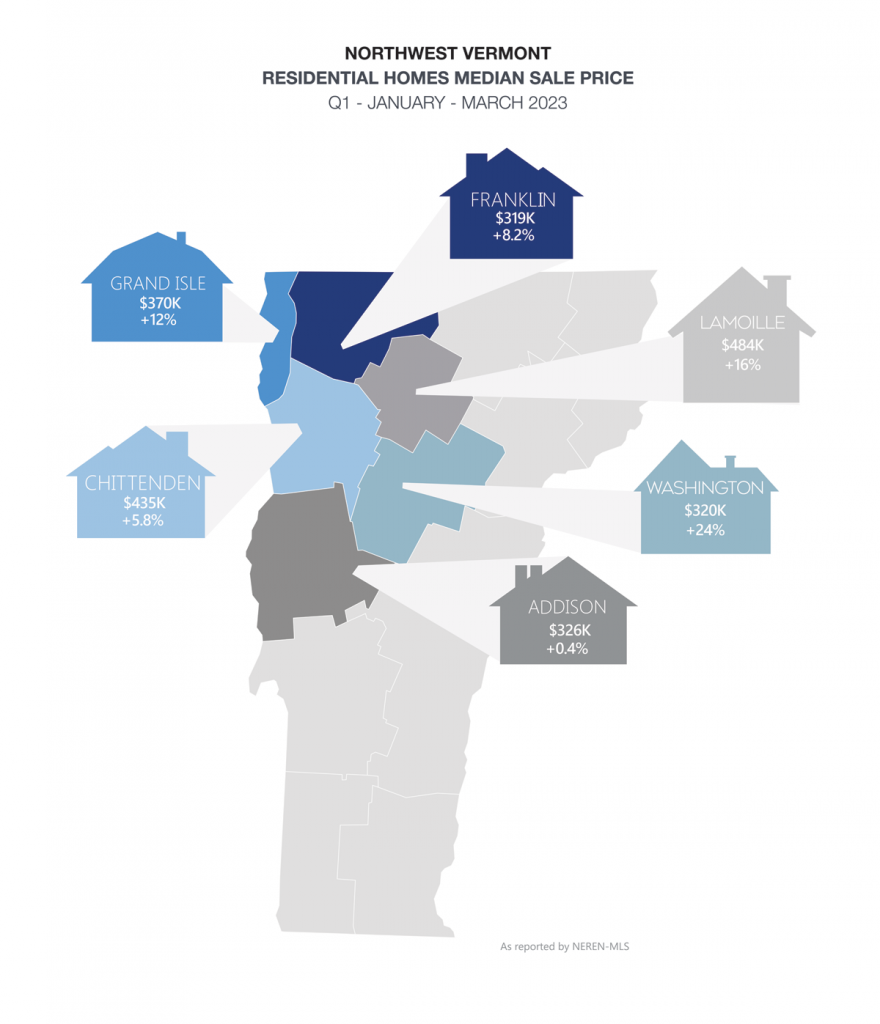

As spring arrives in Vermont, along with the historical start of the busy real estate market, we are taking a close look at the 1st quarter results to provide buyers and sellers with valuable insights to make informed decisions. The housing market in northwest Vermont continues to be robust with strong demand and low inventory. Home prices have been increasing steadily, and multiple offers are still common. The median sale price for a single-family home in the region has increased by 8% to $400,000 compared to the same period last year. The number of homes sold declined by 20%, a result of the 15% decrease in new homes listed during the period – not a lack of demand.

The current higher mortgage interest rates have had an impact on the housing market. As interest rates increase, it becomes more expensive for buyers to finance a home purchase, which can reduce demand and slow down sales. However, the impact of higher interest rates can be mitigated by factors such as strong economic growth, high employment rates, and most notably a shortage of available housing inventory. It appears that many buyers have adjusted to the higher mortgage interest rates and are remaining in the market.

The current higher mortgage interest rates have had an impact on the housing market. As interest rates increase, it becomes more expensive for buyers to finance a home purchase, which can reduce demand and slow down sales. However, the impact of higher interest rates can be mitigated by factors such as strong economic growth, high employment rates, and most notably a shortage of available housing inventory. It appears that many buyers have adjusted to the higher mortgage interest rates and are remaining in the market.

Despite these positive trends, the lack of available housing inventory has been a challenge for both buyers and sellers alike. Many homeowners have opted to stay put until they find a new home in the region or out-of-state, which has further constrained the market, leading to higher prices and competition among buyers. It is important to keep in mind that historically, the first quarter of the year tends to be the smallest in terms of listing and real estate sales volume. Statistically, increases and decreases can be affected by a few changes in the product mix. The next 6 months will be a more accurate benchmark of market trends. Overall, the housing market in northwest Vermont is showing no signs of slowing down, and it will be interesting to see how the market continues to evolve throughout the rest of the year.

Our agents have been closely monitoring the current housing market and have observed some interesting trends. Despite the challenges posed by the shortage of available inventory and higher prices, most of our agents (70%) have reported that they have the same or more buyers looking for homes than before. This is a testament to the continued strength of demand in our market areas. However, with so many buyers competing for limited inventory, nearly 90% of offers have been in multiple offer situations, making it increasingly difficult for buyers to secure a property.

Our agents have been closely monitoring the current housing market and have observed some interesting trends. Despite the challenges posed by the shortage of available inventory and higher prices, most of our agents (70%) have reported that they have the same or more buyers looking for homes than before. This is a testament to the continued strength of demand in our market areas. However, with so many buyers competing for limited inventory, nearly 90% of offers have been in multiple offer situations, making it increasingly difficult for buyers to secure a property.

Despite this, some buyers are still including inspections and financing contingencies in their offers, indicating that they are taking a more measured approach to their purchases. On the seller side, we have seen that most trust their agent’s advice on current market conditions and are readying their homes for the spring selling season. However, it is worth noting that many sellers are challenged when searching for a new home to move to, whether in Vermont or across the country. Finally, most of our agents report an increase in the pace of the market in the past month, which suggests that buyers and sellers alike need to be ready to act when the right opportunity presents itself.

The biggest factor impacting the

The biggest factor impacting the  In 2023, sellers should adjust their expectations. With higher interest rates, there still are buyers out there but not as many as 2021 and early 2022. Sellers will still reap the benefits of strong equity positions in their homes. Offers may come with inspection and financing contingencies. Understanding the current market conditions affecting their home, sellers will benefit from working with an experienced Agent who can guide them to closing with the best terms for them.

In 2023, sellers should adjust their expectations. With higher interest rates, there still are buyers out there but not as many as 2021 and early 2022. Sellers will still reap the benefits of strong equity positions in their homes. Offers may come with inspection and financing contingencies. Understanding the current market conditions affecting their home, sellers will benefit from working with an experienced Agent who can guide them to closing with the best terms for them.

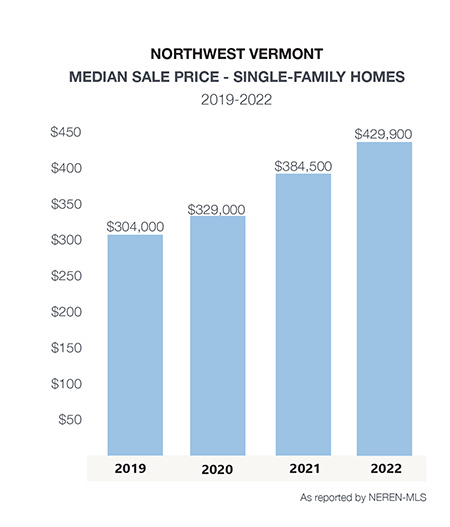

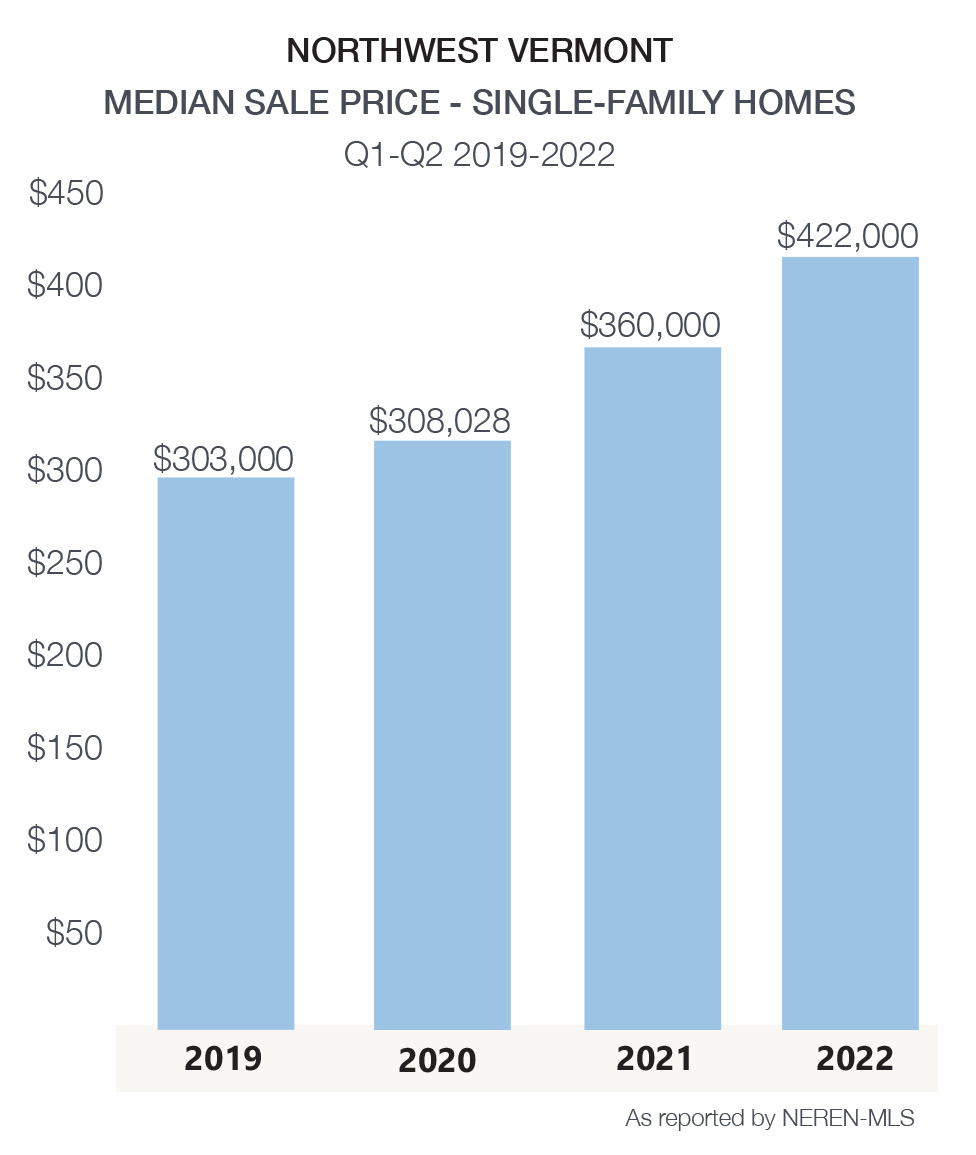

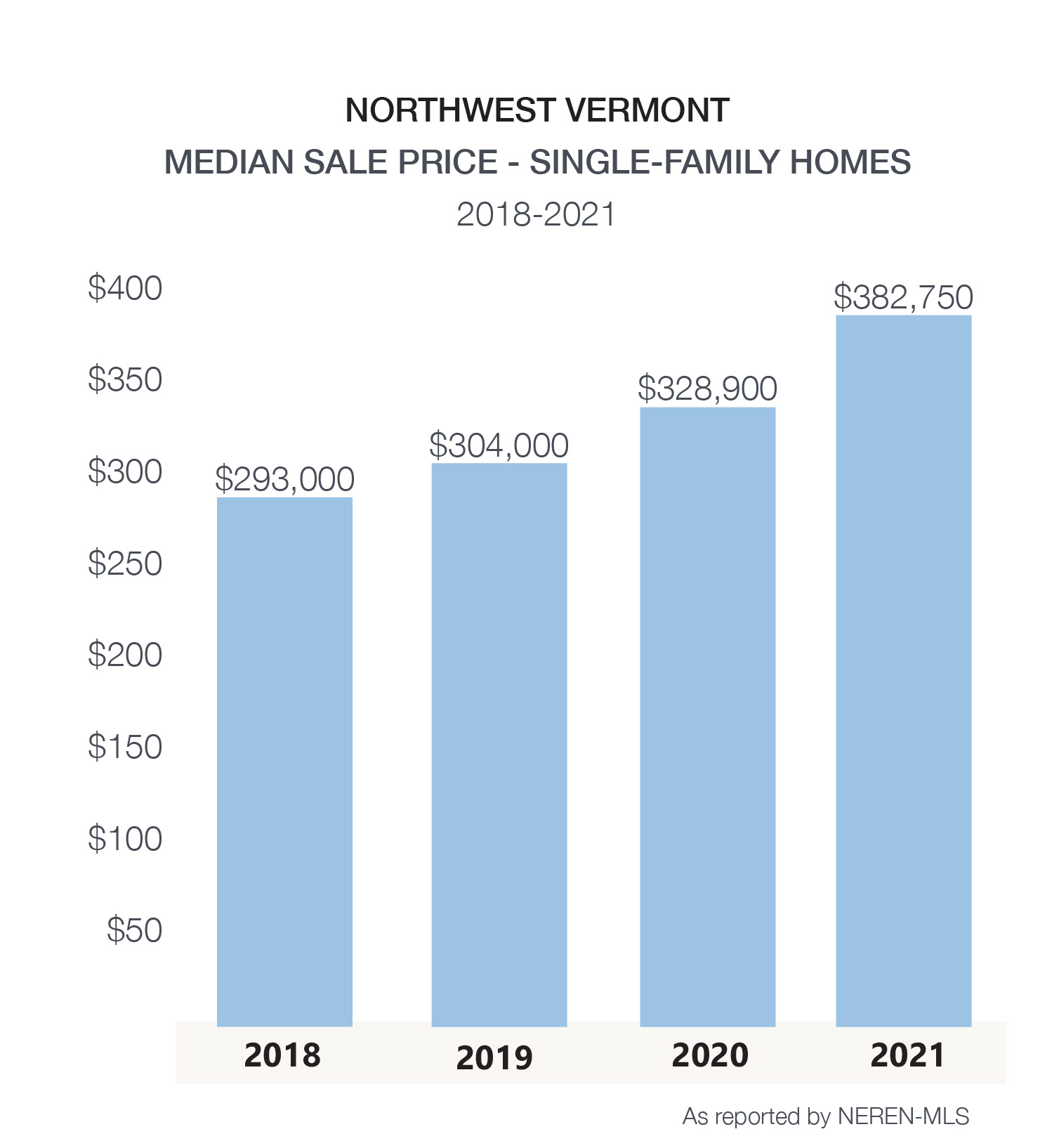

2021, the second year of the pandemic, saw record-setting in sales volume and capped two years of record price appreciation in real estate sales. The impact of the pandemic, coupled with historically low mortgage interest rates in the low 3% range, drove sales up and inventory levels to new record lows to start 2022.

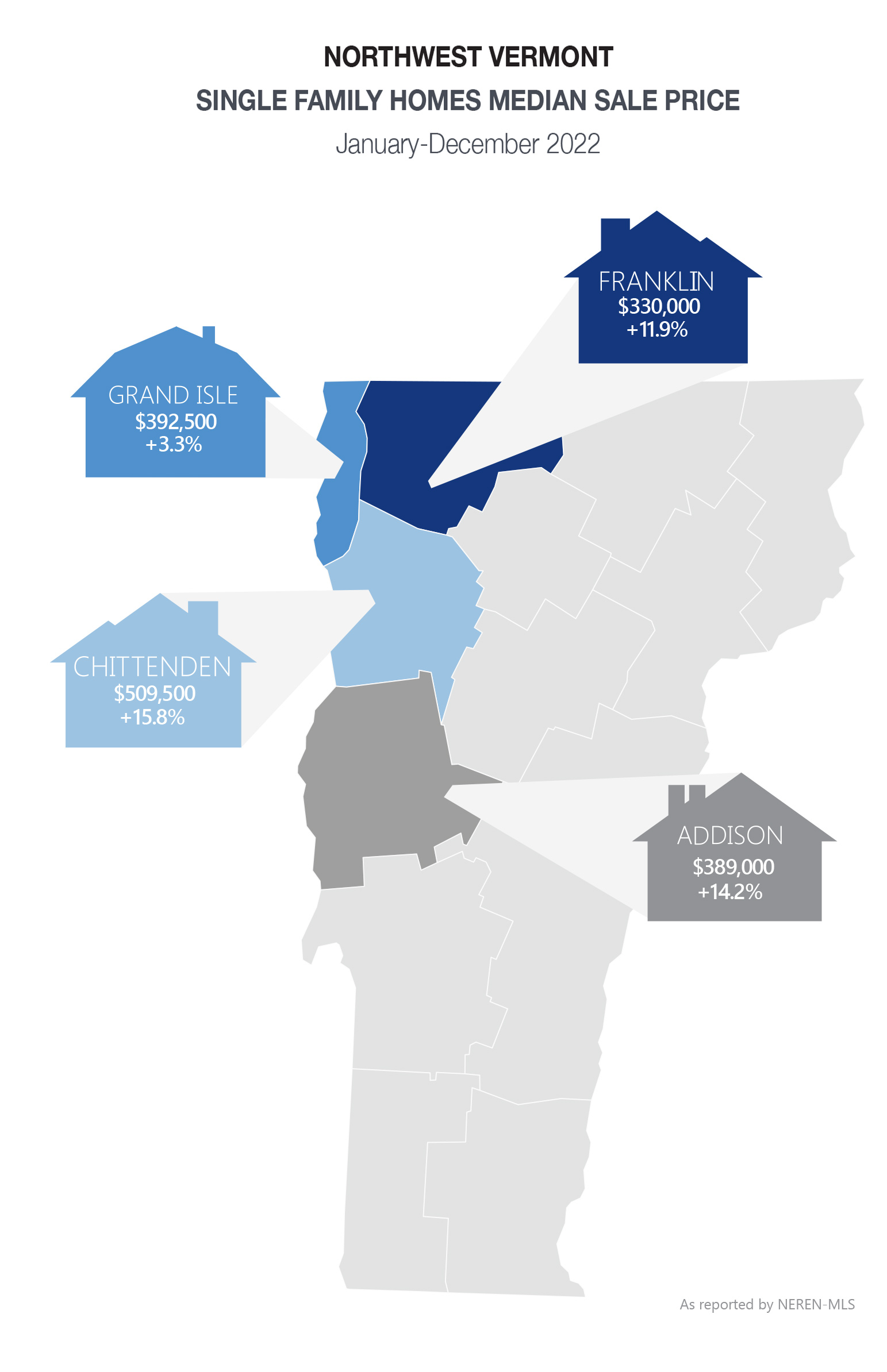

2021, the second year of the pandemic, saw record-setting in sales volume and capped two years of record price appreciation in real estate sales. The impact of the pandemic, coupled with historically low mortgage interest rates in the low 3% range, drove sales up and inventory levels to new record lows to start 2022. Despite these changes, the year-to-date median sale price increase reported nationally hit a new record of $450,000 in June, a 17% gain from last year. Our local market median sale price of single-family homes was a record $422,000, also a 17% increase from 2021. This accelerated rate is not forecasted to continue at the same pace for the second half of 2022.

Despite these changes, the year-to-date median sale price increase reported nationally hit a new record of $450,000 in June, a 17% gain from last year. Our local market median sale price of single-family homes was a record $422,000, also a 17% increase from 2021. This accelerated rate is not forecasted to continue at the same pace for the second half of 2022.

Savvy sellers, following the

Savvy sellers, following the

Association of REALTORS (NAR) recently reported that first time buyers made up 31% of purchases vs. 35% at the same time last year.

Association of REALTORS (NAR) recently reported that first time buyers made up 31% of purchases vs. 35% at the same time last year.

The outlook for 2021 is continued strong demand from both in state and

The outlook for 2021 is continued strong demand from both in state and

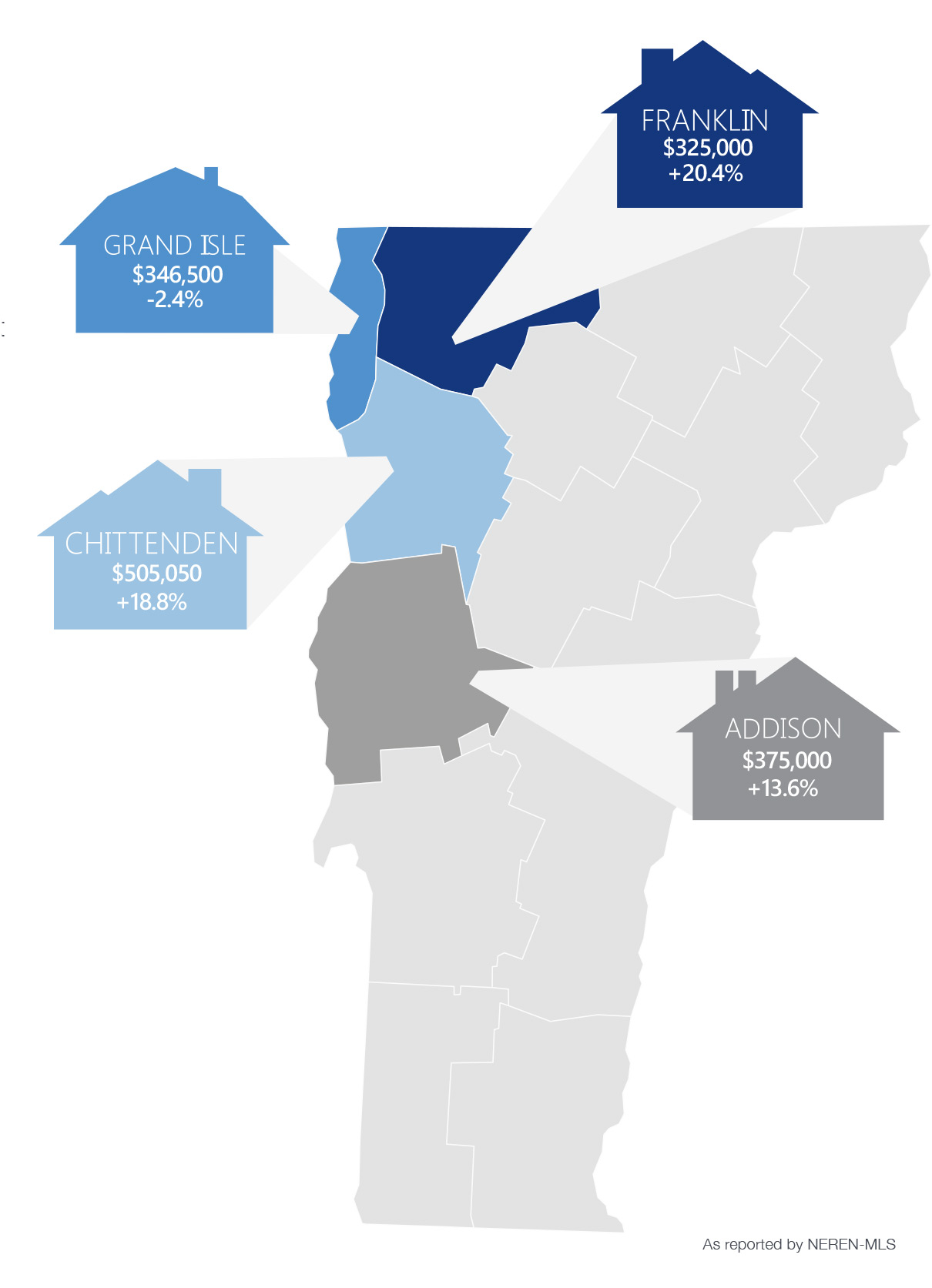

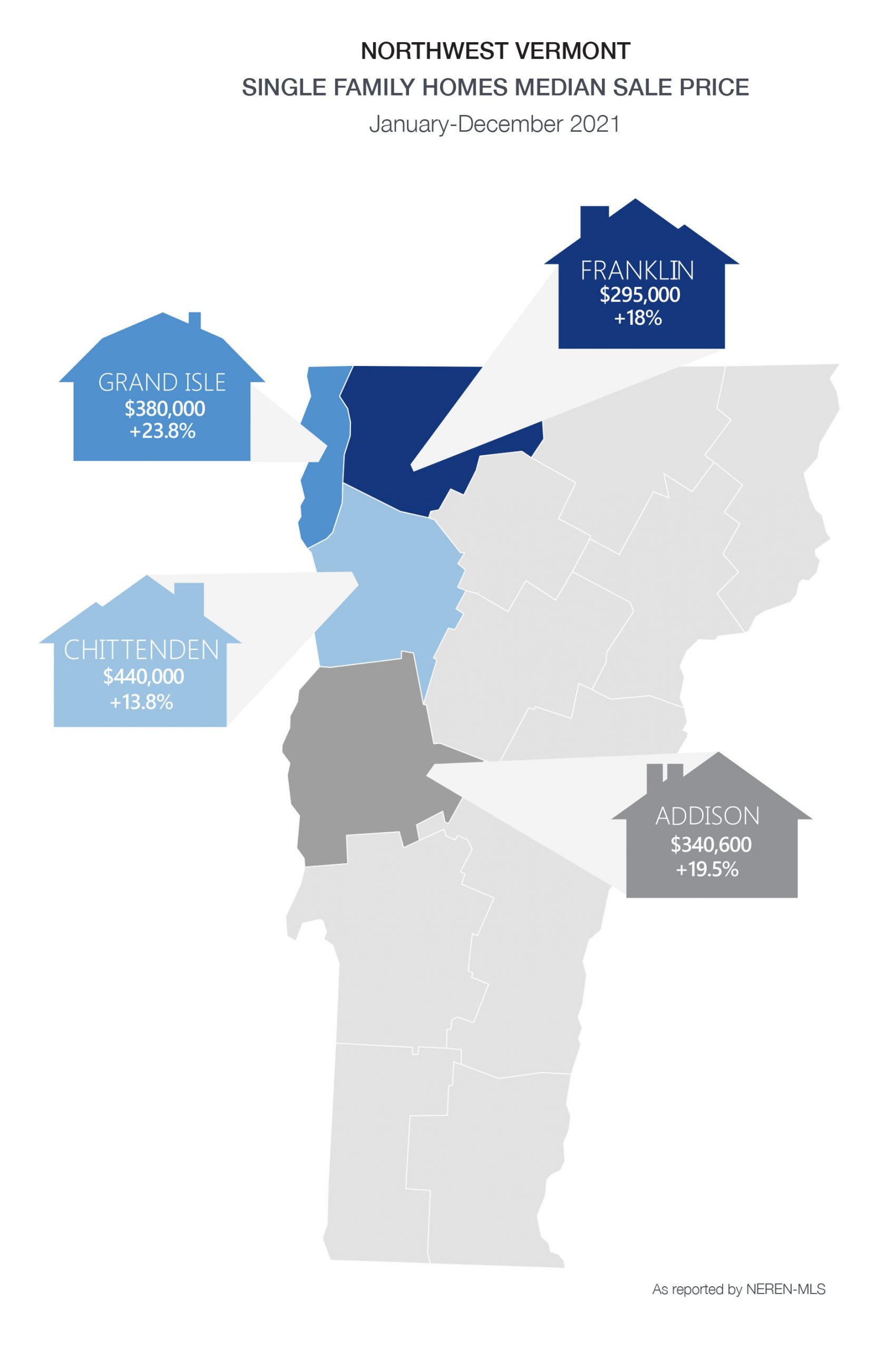

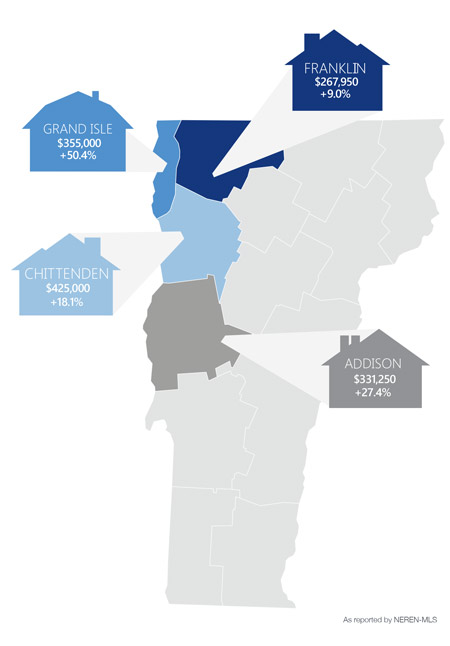

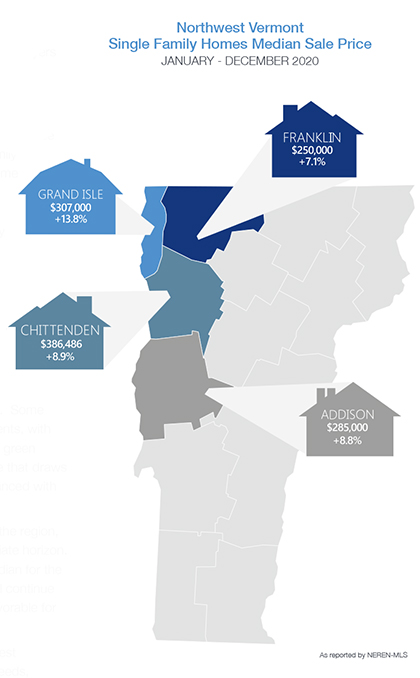

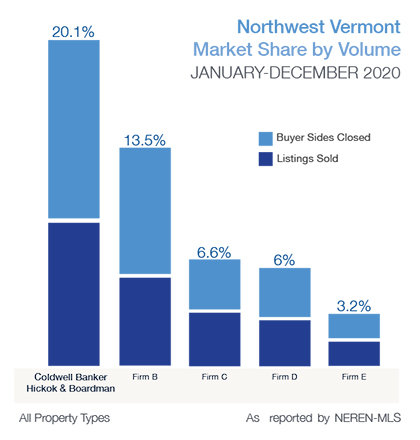

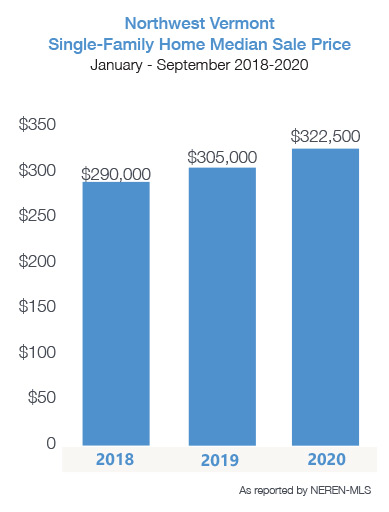

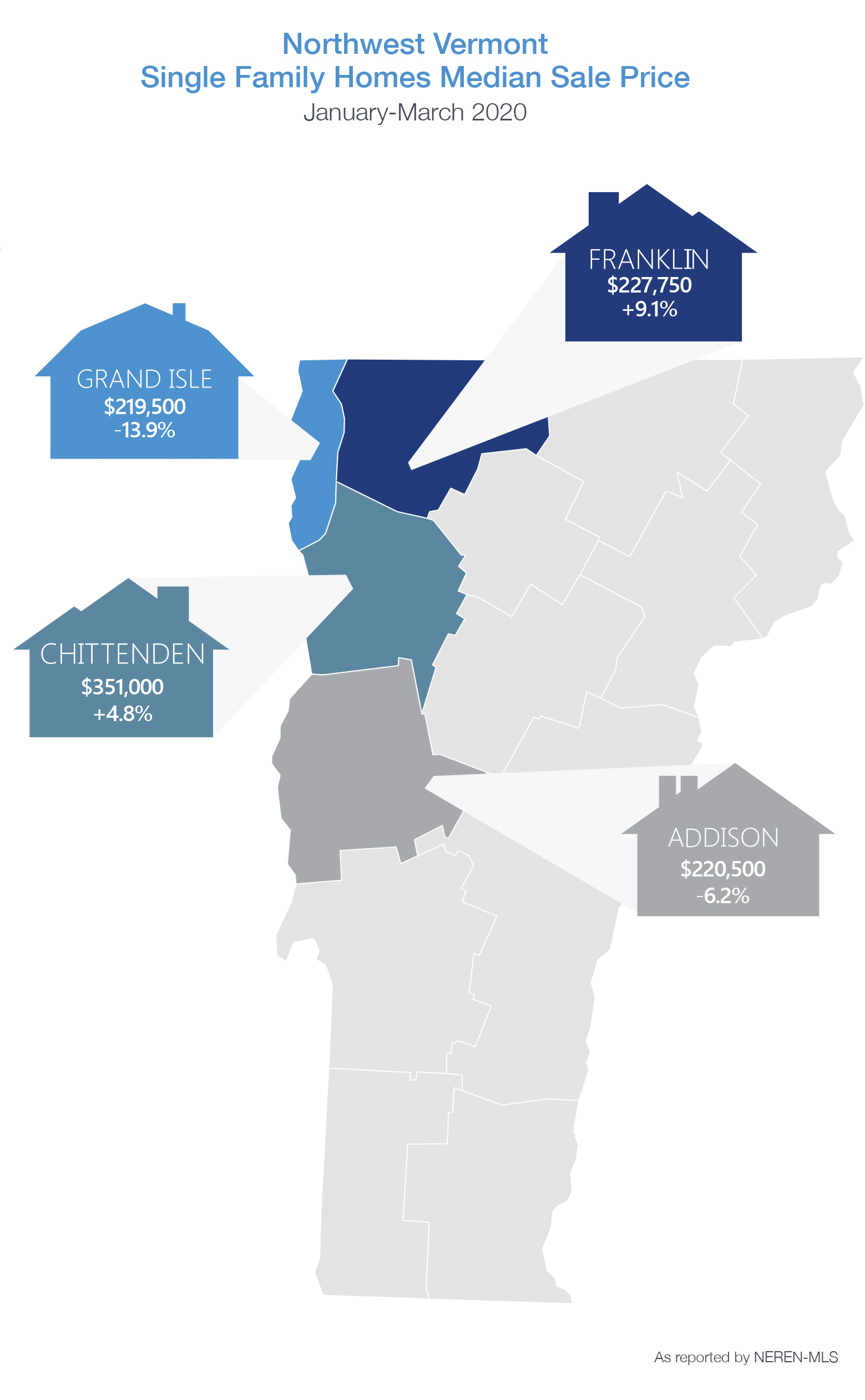

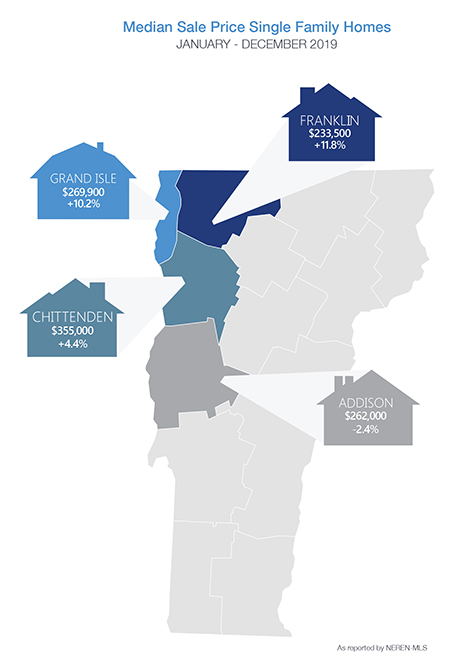

Nationally, the median price of existing homes pushed to a record high of $310,600 – up 11.4% annually. Locally, the median price has increased nearly 6% to $322,500 for a single-family home. These prices vary by county and town, so it is important to consult with

Nationally, the median price of existing homes pushed to a record high of $310,600 – up 11.4% annually. Locally, the median price has increased nearly 6% to $322,500 for a single-family home. These prices vary by county and town, so it is important to consult with

Residential real estate transactions have a longer lead time than most consumer purchases. These transactions close, on average, 45-60 days from the time of contract. Therefore, results in this 1st quarter market report – with sales closed by March 31st – reflect business efforts from the 4th quarter of 2019 through January of this year.

Residential real estate transactions have a longer lead time than most consumer purchases. These transactions close, on average, 45-60 days from the time of contract. Therefore, results in this 1st quarter market report – with sales closed by March 31st – reflect business efforts from the 4th quarter of 2019 through January of this year. We cannot predict how long we will be sheltering in place or how deep the impact will be prior to working our way out of this. We do believe that this time, housing is poised to be part of the solution.

We cannot predict how long we will be sheltering in place or how deep the impact will be prior to working our way out of this. We do believe that this time, housing is poised to be part of the solution.

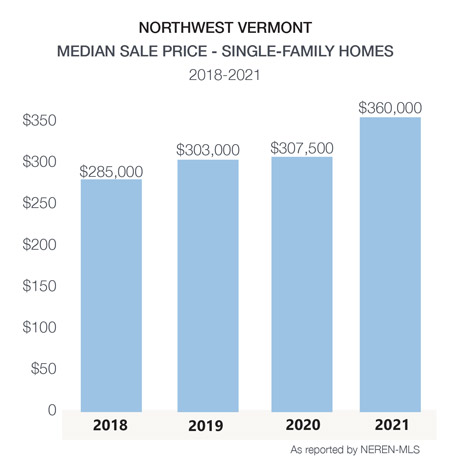

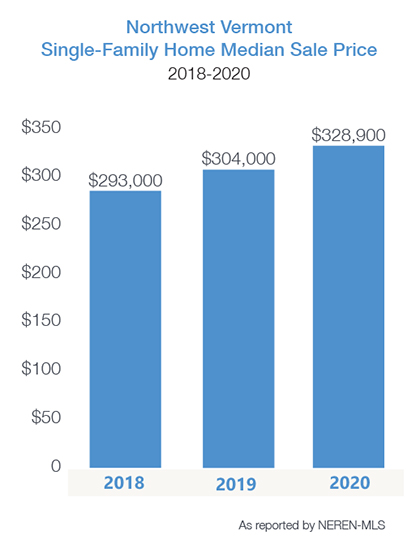

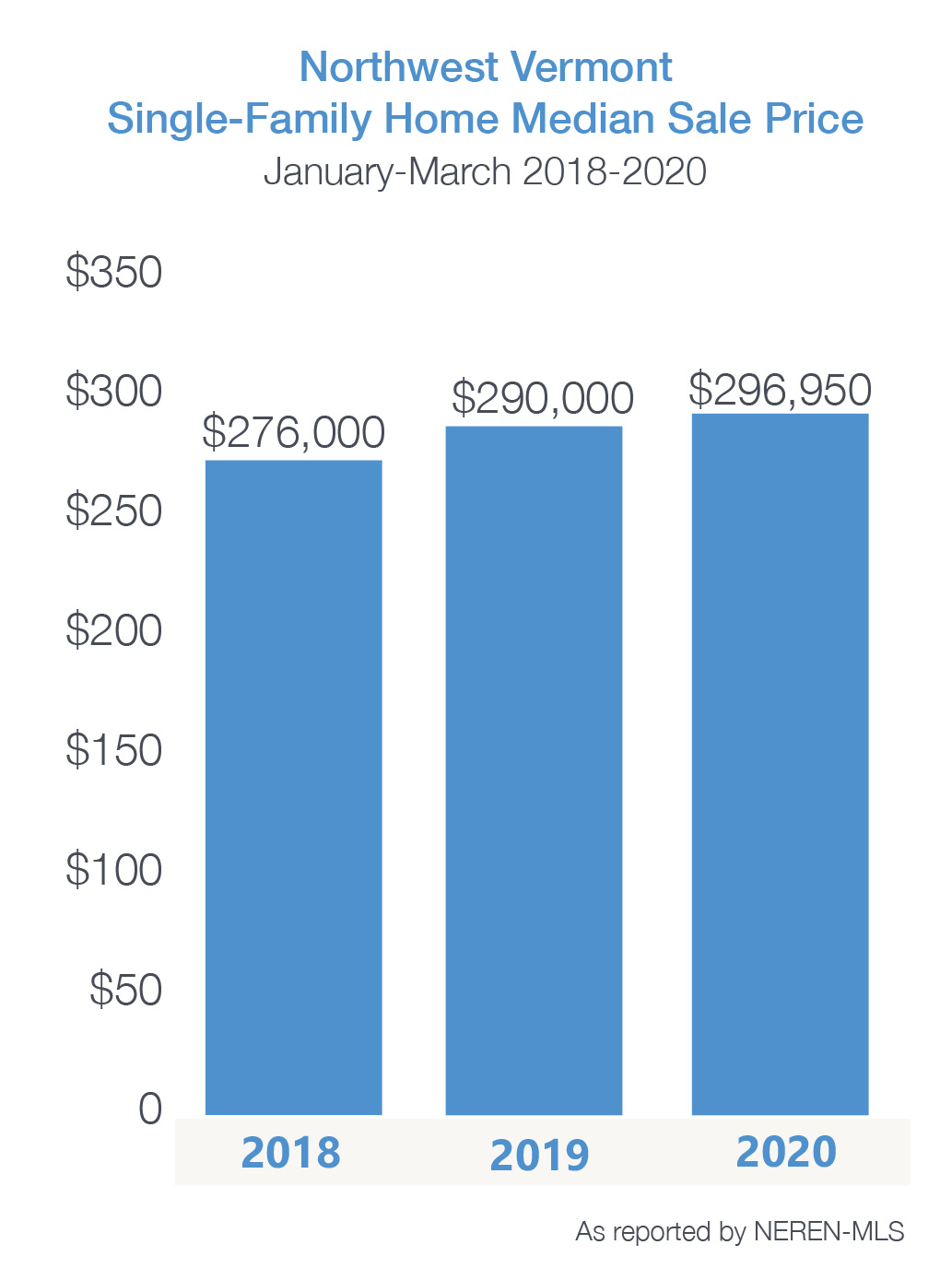

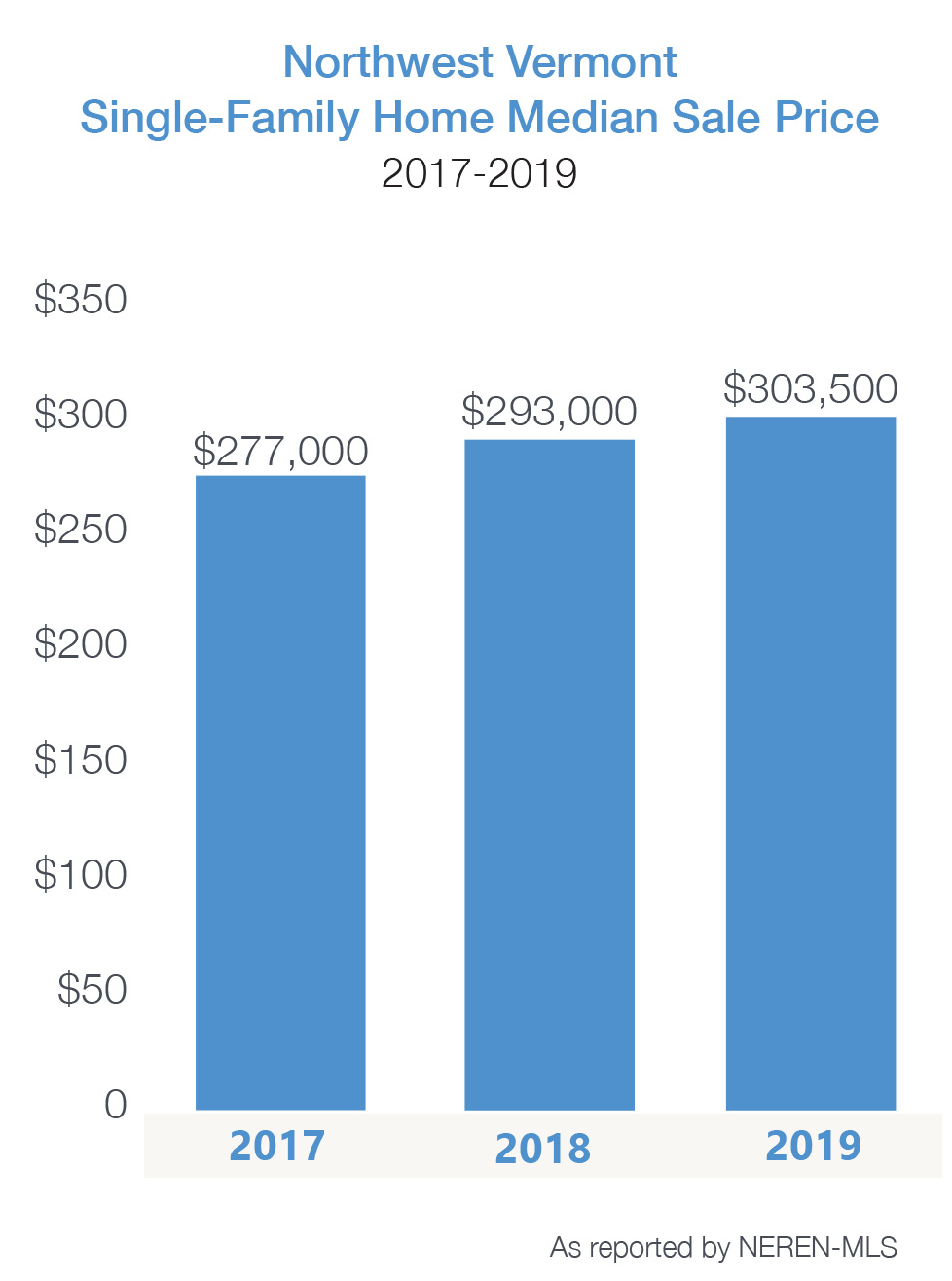

While the supply of homes coming on the market remained lower than buyer demand, many parts of our region reflected an increase in inventory. The median sale price grew, enticing home owners to sell in order to maximize their equity. Interest rates dropped in 2019 by .75-1.0% points and will remain low in 2020 – likely somewhere between 3.7% and 3.9%.

While the supply of homes coming on the market remained lower than buyer demand, many parts of our region reflected an increase in inventory. The median sale price grew, enticing home owners to sell in order to maximize their equity. Interest rates dropped in 2019 by .75-1.0% points and will remain low in 2020 – likely somewhere between 3.7% and 3.9%. Baby Boomers, on the other end of the housing spectrum, are staying in their homes longer than ever; 10-13 years on average vs 7 years, historically. These home owners are willing to sell their large family homes but are having trouble finding new home that are

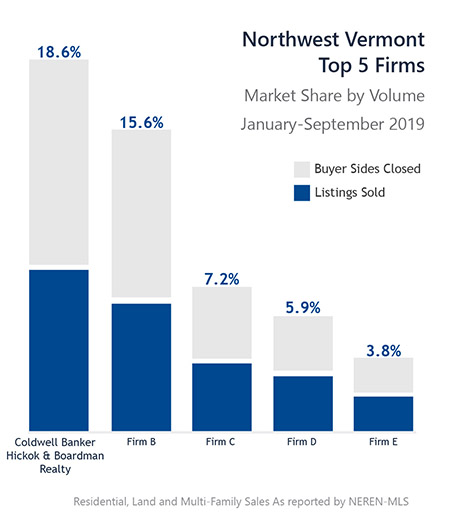

Baby Boomers, on the other end of the housing spectrum, are staying in their homes longer than ever; 10-13 years on average vs 7 years, historically. These home owners are willing to sell their large family homes but are having trouble finding new home that are  Traditionally, the “height of the market” is the 3rd quarter, late spring through summer; however, we have seen this heightened activity continue into fall in recent years. While the ongoing story in the national and regional market has been the contraction of inventory for sale, we did see some relief during the 3rd quarter, with new properties coming on the market increasing slightly over last year. This resulted in an increase in single-family home sales. Still buyer demand exceeds supply – pushing median and average sale prices higher.

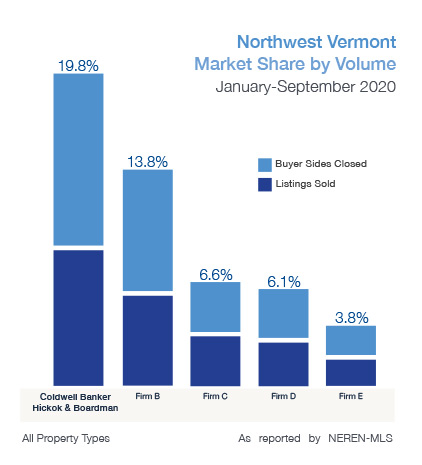

Traditionally, the “height of the market” is the 3rd quarter, late spring through summer; however, we have seen this heightened activity continue into fall in recent years. While the ongoing story in the national and regional market has been the contraction of inventory for sale, we did see some relief during the 3rd quarter, with new properties coming on the market increasing slightly over last year. This resulted in an increase in single-family home sales. Still buyer demand exceeds supply – pushing median and average sale prices higher.