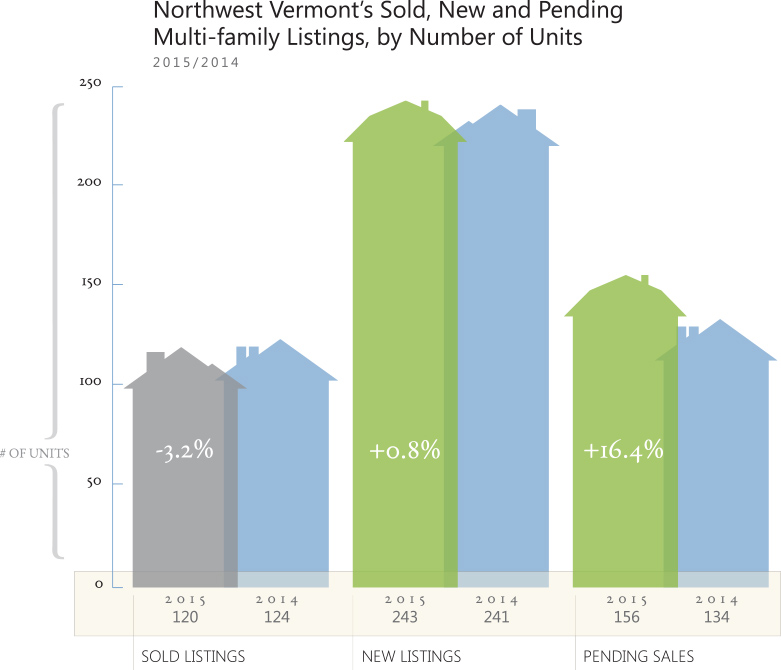

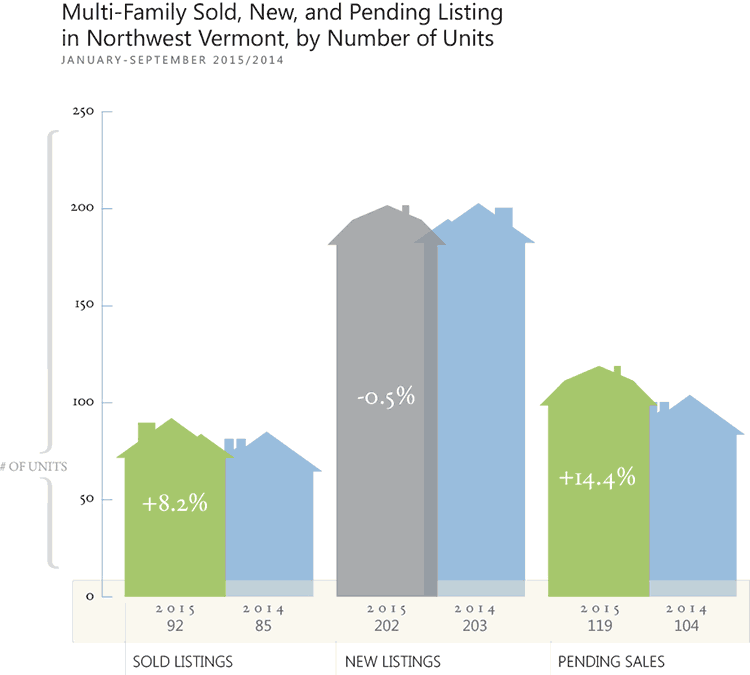

During the first nine months of the year, 91 multi-family properties were sold, little changed from a year earlier. Our Realtors note that demand has been tempered by fewer new listings coming on the market, which is limiting the available inventory of investment properties. Because of that, well-priced properties in desirable locations are selling quickly.

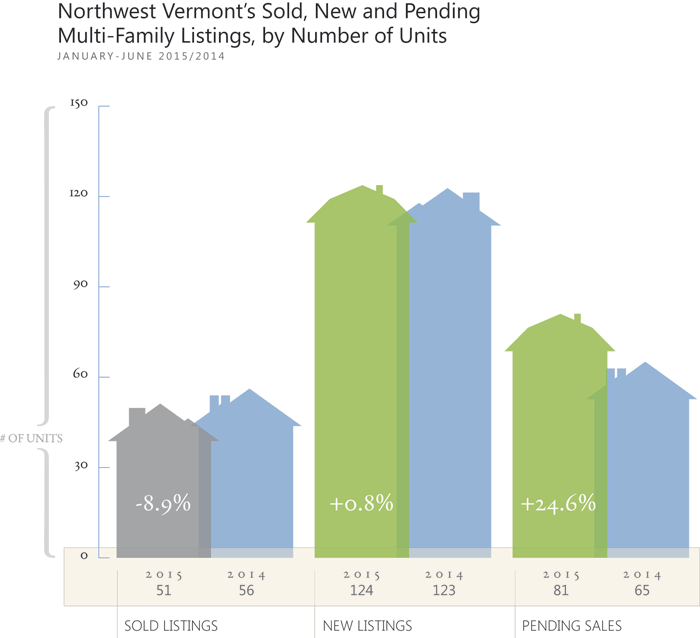

Inventory continues to be tight in Burlington and Winooski, with the latter experiencing a surge in interest from renters because of its revitalized downtown area, which has brought new restaurants and shops to the former mill town. New listings in Burlington, which is the most active town for multi-family homes, have declined by 13% this year.

With demand from buyers remaining far ahead of supply, our Agents note that owners of multi-family properties may want to consider listing to take advantage of the market dynamics.

The following are details about trends impacting the multi-family market:

Tight Inventory for In-Demand Towns

Tight Inventory for In-Demand Towns

New listings in Burlington, which is the most active town for multi-family homes, have declined by 13% this year. Our Realtors are also witnessing tight inventory levels in Winooski, which is drawing more interest because of its revitalized downtown.

The Vacancy Rate Continues to be Low

The rental market’s vacancy rate stood at 2.1% in Chittenden County in June, according to real estate consultancy Allen & Brooks. That’s significantly higher than the rates seen in 2010-2014, when it averaged about 1.4%. While rents are stabilizing as a result, that hasn’t impacted demand or pricing for multi-family properties as the region’s vacancy rates are substantially lower than the roughly 4.5% national rate.

Rents are stabilizing

Younger buyers with student loans may end up in the rental market for more years than older generations because of their loan repayments. Allen & Brooks is also forecasting increasing demand from seniors for rental housing, as many decide to scale down and sell their single-family homes.

Winooski Remains Attractive

Winooski Remains Attractive

Local businesses such as Keurig Green Mountain and the Immigration and Naturalization Service are hiring and bringing new professionals to the region. Many of those young professionals prefer to rent rather than buy at the moment.

Local businesses such as Keurig Green Mountain and the Immigration and Naturalization Service are hiring and bringing new professionals to the region. Many of those young professionals prefer to rent rather than buy at the moment.