The 532 new units projected to open in 2023 is 53% higher than the average Chittenden County growth over the past 3 years, and 82% higher than the long-term average since 2000. Of the 532 expected units, 57% (304) are already completedThe current 2024 forecast shows 872 apartments are expected to open in 2024. This will be the highest number of units to open in a single year since the report record began in 2000. Most of these units are planned for South Burlington (420 units or 48%), followed by Burlington at 279 units or 32%. It’s important to note that almost 300 of the South Burlington units are part of UVM & UVM Health Network’s construction project to house students and faculty off campus. These units are not made available to the general public. *Source: Allen, Brooks, & Minor Report, December 2023 as of June. For comparison, the total of new units constructed in 2022 was 291, a promising indicator.

| AVERAGE APARTMENT RENTS IN CHITTENDEN COUNTY | RANGE |

|---|---|

| Studio, 1 Bath | $1,300 - $2,050 |

| One Bedroom, 1 Bath | $1,400 - $3,000 |

| Two Bedroom, 1 Bath | $1,675 - $4,000 |

| Two Bedroom, 2 Bath | $1,850 - $4,200 |

Coldwell Banker Hickok & Boardman’s Relocation Department assists individuals and companies with employment related transfers. Through that service, we understand people considering a move to Vermont may want to get to know the area before deciding to purchase a home. Renting or longterm stay options can be an alternative – but in a competitive rental market, like Chittenden County, finding a place can be a challenge.

Contact us for our Chittenden County Rental Guide to aid in your rental search. Our guide includes an update on the current rental market, information about new complexes, and answers to the most frequently asked questions. Go to HickokandBoardman.com/vermont-rental-guide for a free download.

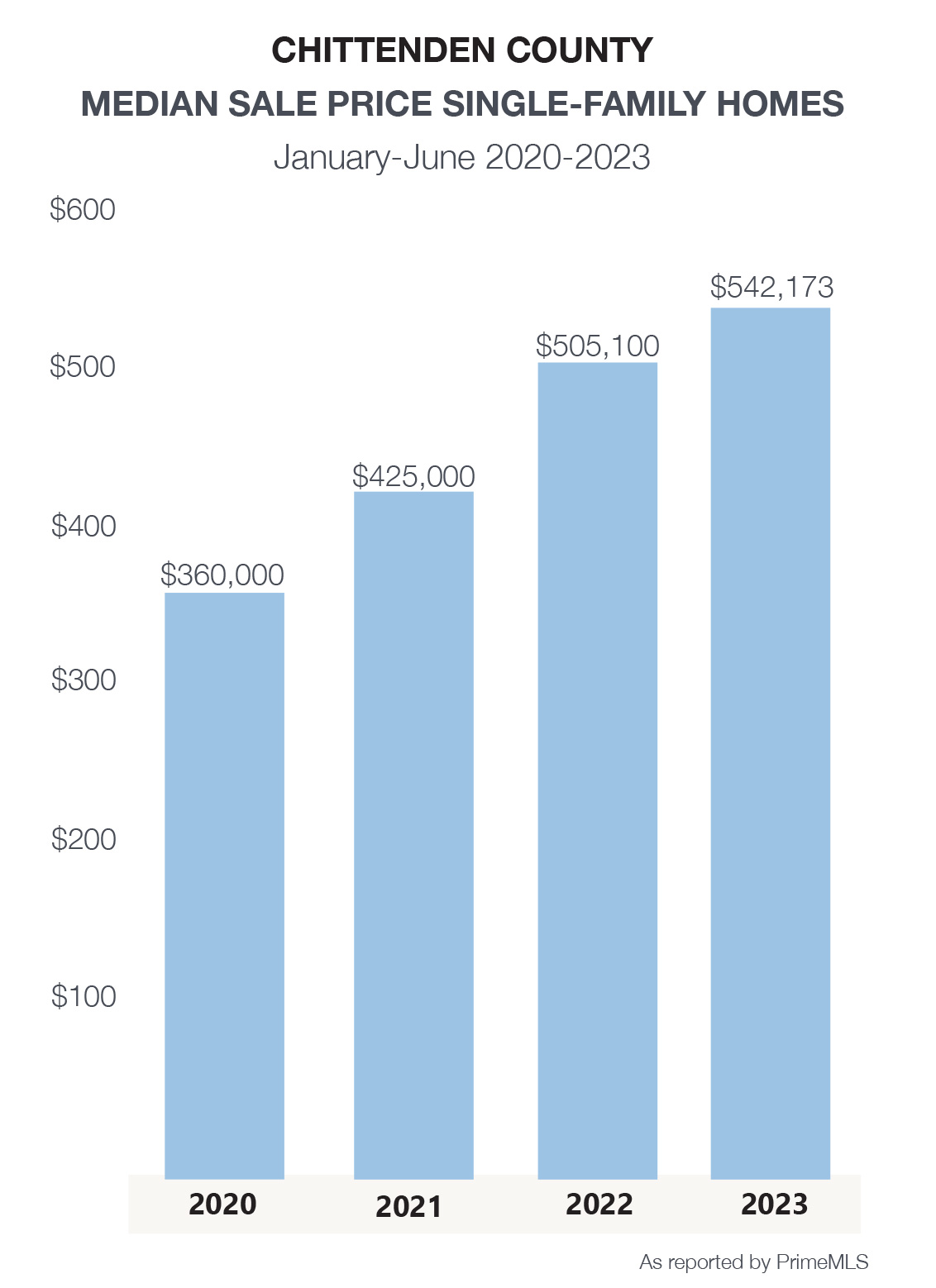

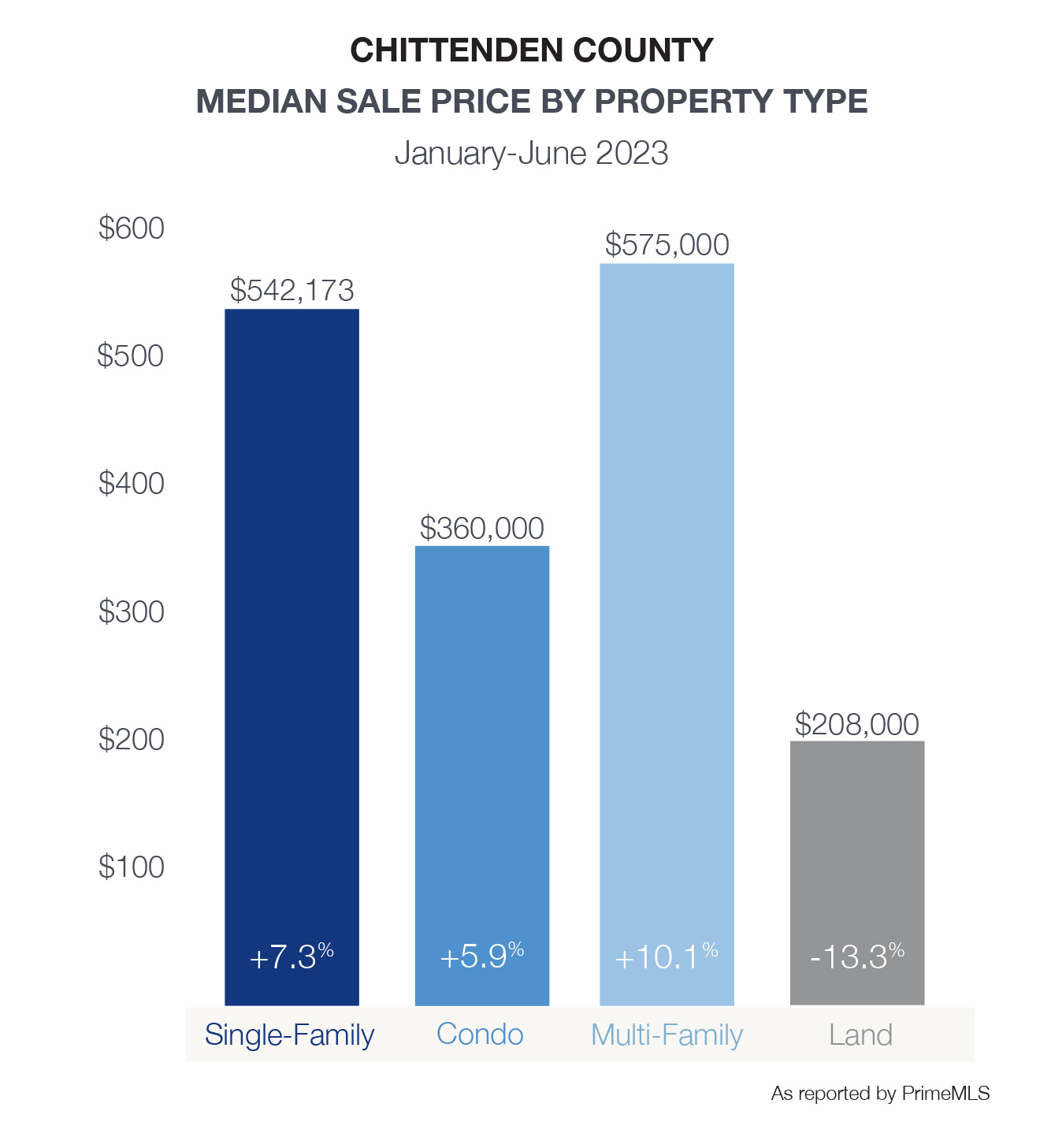

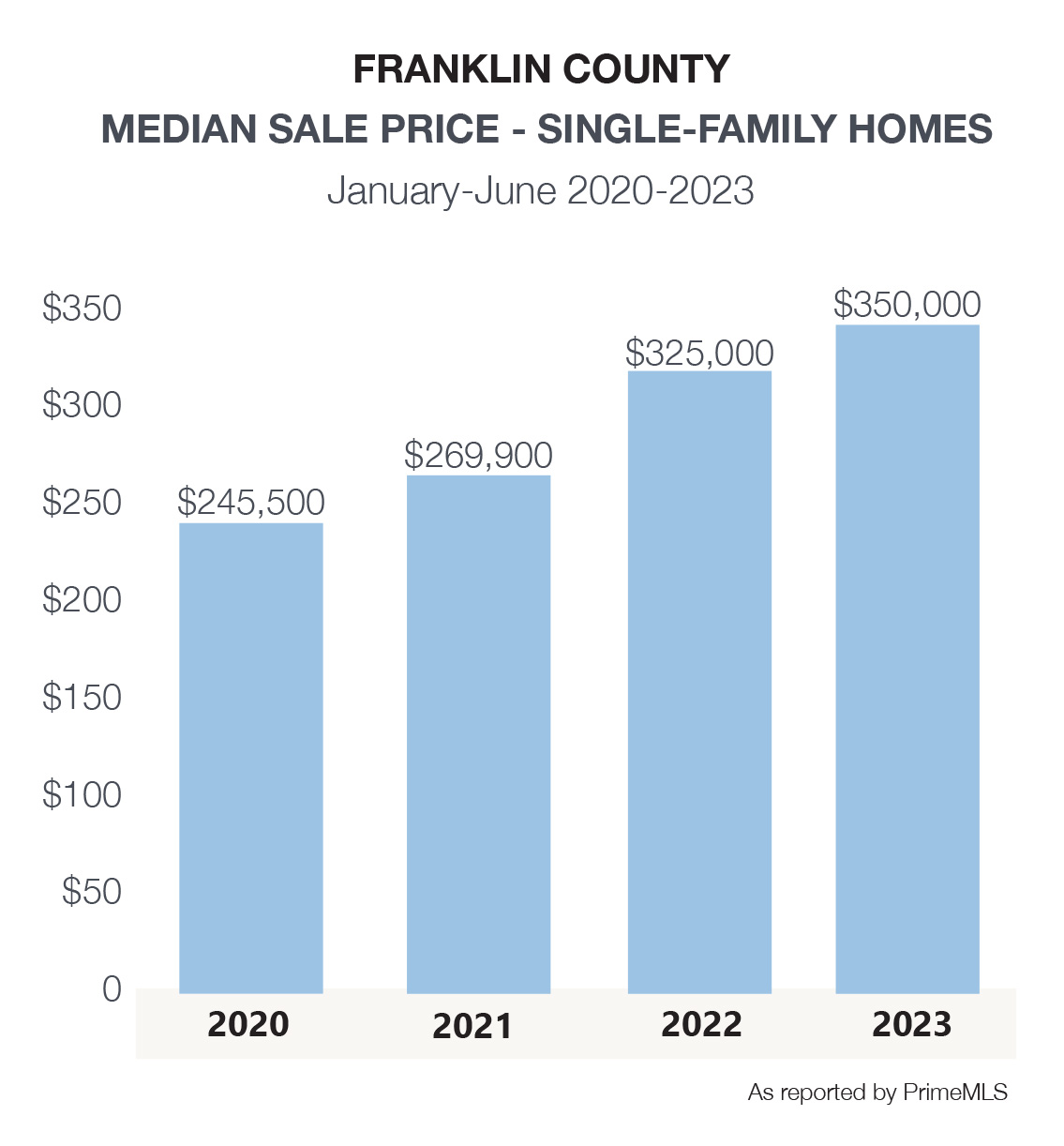

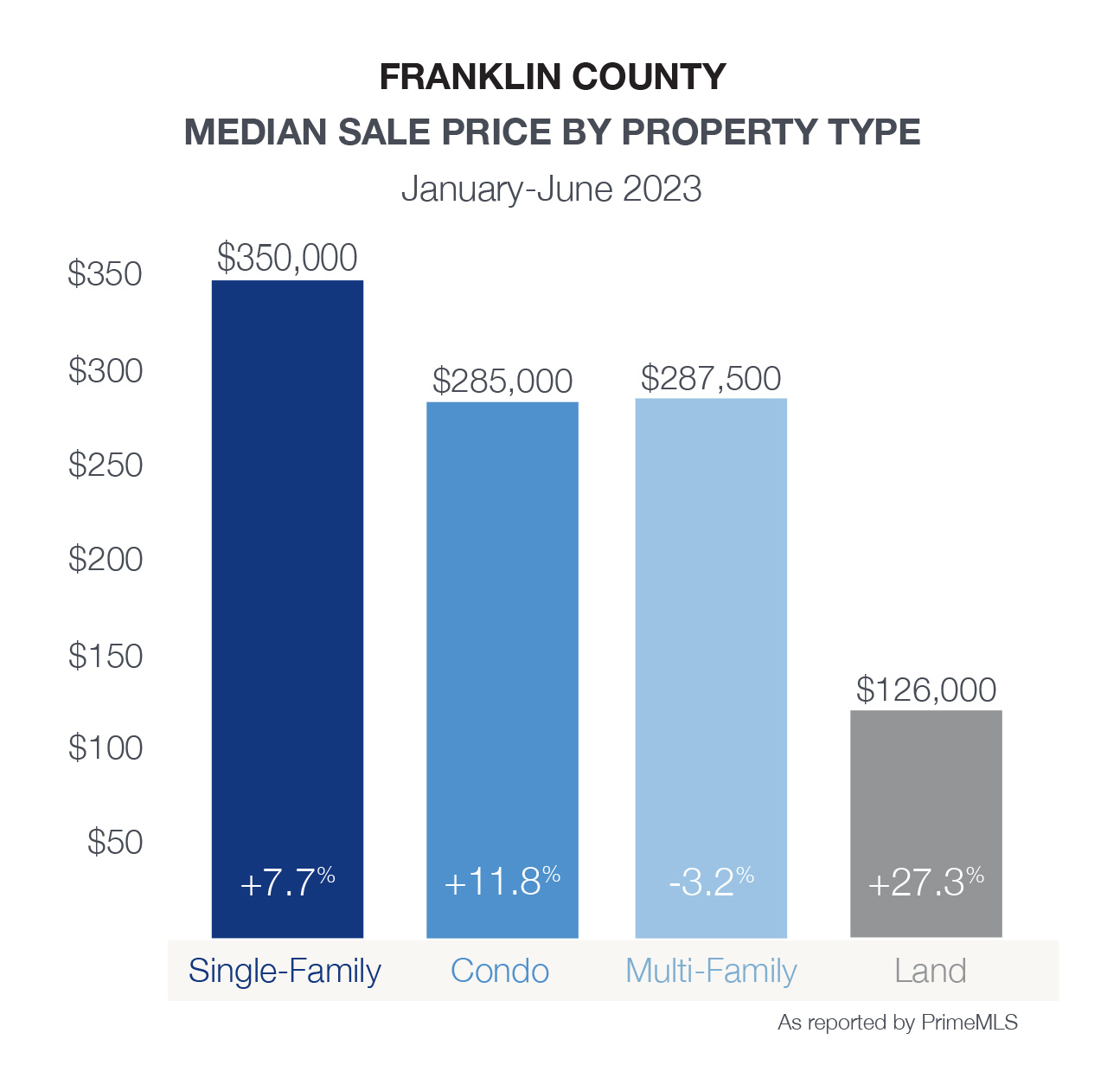

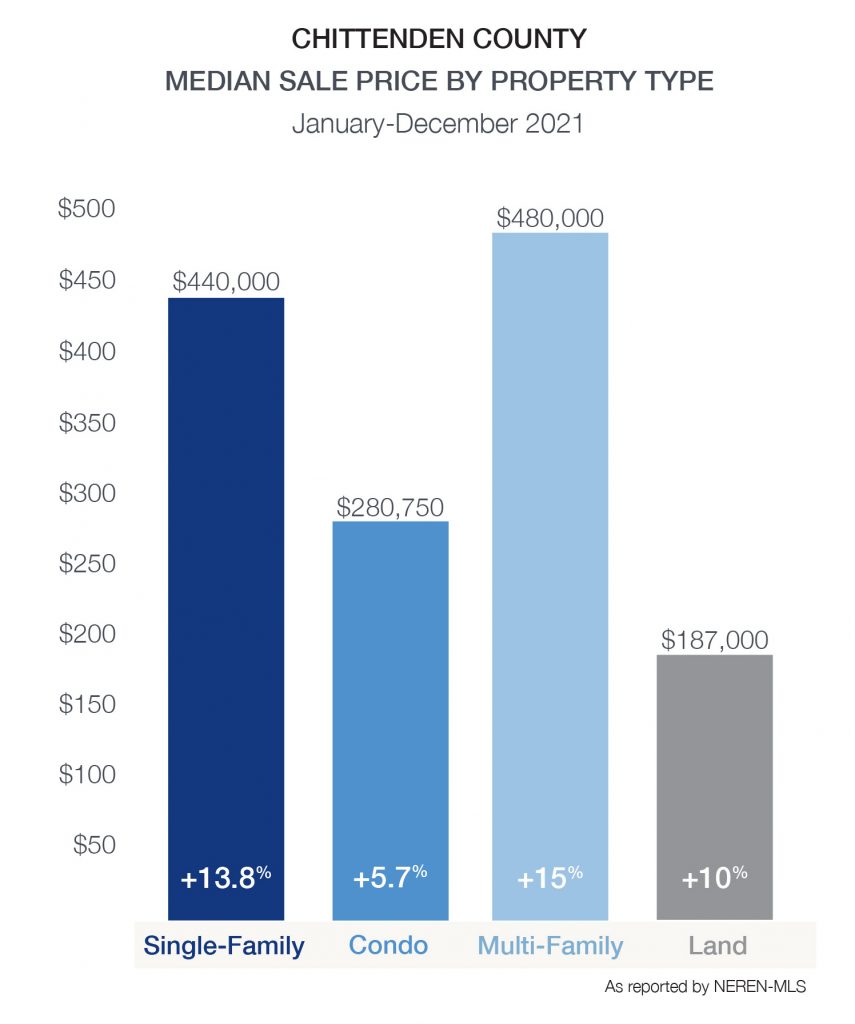

While prices for single family homes have increased across the county by nearly 51% since mid-year 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen increased equity over the past few years, while benefiting as the largest portion of their living expenses – their mortgage – remained stable. Year to date, although buyer demand remained strong, a drop of 16% in new listings resulted in a decline in closed sales. Some buyers, many who paused searches in the second half of 2022 due to rising interest rates, have reentered the market this spring to face competitive offers. This is more frequent in the more affordable price ranges. The decline in new listings is also beginning to moderate as lifestyle factors encourage many sellers to maximize gains and make moves long delayed since the pandemic.

While prices for single family homes have increased across the county by nearly 51% since mid-year 2020, growth has moderated in 2023 at a 7% increase. Homeowners have seen increased equity over the past few years, while benefiting as the largest portion of their living expenses – their mortgage – remained stable. Year to date, although buyer demand remained strong, a drop of 16% in new listings resulted in a decline in closed sales. Some buyers, many who paused searches in the second half of 2022 due to rising interest rates, have reentered the market this spring to face competitive offers. This is more frequent in the more affordable price ranges. The decline in new listings is also beginning to moderate as lifestyle factors encourage many sellers to maximize gains and make moves long delayed since the pandemic.