The rental market in Northwest Vermont remains tight, although there’s some good news on the horizon for renters: with an influx of newly constructed apartments, rental prices are showing signs of stabilizing, a trend that is expected to continue.

The Vacancy Rate Is Easing

The Vacancy Rate Is Easing

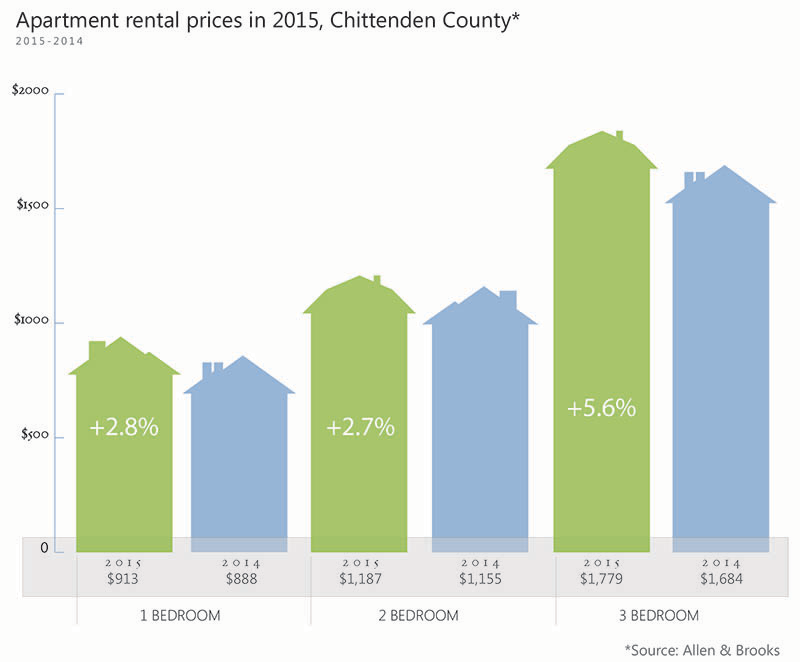

The vacancy rate stood at 2.1% in June, significantly higher than the rates seen in 2010-2014, when it averaged about 1.4%, according to real estate consulting firm Allen & Brooks. With more than 3,000 new apartments being constructed across Chittenden County, there will be more options for renters, including some new affordable housing and age-restricted rentals. Almost 600 new apartments will open in 2016 alone, Allen & Brooks forecasts.

More Choices for Renters

The burst of new construction is providing more choices to renters, such as whether to opt for a newly constructed apartment or an older home in neighborhoods such as Burlington’s Old North End, according to our Agents. Newer buildings may be slightly more expensive, but also can include some amenities, such as covered parking, that older properties do not.

Stabilizing Rents

Monthly rents are stabilizing, thanks to the slightly higher vacancy rates and newly constructed apartment buildings. The rate of increases should moderate in the near future, after several years of rates increasing at more than 2 percent annually, Allen & Brooks notes.

Plan for a Two-Month Search Before a Move

Renters should plan to begin their search for a new apartment about 45 days to 60 days before they move, according to our Agents. Finding a rental can be competitive, even with the higher vacancy rate.

Revitalized Neighborhoods

Revitalization is bringing new residents to older neighborhoods and towns, such as Winooski and the Old North End of Burlington. Winooski has earned a reputation as “The Brooklyn of Vermont” because of its excellent new restaurants and more affordable rents than neighboring Burlington. Both areas are seeing new construction, such as the

237 Pearl Street Apartments in the Old North End and Riverrun in Winooski.

Chittenden County’s Rental Market Insights

- The county’s vacancy rate is 2.1%, significantly below the national average of 4.5%.

- Rents have increased by more than 2% annually since 2011.

Winooski Remains Attractive

Winooski Remains Attractive

The Mid-Priced Sweet Spot

The Mid-Priced Sweet Spot

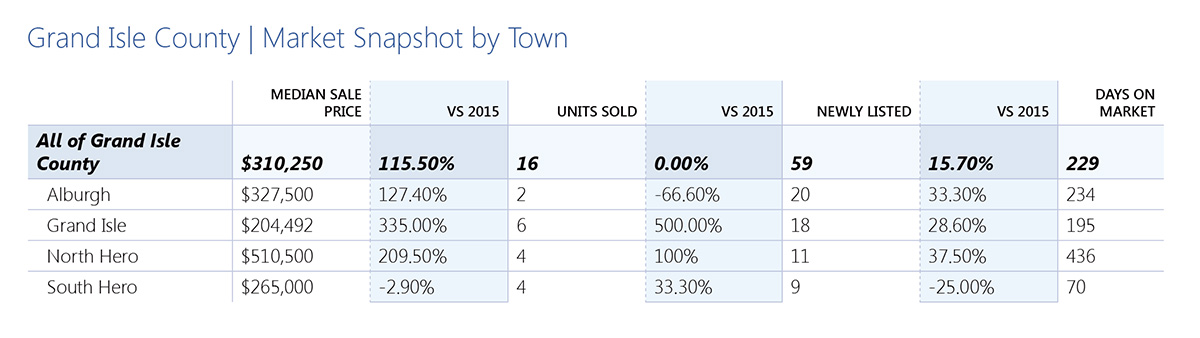

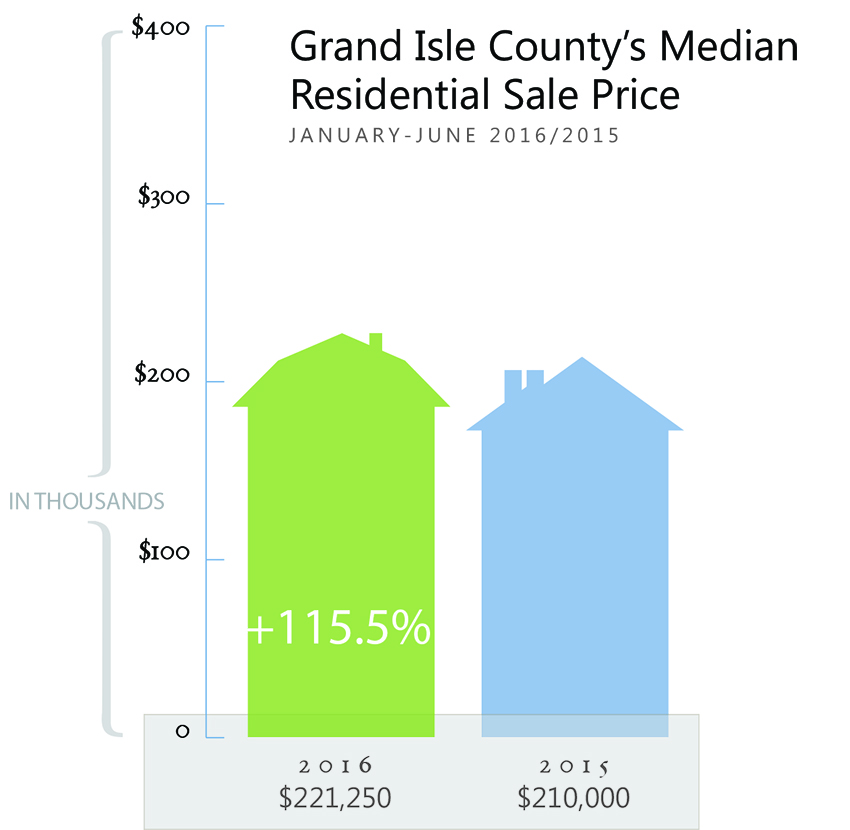

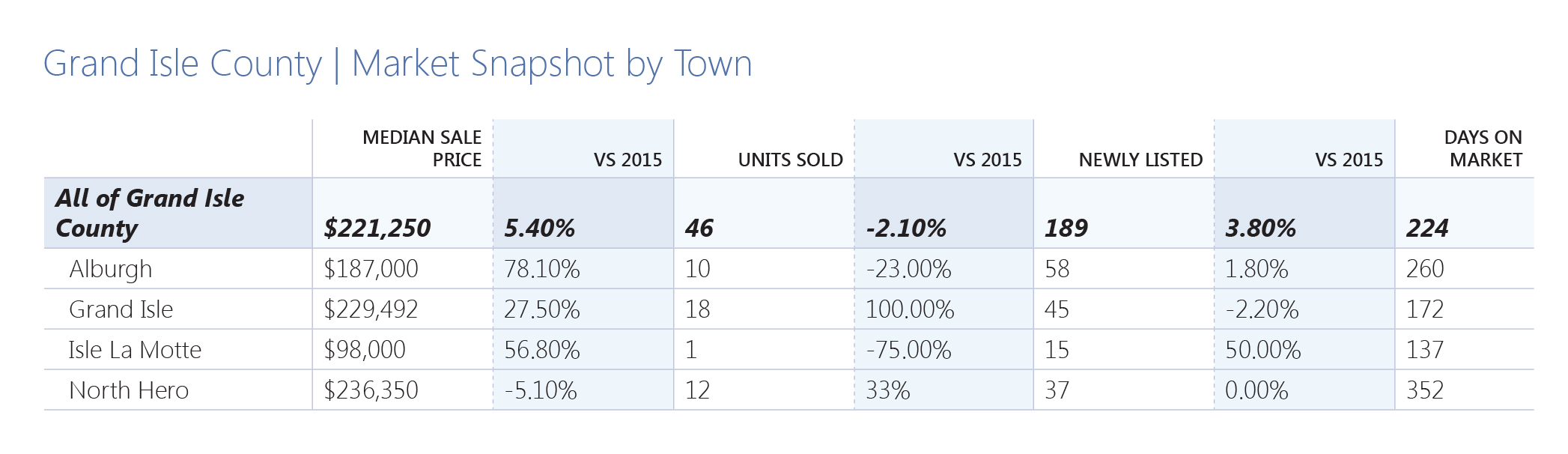

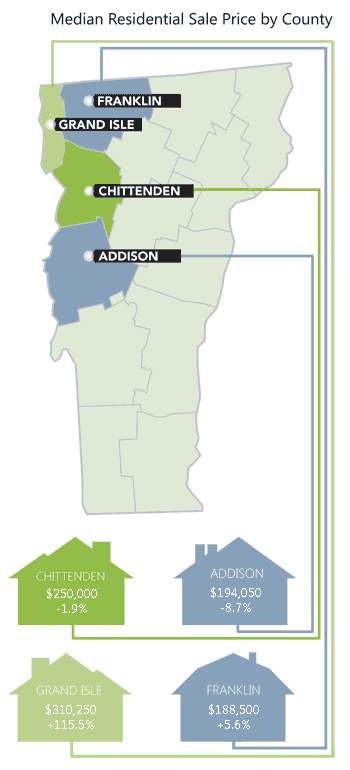

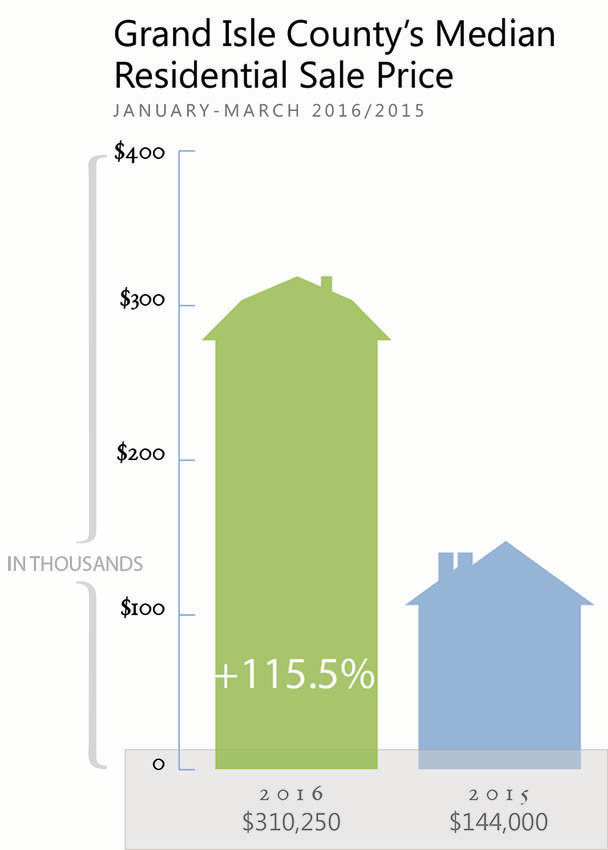

Grand Isle’s property market refocused on slightly higher-end properties in the first quarter of 2016 after buyers last year were drawn to mid-priced homes. As a result, the median sale price rose 55 percent to $310,250 from last year’s median sale price of $200,000. On a year-over-year basis, the median sale price more than doubled.

Grand Isle’s property market refocused on slightly higher-end properties in the first quarter of 2016 after buyers last year were drawn to mid-priced homes. As a result, the median sale price rose 55 percent to $310,250 from last year’s median sale price of $200,000. On a year-over-year basis, the median sale price more than doubled.